Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The most-hated rally ever ??

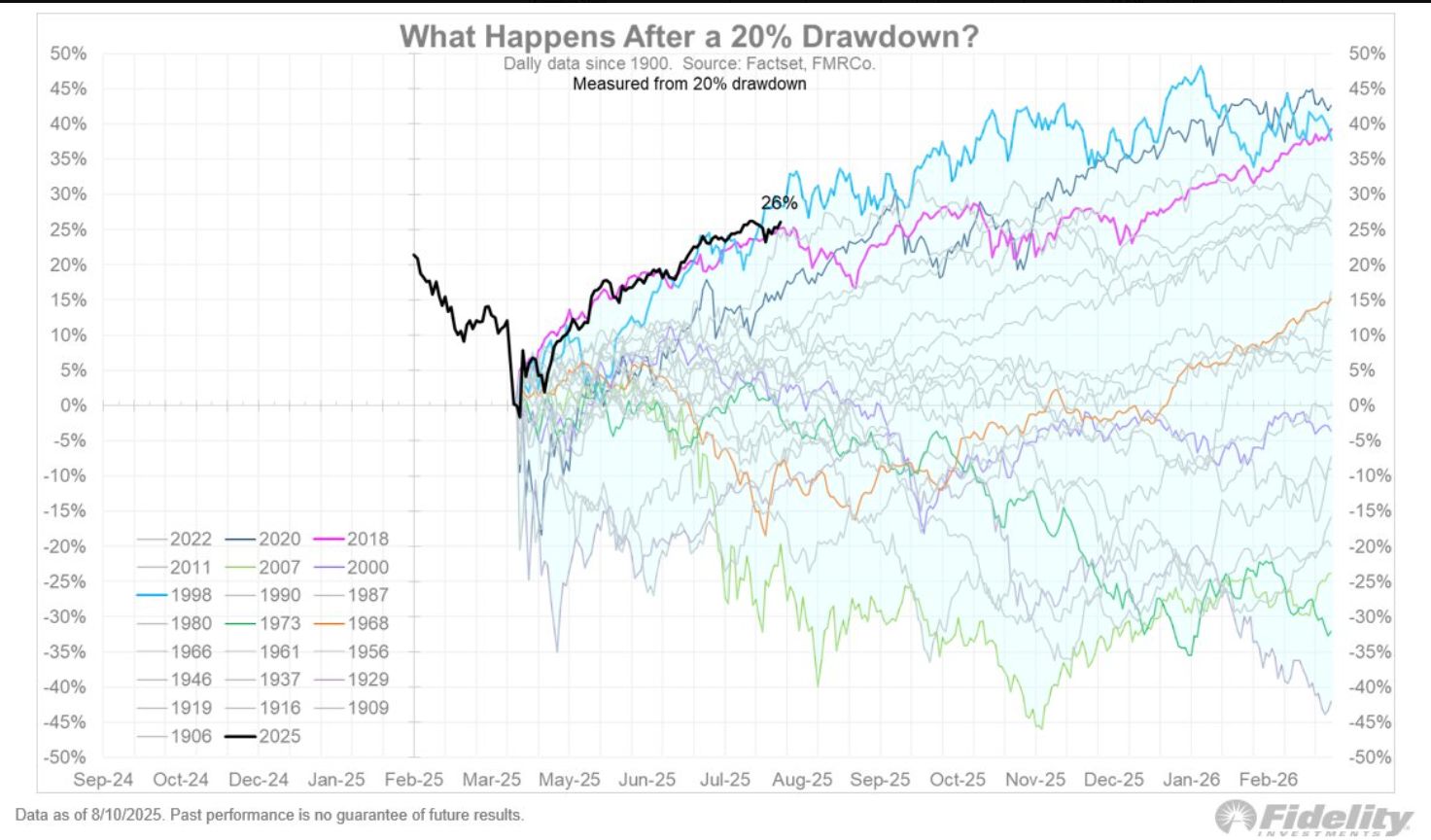

A record 91% of fund managers say U.S. stocks are overvalued (BofA fund manager survey). Meanwhile, the S&P 500 index continues on its V-shaped recovery track and remains in the running for the fastest and strongest recovery ever following a 20% drawdown ‼️ Source: Fidelity

The US president said he was nominating the 'Highly Respected Economist' EJ Antoni from the right wing Heritage Foundation to chair the agency

After firing the former commissioner for a gloomy jobs report he claimed was 'rigged' https://on.ft.com/3UkAOWG Source: FT

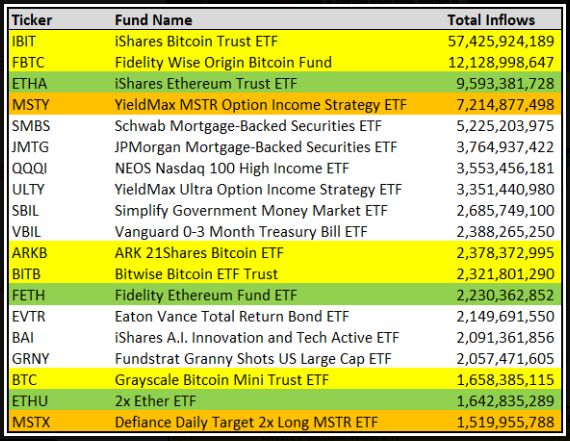

Out of all the 1,300+ ETFs that launched since the start of 2024 here are the top 20 that have gotten the most inflows

👑 $IBIT - iShares Bitcoin ETF 🥈 $FBTC - Fidelity Wise Origin Bitcoin Fund 🥉 $ETHA - iShares Ethereum ETF 4. $MSTY - Yield Max MSTR Option Income ETF 5. $SMBS - Schwab Mortgage Backed Securities ETF 6. $JMTG - JP Morgan Mortgage Backed Securities ETF 7. $QQQI - NEOS Nasdaq 100 High Income ETF 8. $ULTY - YieldMax Ultra Option Income ETF 9. $SBIL - Simplify Government Money Market ETF 10. $VBIL - Vanguard 0-3 Month Treasury Bill ETF Source: ETF Tracker @TheETFTracker thru @NateGeraci

In proportion to population the millionaires exodus from the UK is unprecedented

Main beneficiaries (in proportion of population): UAE, Italy, Switzerland, Singapore, Portugal and Greece Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks