Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US companies announced share repurchases totaling $166 billion last month, the highest dollar value on record for July ...

For the year, announced buybacks stand at $926 billion, which is $108 billion ahead of the previous year-to-date record set in 2022. Source: Bloomberg, Birinyi Associates, RBC

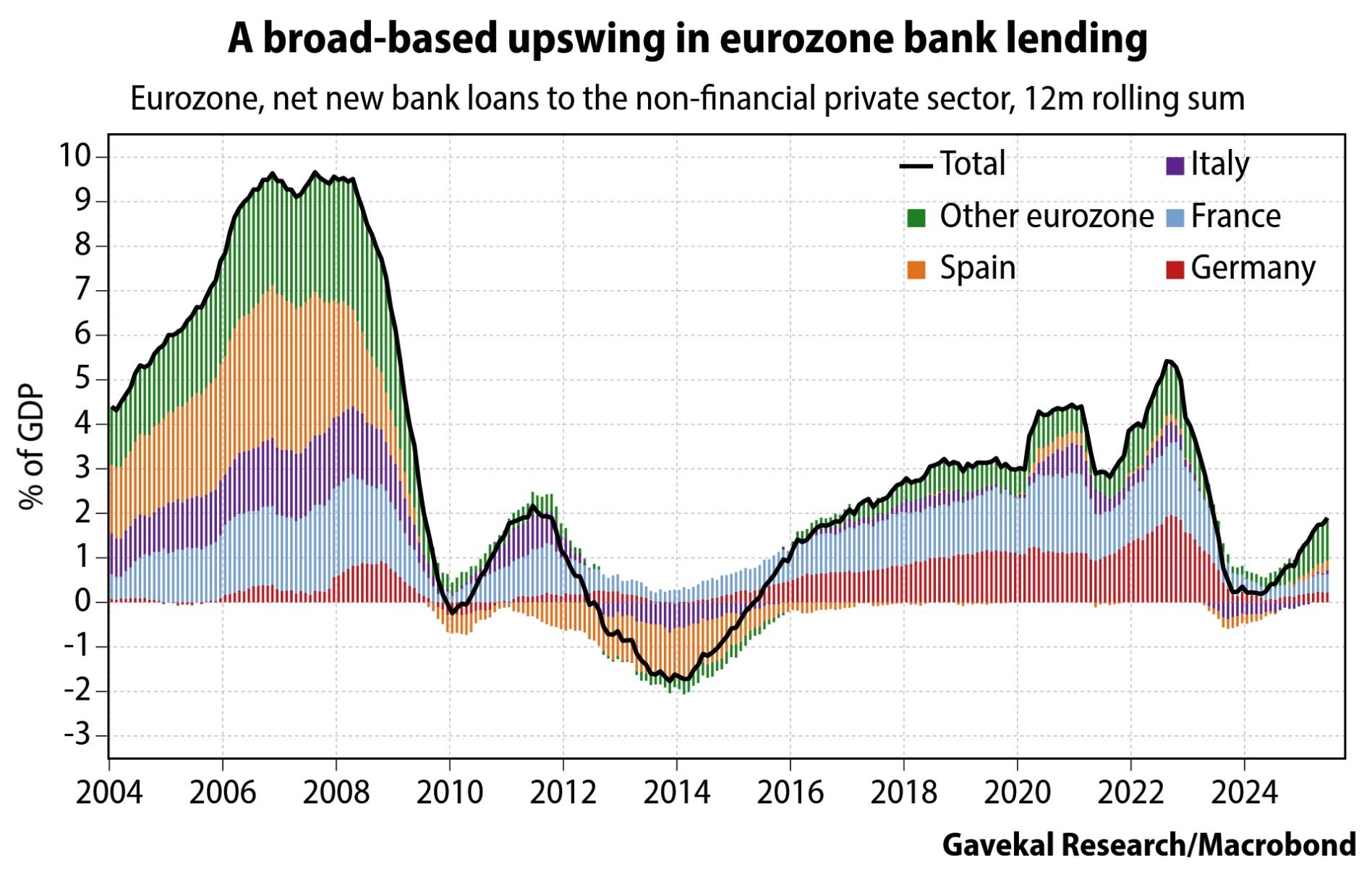

An interesting view on europe by Gavekal

"The 15% tariff rate on US imports from the European Union will hit the old continent's exporting sector. But the broader economy can count on its domestic segment to mitigate the shock. Notably, the effect of the ECB’s interest rate cuts is becoming visible in a bank lending recovery across the eurozone". Source: Gavekal, Macrobond

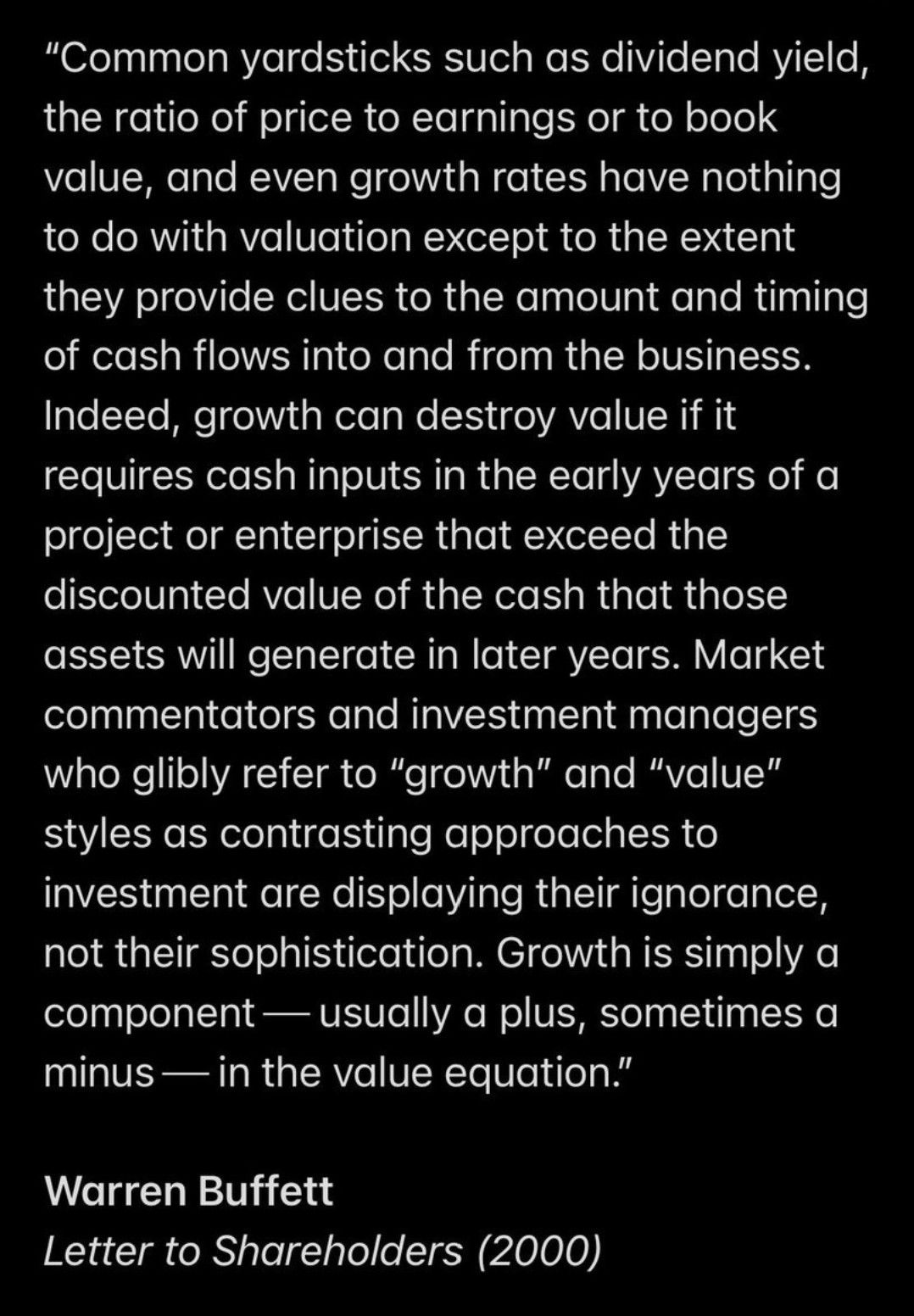

Buffett explains how growth impacts valuation

Source: Brian Feroldi

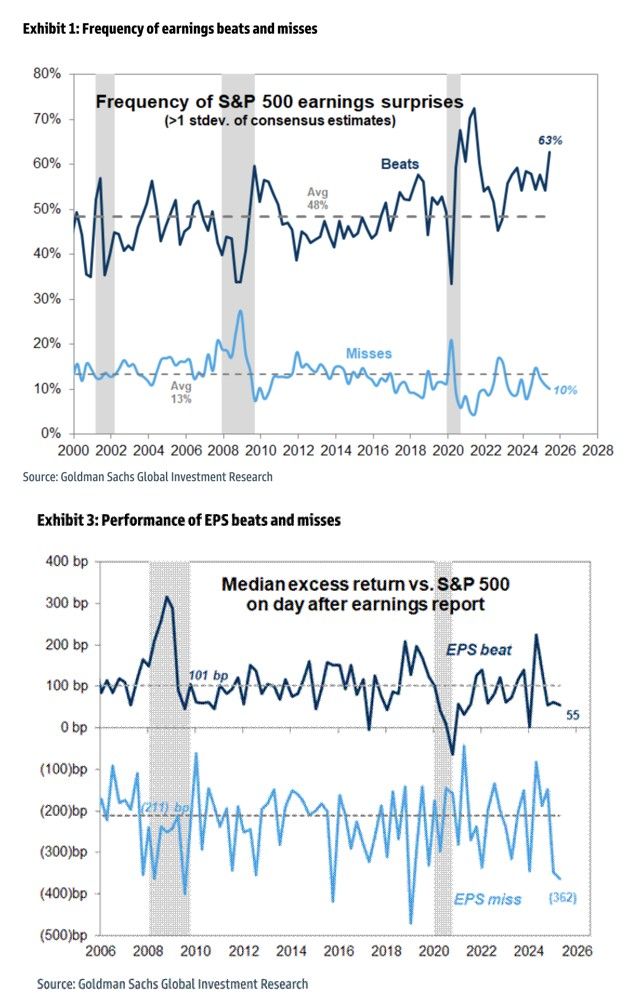

US earnings season update: so far so good...

Companies are beating, EPS growth is more than double so far vs expectations.. but beats are barely getting paid, while misses are getting pounded a little worse. Source: Goldman Sachs, RBC

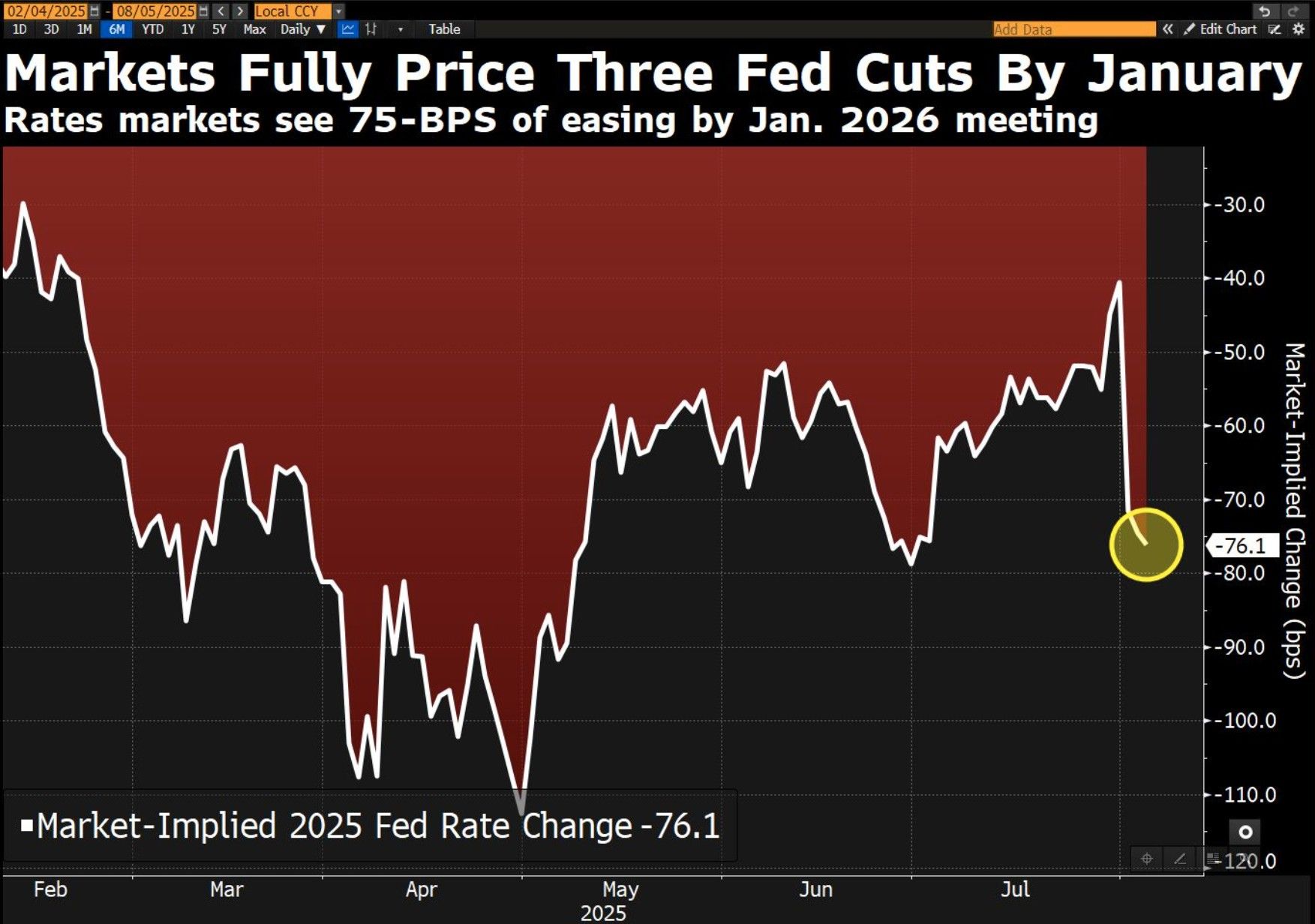

Markets have fully priced three Fed rate cuts by the January meeting. That's a cut at three of the next four FOMC meetings.

Source: David Ingles @DavidInglesTV, Bloomberg

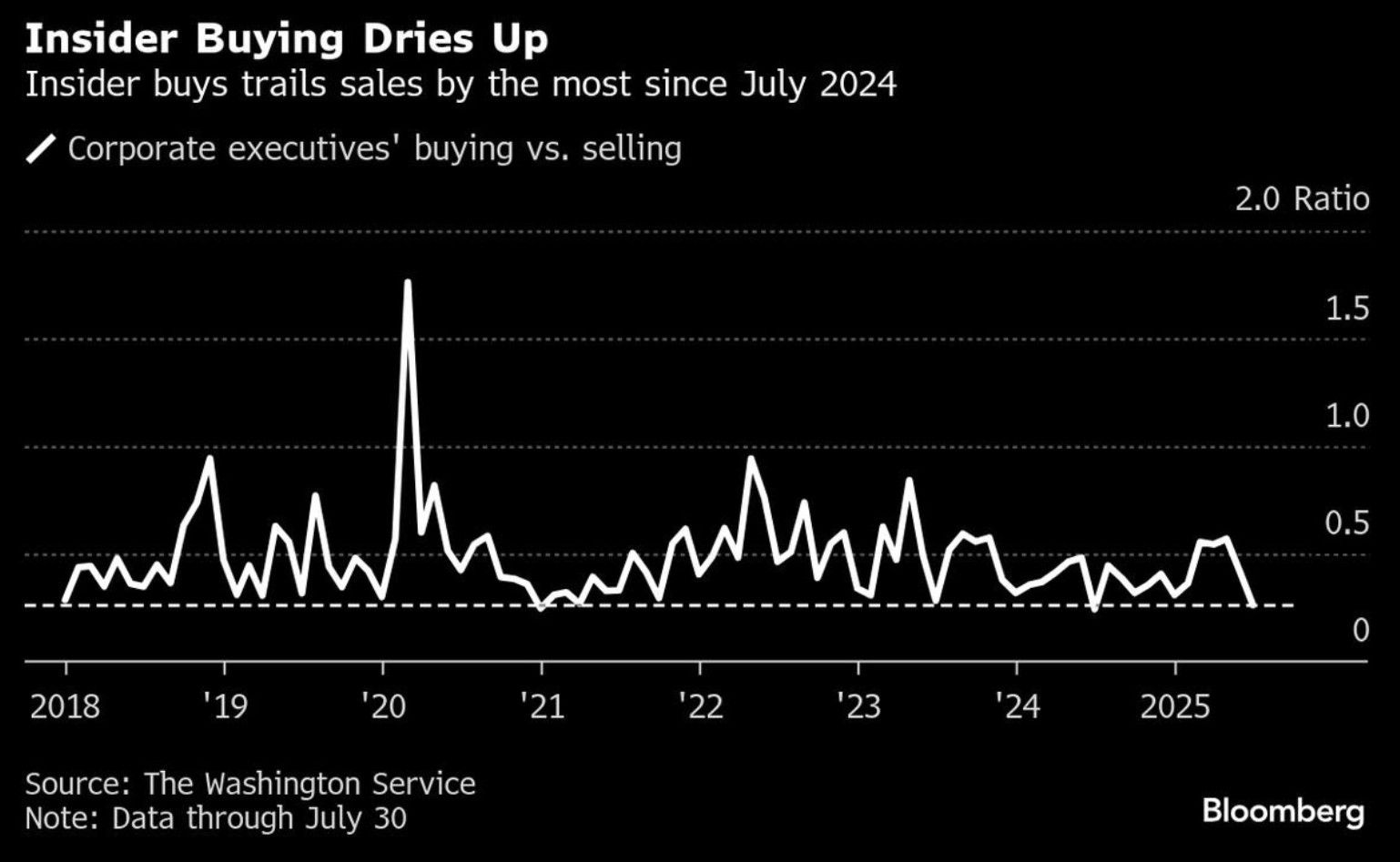

“Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018, according to data compiled by the Washington Service.”

Source: Kevin Gordon on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks