Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

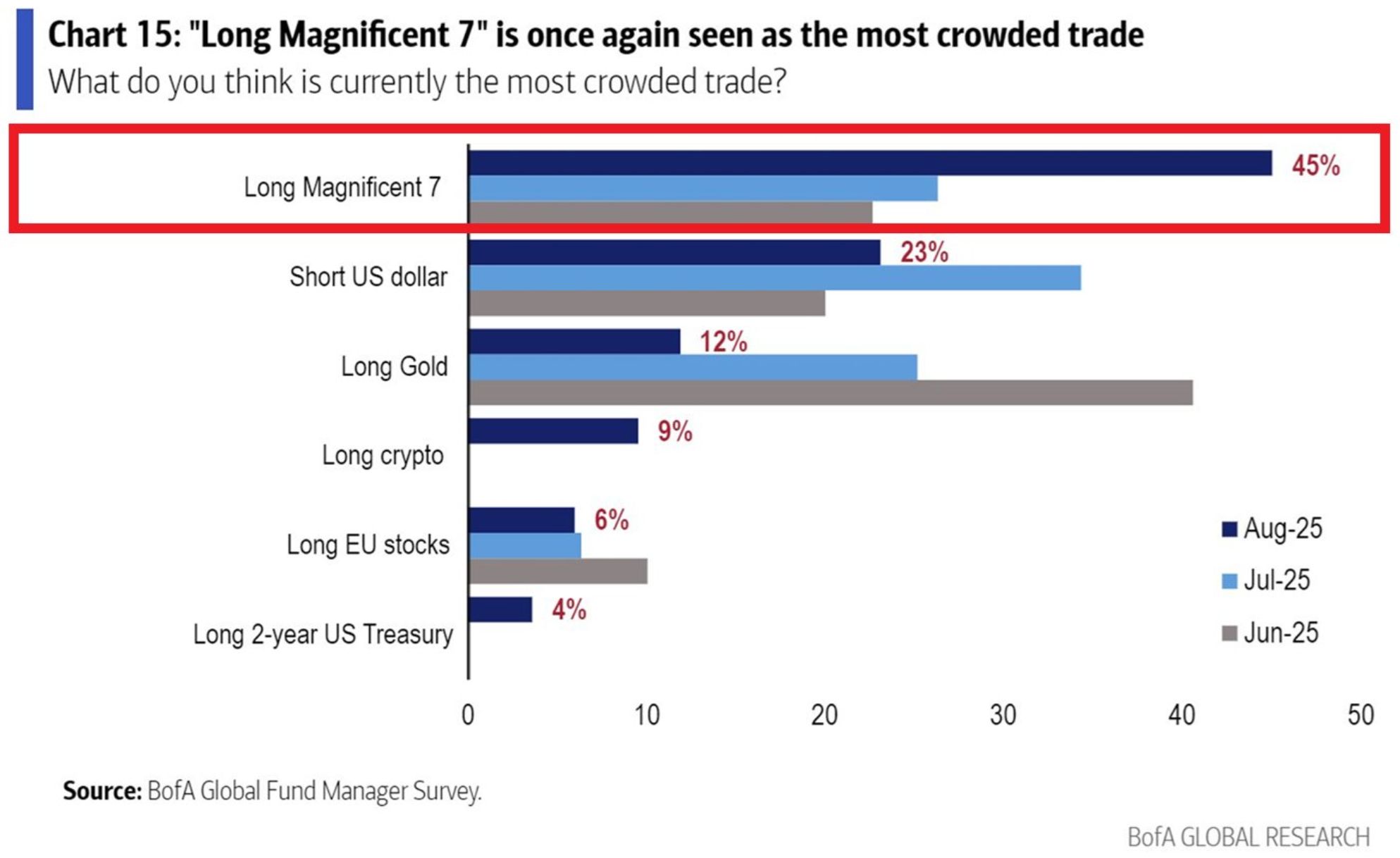

Almost everyone is all-in on the Mag7 stocks

169 surveyed fund managers with $413 billion in assets said in August that the 'Long Magnificent 7' is the most crowded trade. Professionals, foreigners, and retail investors are heavily invested in these stocks. Source: Global Markets Investor, BofA

U.S. Treasury volatility falls to its lowest level since January 2022

No Fear left in the market! Source: Barchart

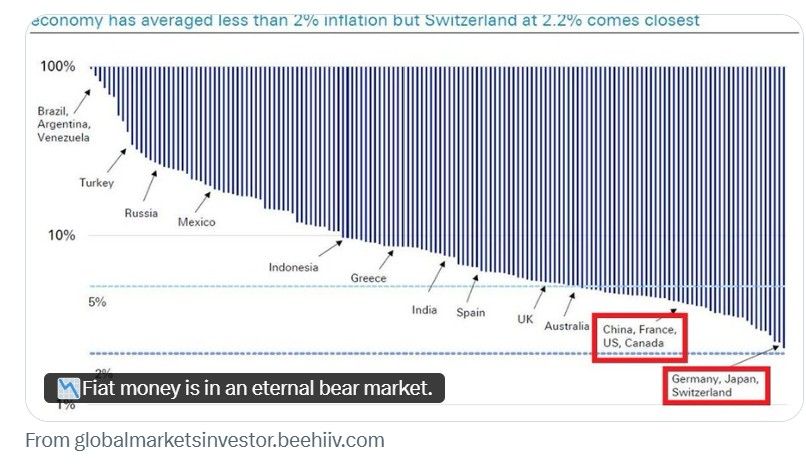

Currency debasement is not a bug — it’s a feature of the fiat system.

Since Bretton Woods collapsed in 1971, not one of 152 countries has kept average inflation below 2%. Even Switzerland averaged 2.2%. Source: Global Markets Investors

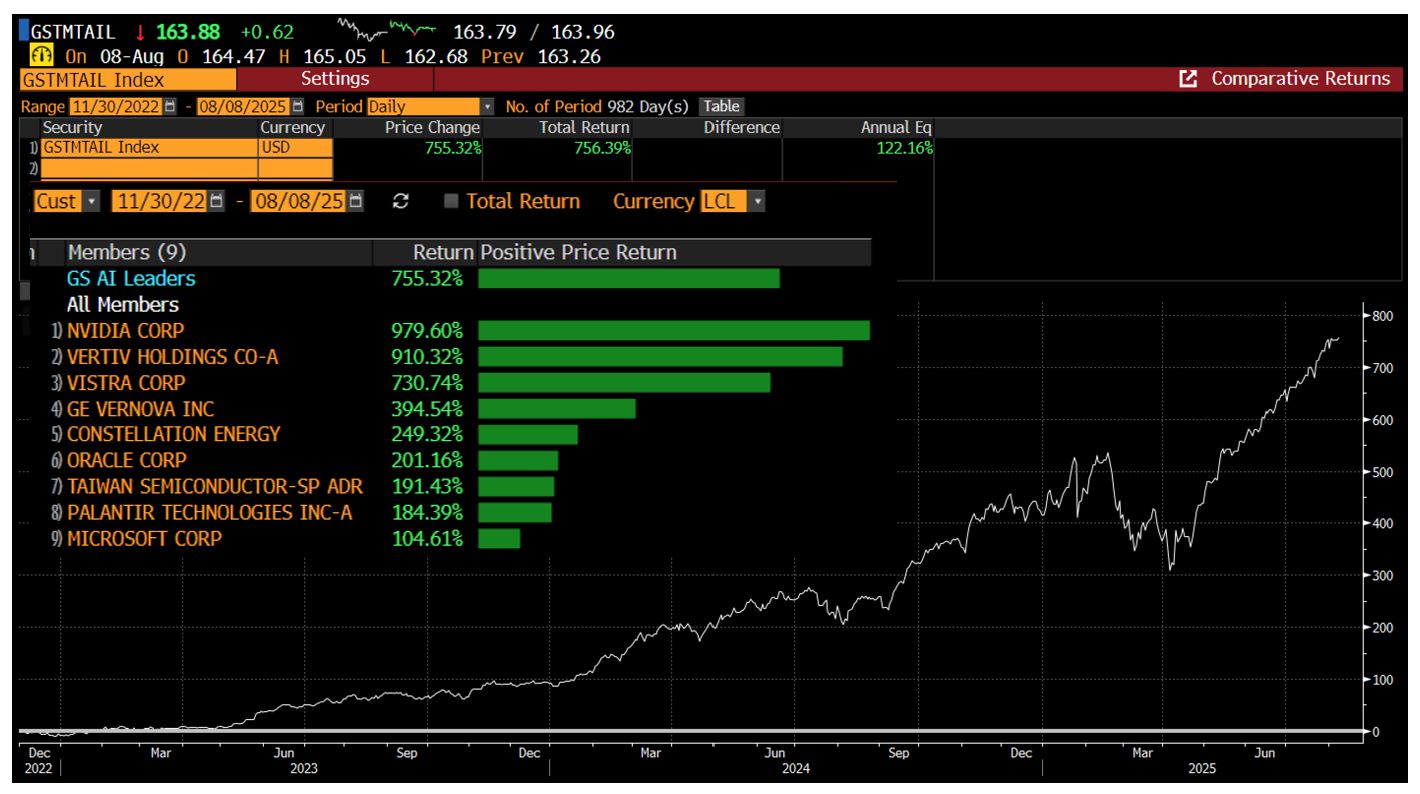

The Goldman Sachs AI Leaders Basket

Consisting of the 9 leading AI stocks (semiconductors: Nvidia, TSMC), software/data center (Palantir, Oracle, Microsoft, Vertiv), and power/infrastructure (GE Vernova, Constellation, Vistra) has made 756% since ChatGPT launch in 2022, an avg of 122% per year! Source: Bloomberg, HolderZ

Some very important charts...

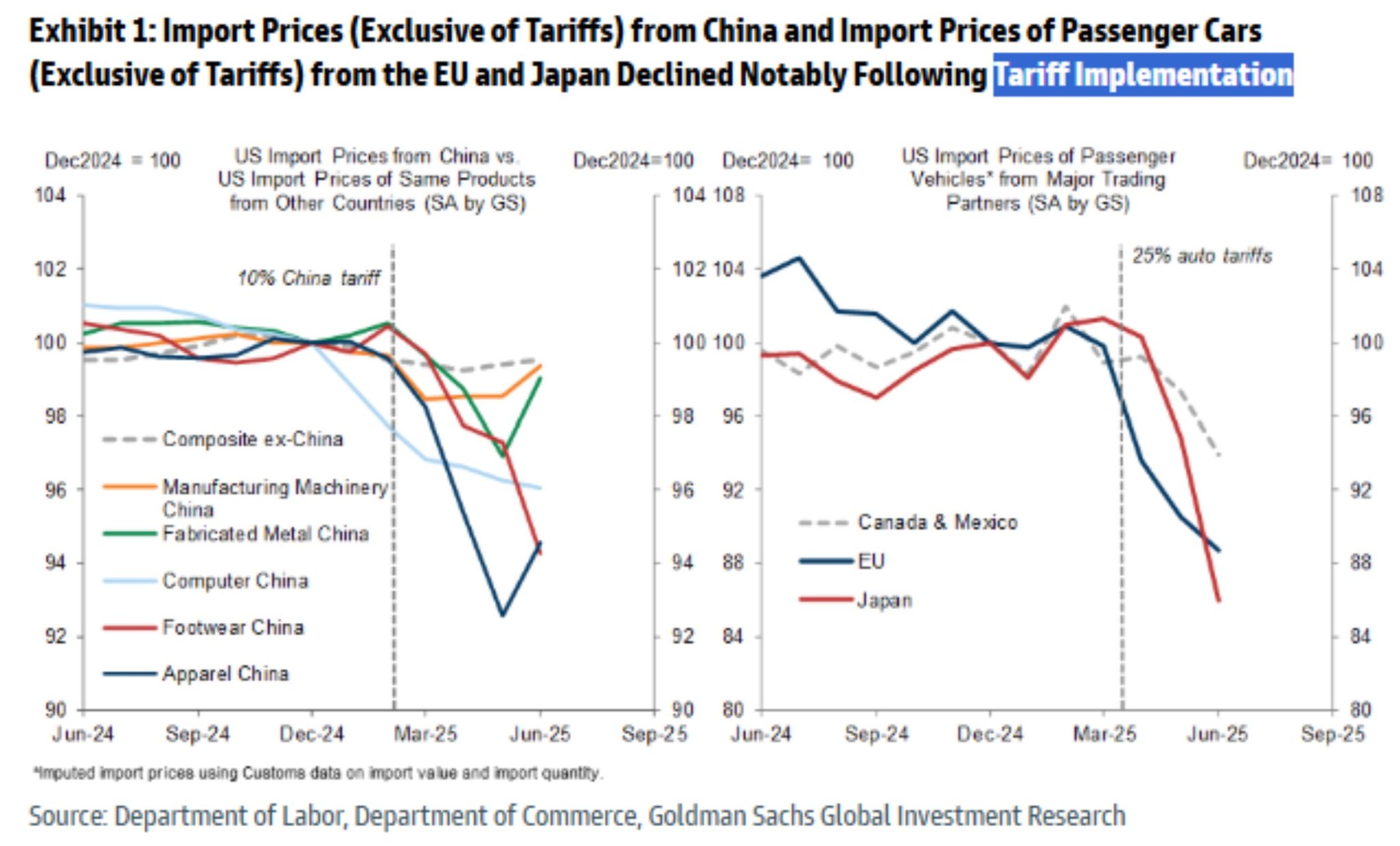

Goldman Sachs find that US import prices on tariffed goods have declined somewhat, suggesting that foreign exporters have absorbed some tariff costs by lowering their export prices to the US, unlike during the 2018-2019 trade war. Source: Goldman Sachs thru Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks