Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

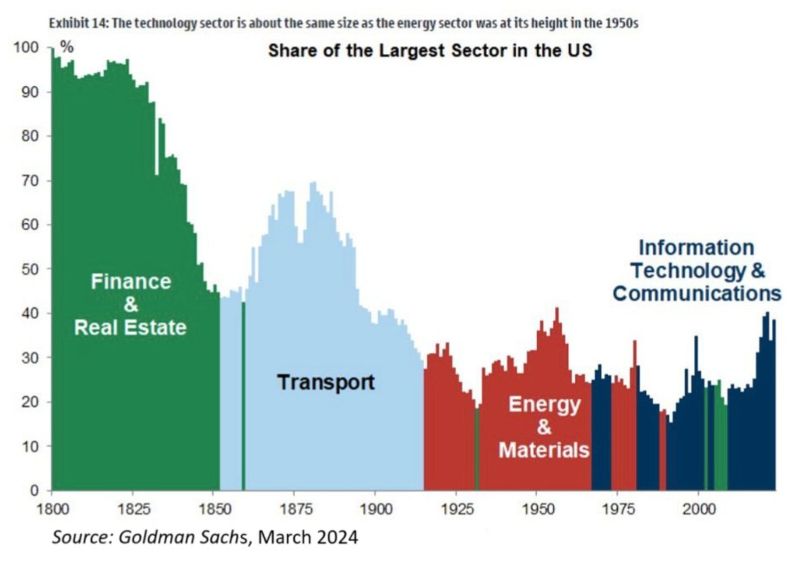

Sector dominance has persisted for long periods of time. Deep history from Goldman Sachs via @CallumThomas

Source: Mark Ungewitter @mark_ungewitter on X

The US has got the softest inflation surprises on Earth...

Could this influence the FOMC tomorrow??? Source: Andreas Steno Larsen @AndreasSteno, Macrobond

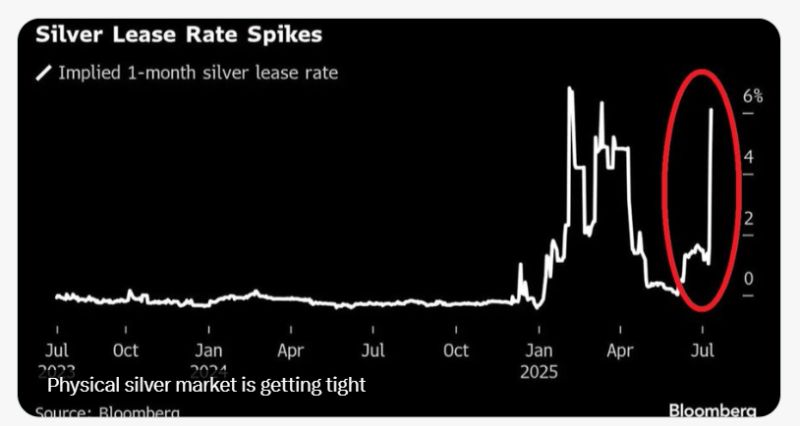

‼️Physical silver market is getting TIGHT

1-month silver lease rates, the cost to borrow silver short-term, spiked above 6%. It’s normally close to 0% because physical silver is usually abundant and easy to borrow. Source: Bloomberg, Global Markets Investor

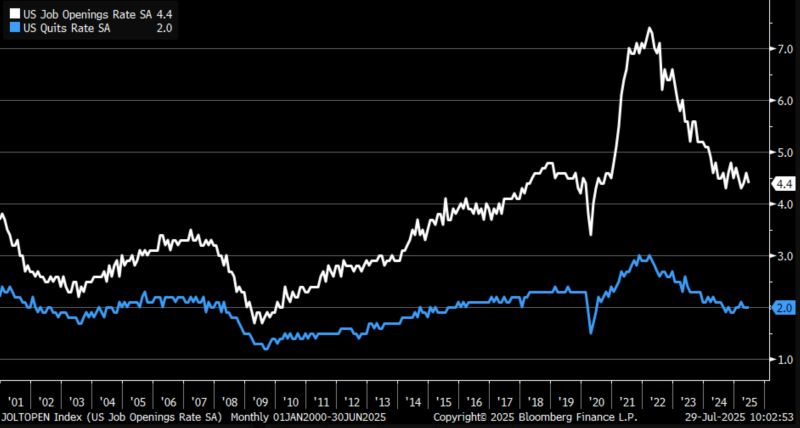

June JOLTS job openings rate (white) down to 4.4% vs. 4.6% prior ... quits rate (blue) unchanged at 2%

Source: Bloomberg, Kevin Gordon

The IMF has upgraded its global growth forecast amid signs that Donald Trump’s trade war will do less damage to the world economy than initially feared, helped by a weaker US dollar

Source: FT

It is hard to see gold and other store of values as a bad long-term investment with Money Supply exploding all across the world!

Source: Andrea Lisi

It's a race to the first major fib extension.

Who's tagging it first? $SPY | $QQQ

Investing with intelligence

Our latest research, commentary and market outlooks