Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The European Union will delay planned tariffs for six months to allow for trade talks

The European Union announced Monday that it is suspending for six months its planned countermeasures against the United States’ tariffs, which which were set to take effect this week. “On 27 July 2025, European Commission President Ursula von der Leyen and US President Donald J. Trump agreed a deal on tariffs and trade,” the EU Commission spokesperson for trade said in a statement. The spokesperson touted the agreement as restoring “stability and predictability for citizens and businesses on both sides of the Atlantic.” “The EU continues to work with the US to finalise a Joint Statement, as agreed on 27 July,” the spokesperson said. “With these objectives in mind, the Commission will take the necessary steps to suspend by 6 months the EU’s countermeasures against the US, which were due to enter into force on 7 August.” Source: CNBC

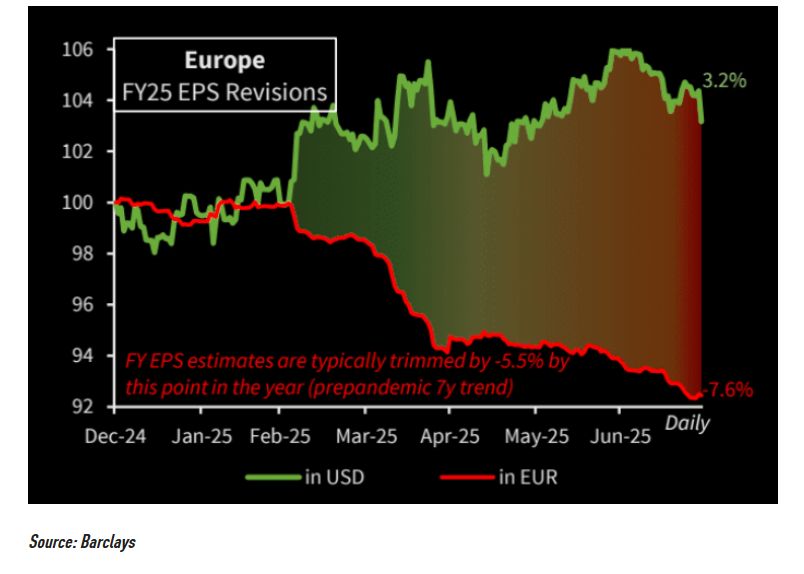

FY25 EPS revisions in Europe are trending somewhat worse than that of a typical year.

Source: Barclays, The Market Ear

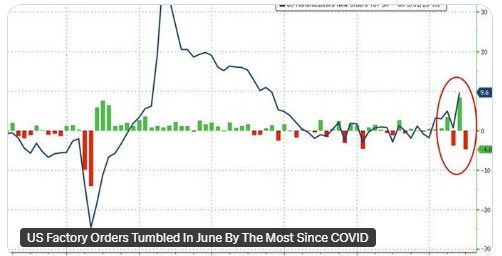

US Factory Orders Tumbled In June By The Most Since COVID

Source: zerohedge

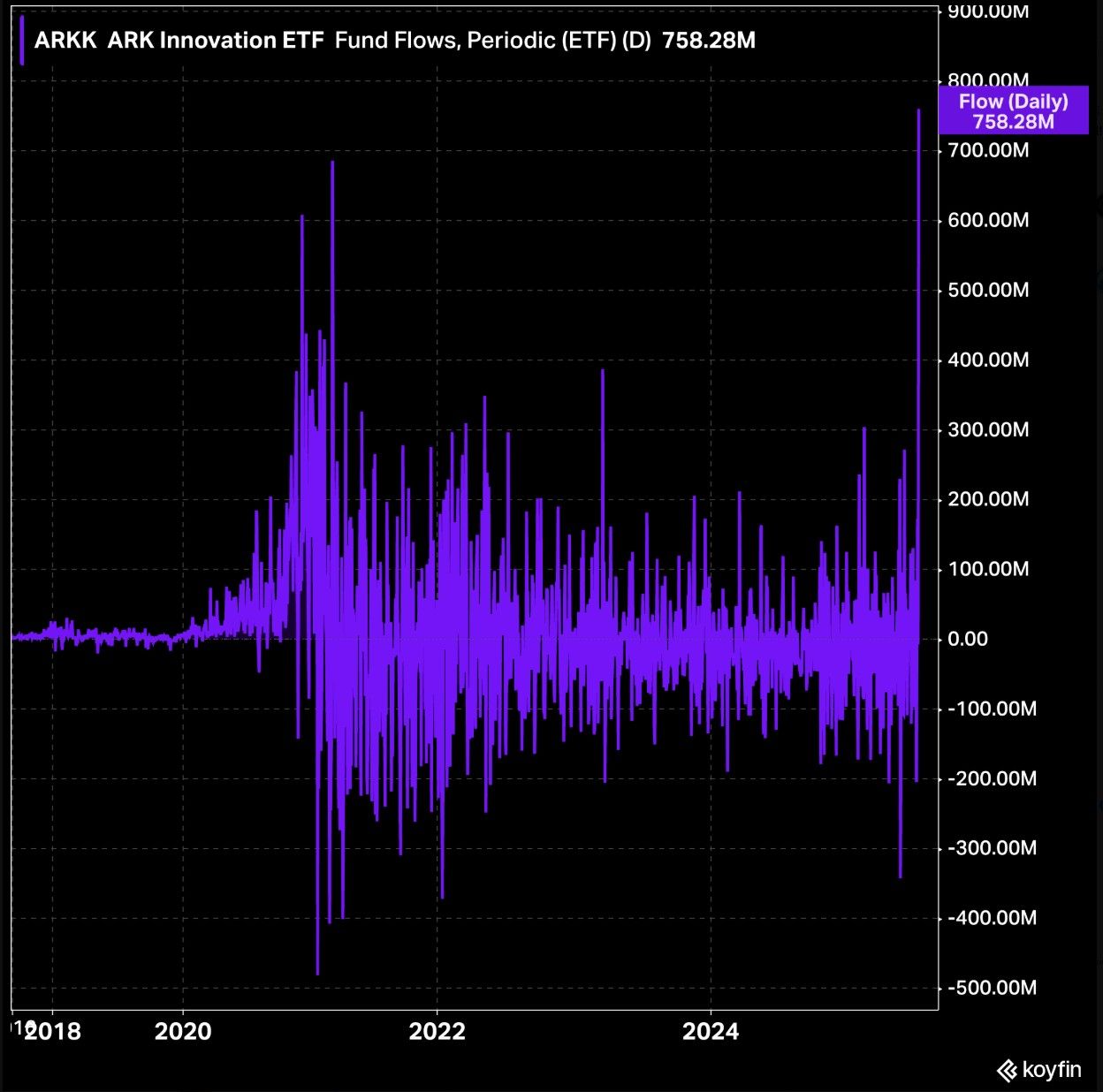

The "buy the dip" mentality is intact.

$ARKK Cathie Wood's ARK Innovation fund $ARKK saw its largest ever single day of inflows on Friday. Source: Koyfin

Top AI companies by Market Cap

Source: Mark Roussin, CPA @Dividend_Dollar

$PLTR absolutely destroyed their Q2 earnings

Palantir topped Wall Street’s estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance. Shares rallied more than 5%. • Sales $1.0B vs Est. $939M • EPS $0.16 vs Est. $0.13 • US Commercial: $306M -- up 93% YoY • Customer count up 43% YoY Q3 Outlook • Sales $936M vs Est. $899M • Operating Profit $495M vs Est. $417M FY25 Outlook • Sales $4.14B vs Est. $3.90B • Operating Profit $1.92B vs Est. $1.72B Source: Shay Boloor @StockSavvyShay, CNBC

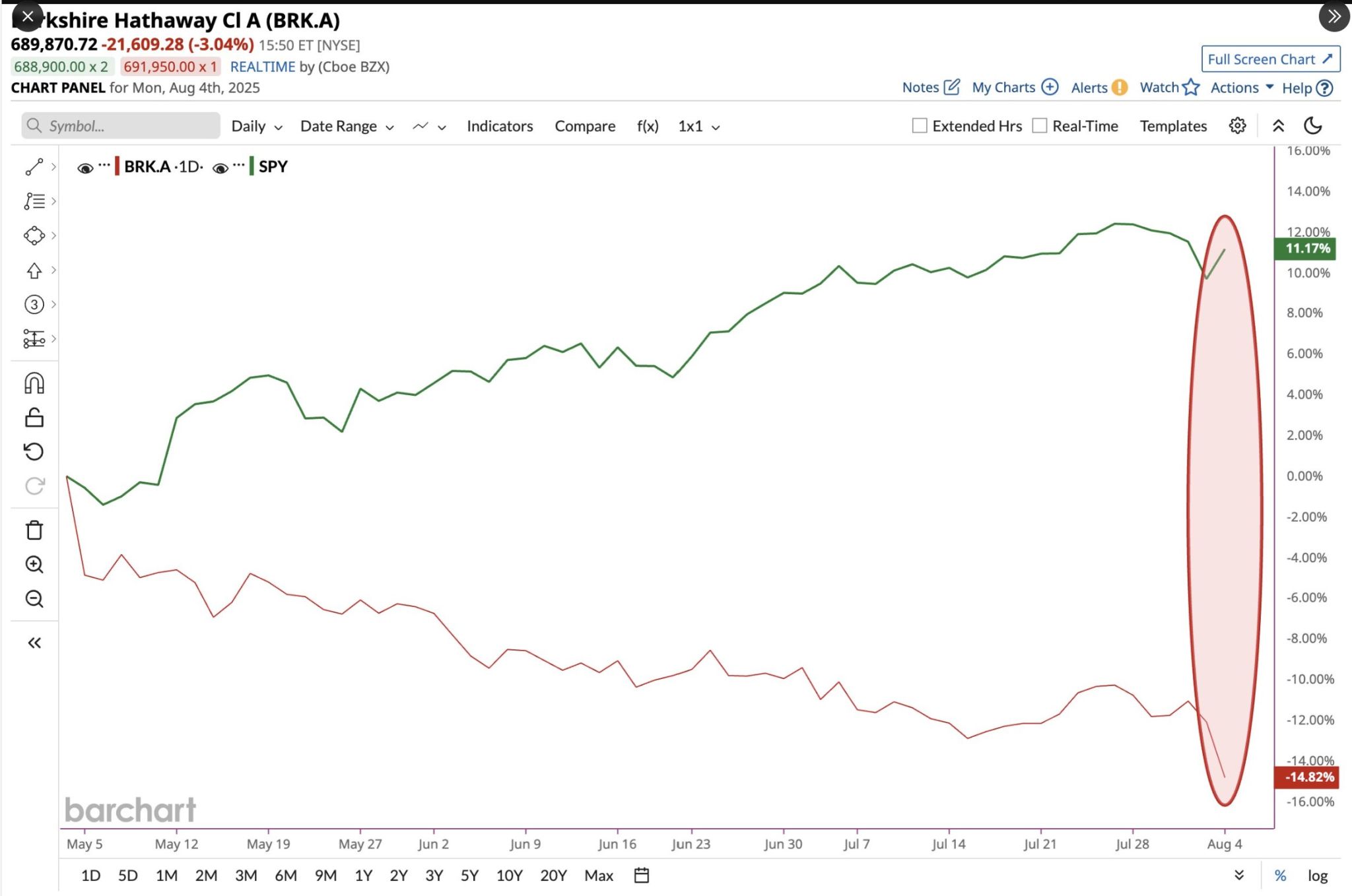

Buffett might have to cancel his retirement!

Berkshire Hathaway $BRK.A is now underperforming the S&P 500 by 26 percentage points since his retirement announcement... Source: Barchart

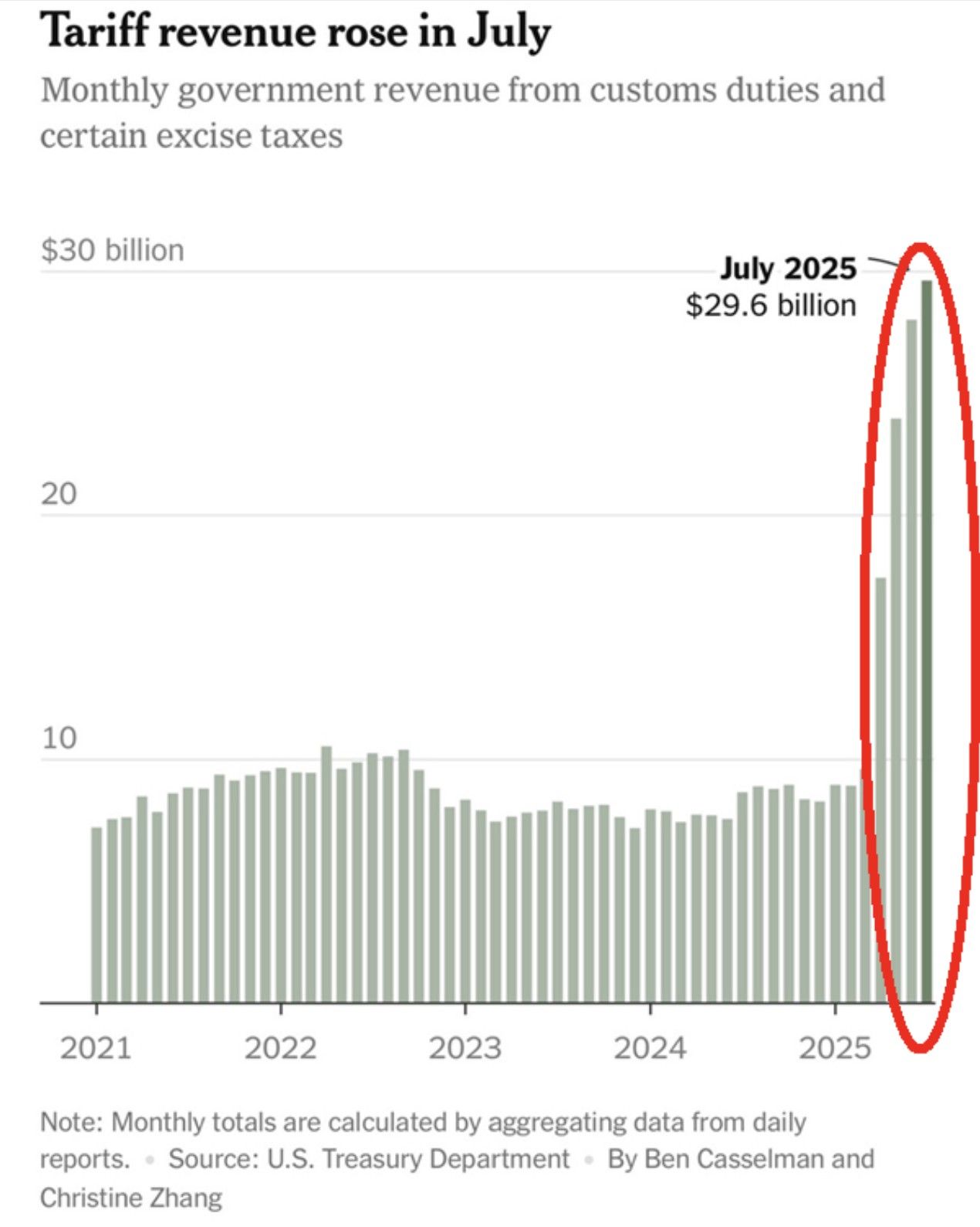

US federal government tariff revenue is skyrocketing

Customs and certain excise taxes collected in the US SPIKED to $29.6 billion in July, an all-time high. On an annualized basis, tariff revenue is running at ~$310 billion, more than 3 TIMES higher than a year ago. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks