Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

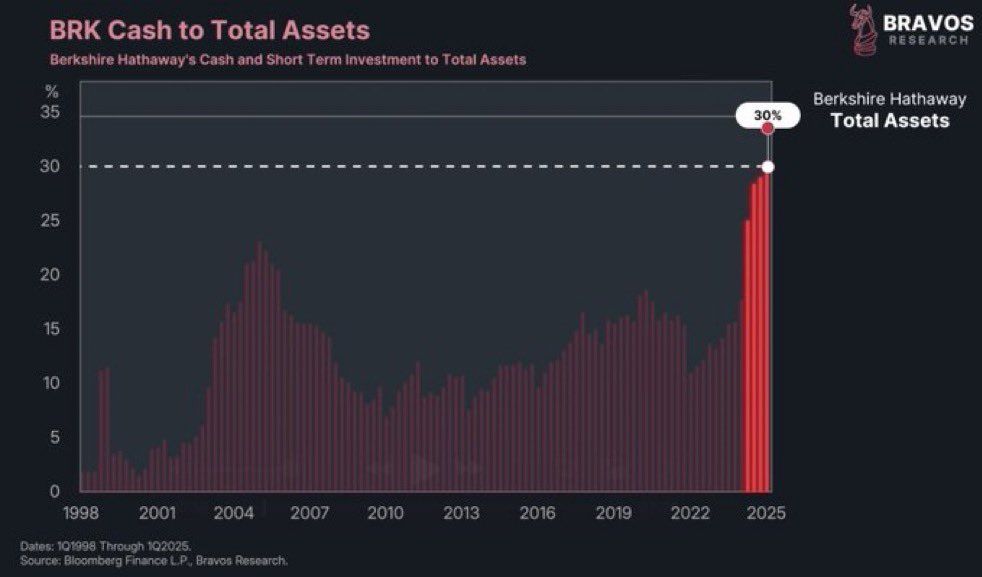

Berkshire Hathaway’s cash position is now 30% of their total assets, the most in history.

Source: Barchart

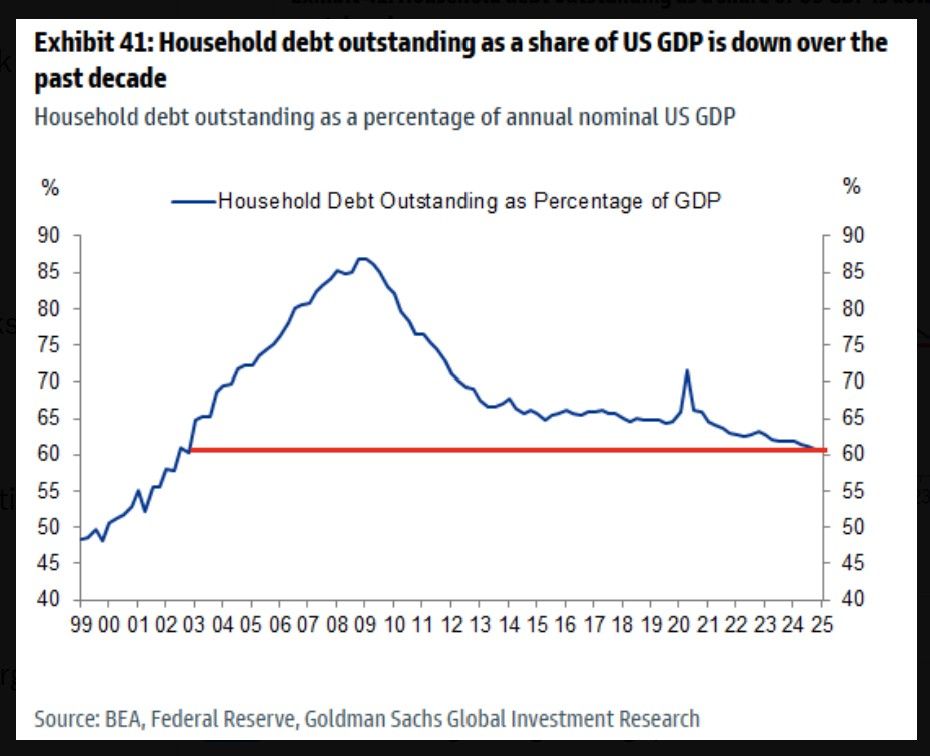

In the us, leverage is with the government, and less with companies and households.

Indeed, household debt outstanding as a share of US GDP is down over the past decade. Lowest since 2002. Source: BofA

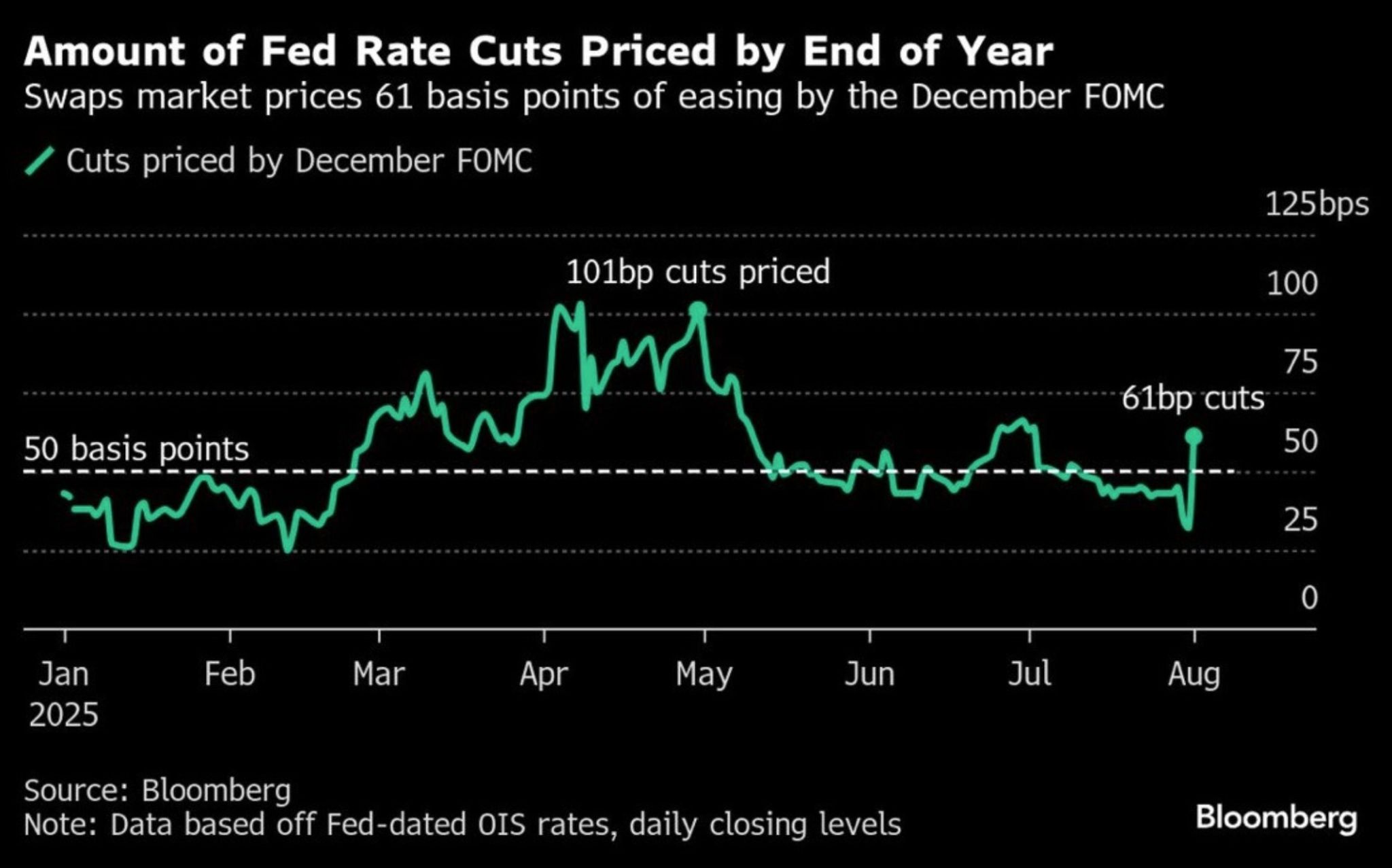

Market expectations for rate cuts this year have been quite volatile

We could gain more clarity on this at the upcoming Jackson Hole Symposium (August 21-23), or soon thereafter. Source: Bloomberg. Mo El Erian

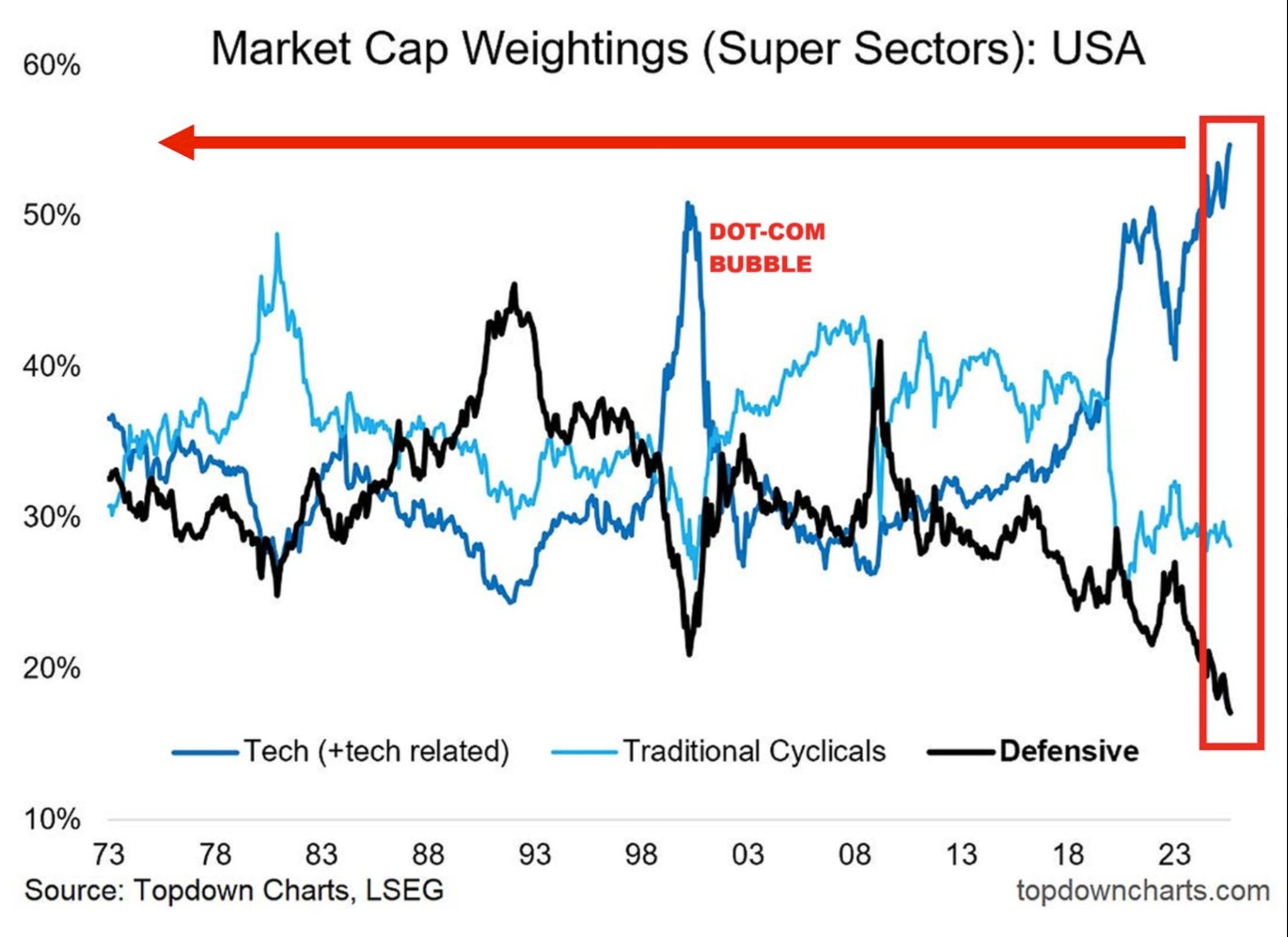

It is all about tech...

US technology and tech-related stocks now account for ~55% of the US stock market, the highest share EVER. It has exceeded the 2000 Dot-Com Bubble levels by ~5 percentage points. By comparison, defensive stocks now reflect ~18% of the market. Source: Global Markets Investor

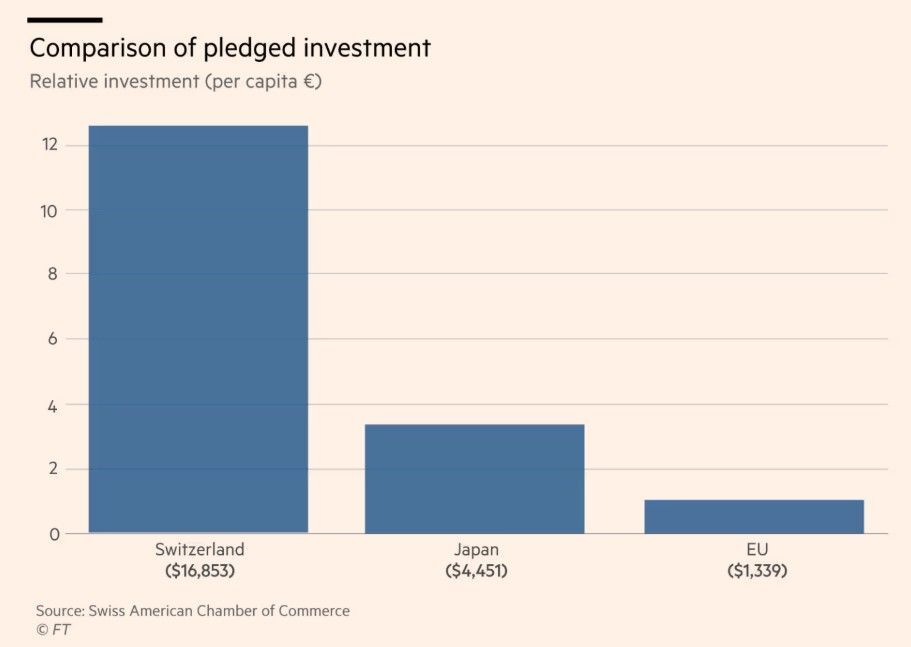

US Tariffs 2.0: how can Switzerland secure a better deal?

Switzerland said it was confident about securing an early trade deal as it was willing to pledge nearly $150bn in US-bound investment (which is huge on relative terms). “We have nine million people in Switzerland, yet our investment pledge per capita is much more than what Japan or the EU have pledged. If we talk about a $40bn trade deficit, one has to put that [in] perspective,” said Rahul Sahgal, chief executive of the Swiss-American Chamber of Commerce. Let’s also keep in mind that we are also a huge investor in the US, with Nestlé, Roche and Novartis employing thousands of Americans. Gold exports — often transiting through Switzerland for refining or trade — are largely responsible for the country’s trade imbalance with the US. Yet both gold and pharmaceutical products are exempt from Trump’s “reciprocal tariffs. Pharmaceutical sector could be the tipping point: Switzerland’s pharma sector sends about 60% of its exports to the US. Novartis and Roche’s US subsidiary Genentech were among the pharmaceutical companies that received letters from the Trump administration this week demanding that they lower drug prices. Swiss watchmaker Breitling’s CEO Georges Kern said his country was being “held hostage” by the pharmaceutical industry that had irritated Trump. Source: FT

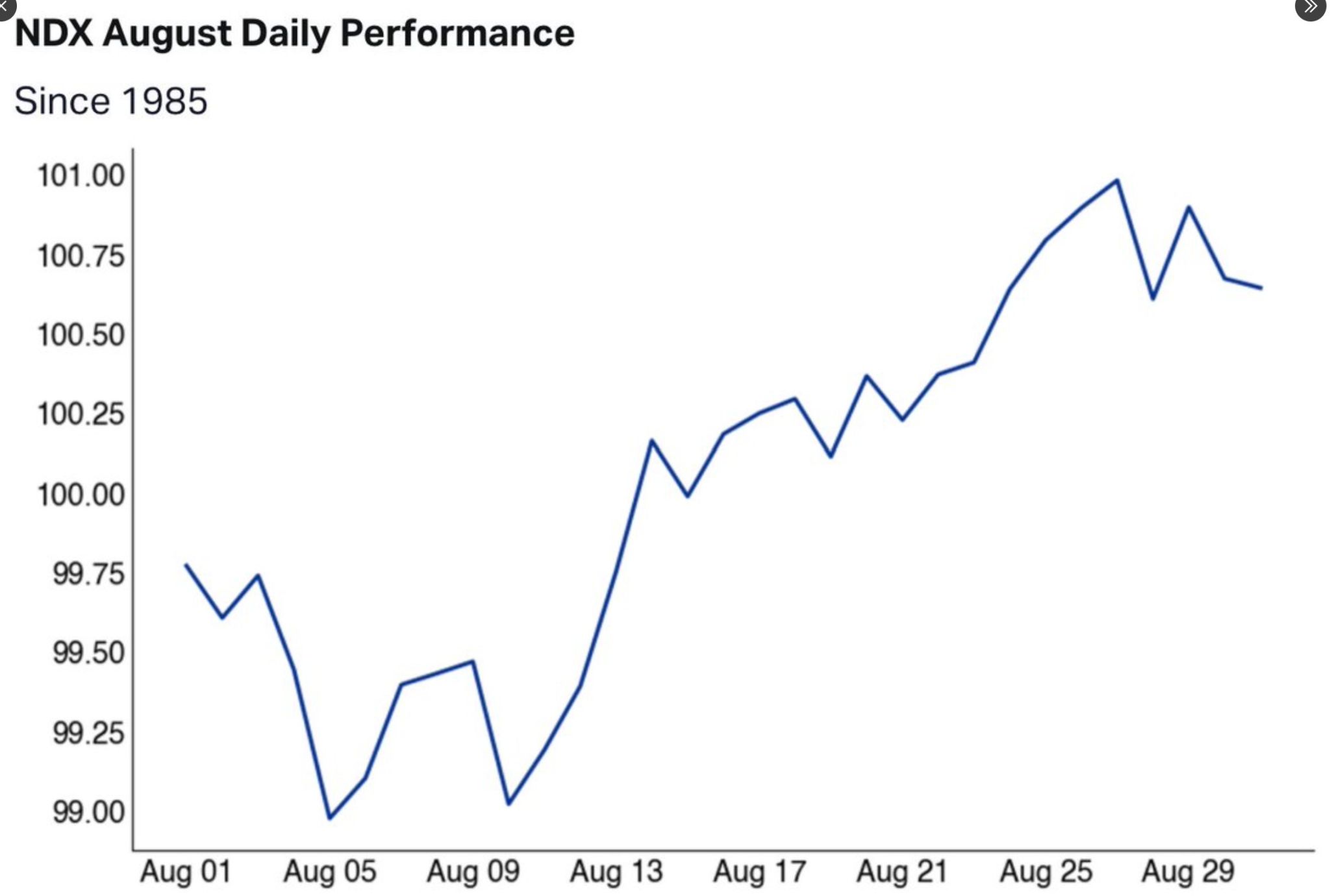

Since 1985, Nasdaq 100 has a rough start to August, with double-dips ultimately resulting in a W-shaped recovery into end-of-month.

Might take a little longer (release of CPI mid-month) if downside persists and before recovery ensues in 2025. Source: Seth Golden

Ever wonder why S&P 500 concentration is hitting record highs?

Investors are piling into mega tech for one big reason: huge free cash flow generation and strong net income growth! ➡️ The net income gap between the top 10 giants and the rest keeps widening. Without the top 6, S&P 500 earnings growth is flatlining. ⚠️ Meanwhile, around 40% of Russell 2000 small caps aren't even profitable. Source: FT thru Andrea Lisi

Investing with intelligence

Our latest research, commentary and market outlooks