Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

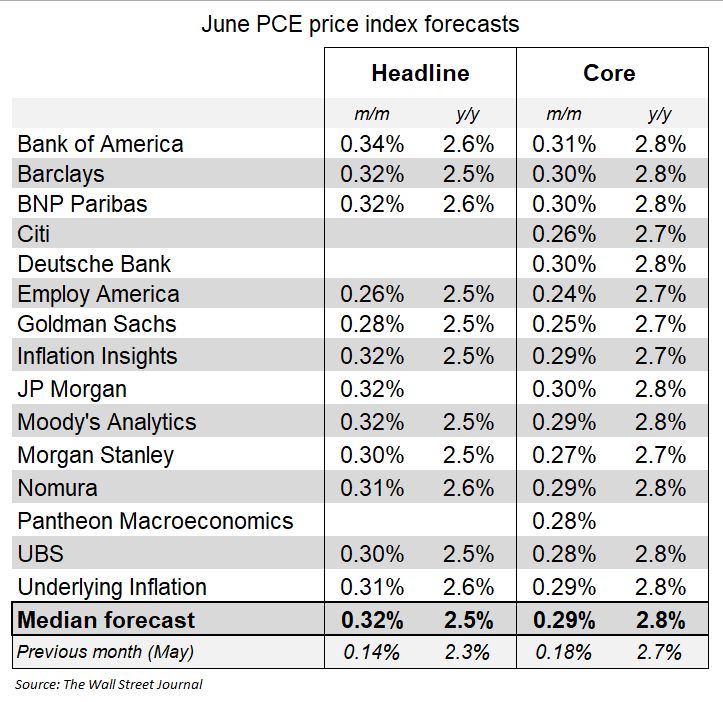

Economists who translate the CPI and PPI into the PCE expect monthly core inflation firmed in June. BEA reports this on Thursday.

Core PCE estimate: +0.29% (highest since February), which would push the year-over-year to 2.8% Headline PCE: +0.32% (y/y rises to 2.5%) Source: Nick Timiraos @NickTimiraos

Foreign Investors now own 18% of U.S. Equities, the most in history.

Source: barchart

U.S. Dollar Index $DXY now on a 4-day winning streak and is at its highest level in more than 1 month 📈📈

Source: barchart

US earnings growth outperforming.

Source: @fundstrat thru Mike Zaccardi, CFA, CMT, MBA

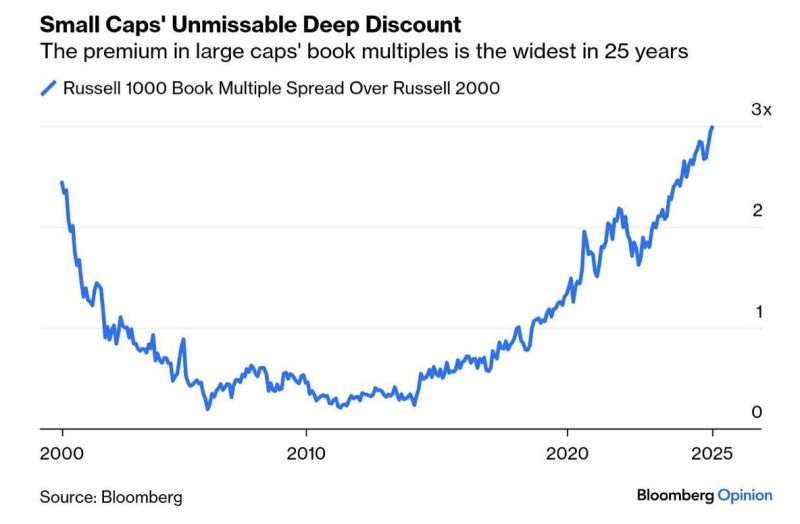

Small Cap Stocks are trading at the largest discount relative to Large Caps in AT LEAST 25 years

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks