Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

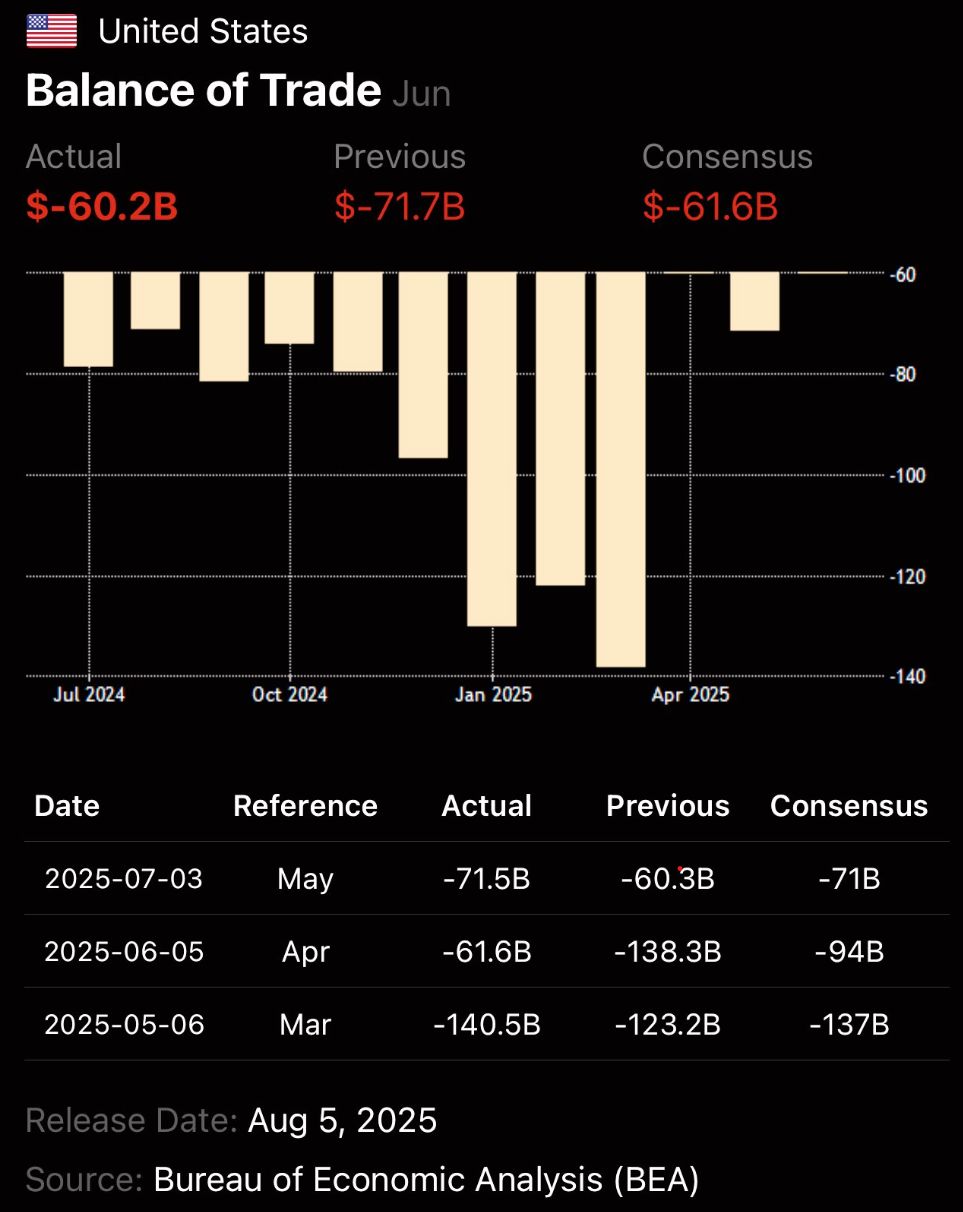

US Trade Deficit Plunges 16% in June to $60.2B – Lowest Since 2023!

Sharp import drop drives the narrowing, beating economist forecasts of ~$61-62B. Positive boost for GDP as net exports rise! Source: Andrea Lisi, CFA @Andrea_Texas_82, BEA

Nvidia & Microsoft alone account for almost half of sp500 $SPX returns this year

Source: Tatiana Darie, MLIV, Bloomberg thru Joumanna Bercetche

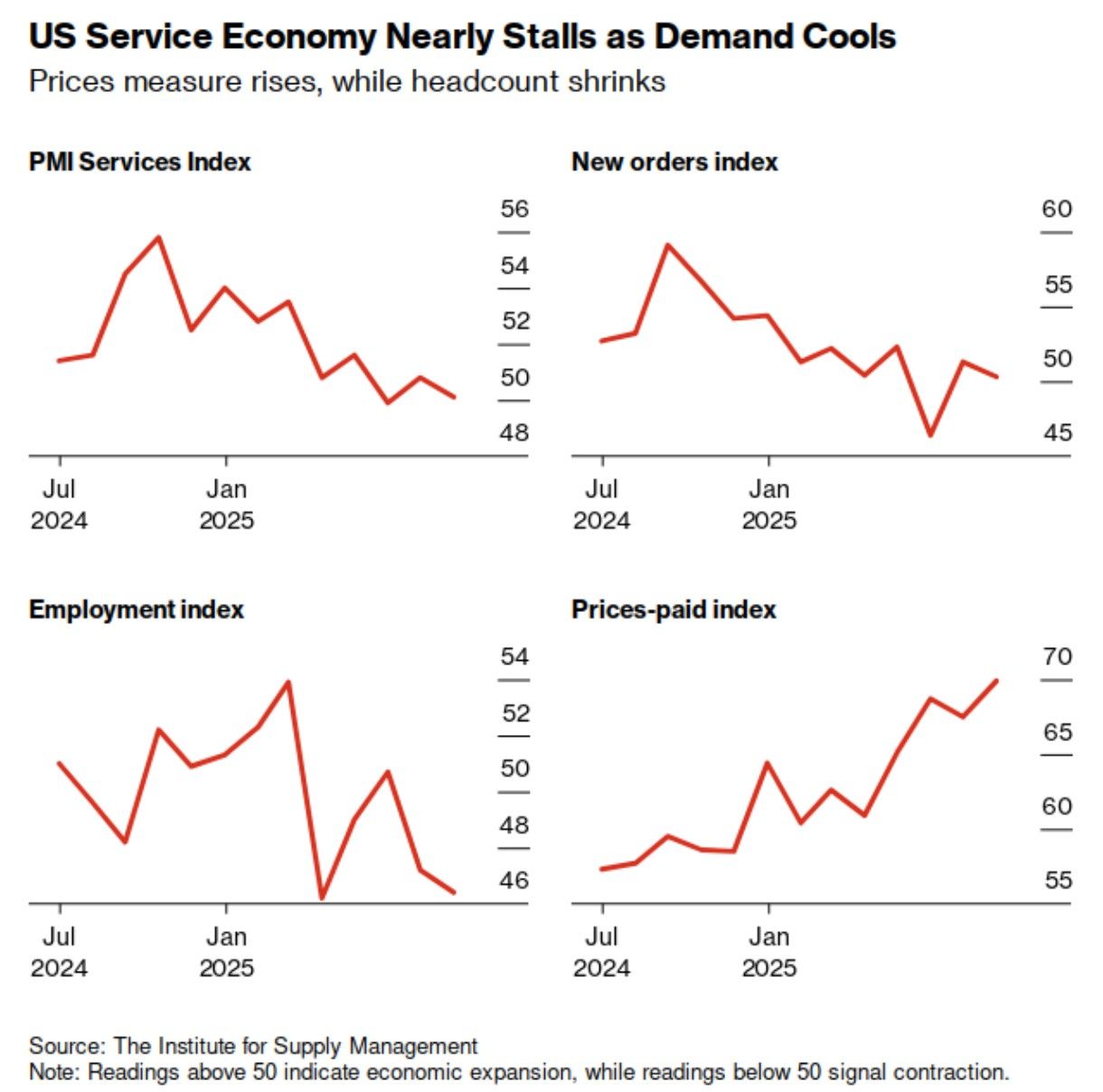

Nasty print on the US ISM services... sounds "stagflationary"

US ISM Services PMI Actual 50.1 (Forecast 51.5, Previous 50.8) US ISM Services Prices Paid Actual 69.9 (Forecast 66.5, Previous 67.5) US ISM Services Employment Actual 46.4 (Forecast -, Previous 47.2) US ISM Services New Orders Actual 50.3 (Forecast -, Previous 51.3) Source: ISM

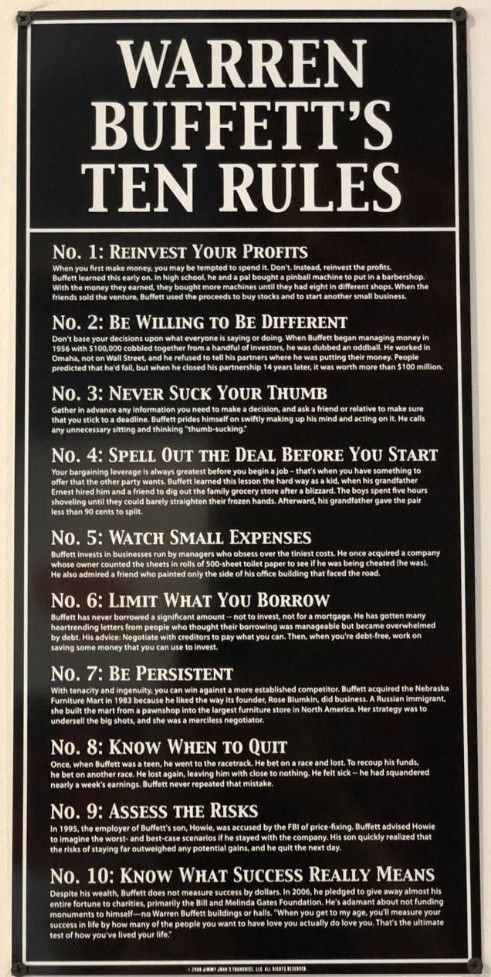

Buffett's 10 investing rules

Source: Invest In Assets @InvestInAssets

Super Micro shares plunge 15% on weak results, disappointing guidance...

Nothing super about it.... $SMCI 🩸 Here’s how the company did in comparison with LSEG consensus: - Earnings per share: 41 cents adjusted vs. 44 cents expected - Revenue: $5.76 billion vs. $5.89 billion expected Source: Trend Spider

The S&P 493 – that’s the S&P 500 excl “Magnificent 7” – is expected to deliver just 2-3% net income growth in Q2, Q3, and Q4.

That’s slower than inflation, meaning most of the market is barely growing in real terms. Measured against this, US equities are quite expensive! Source: Strategas thru HolgerZ

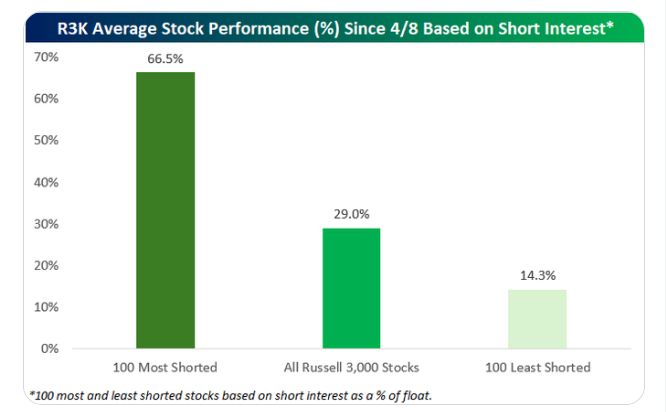

Update on the short squeeze...

The 100 most heavily shorted stocks in the Russell 3,000 are now up 66.5% since the 4/8 low versus 29% for all stocks and 14% for the 100 least shorted. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks