Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING >>> Trump spars with Powell over renovation costs during Fed visit, but says not ‘necessary’ to fire chairman

Trump: It looks like it’s about $3.1 billion Powell: I’m not aware of that. Trump: It just came out Powell: You just added in a third building Trump: It’s a building that’s being built Powell: It was built five years ago. Source: @SpencerHakimian

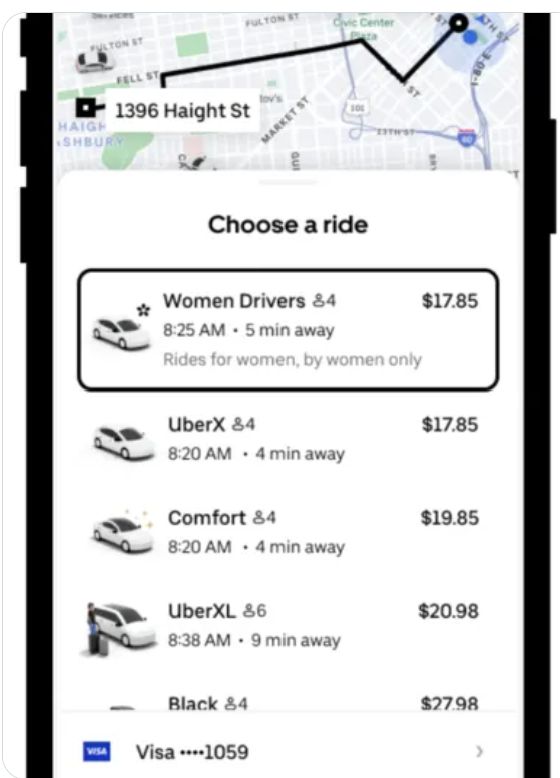

UBER TO LET WOMEN AVOID MALE DRIVERS IN NEW SAFETY PILOT

Starting next month, Uber will allow women drivers and riders to opt for same-gender pairings in Los Angeles, San Francisco, and Detroit. VP Camiel Irving: “It’s about giving women more choice, more control, and more comfort." The move follows similar tests in countries like France, Germany, and Argentina, and comes amid long-standing safety concerns on ride-hailing platforms. Source: CNBC thru Mario Nawfal

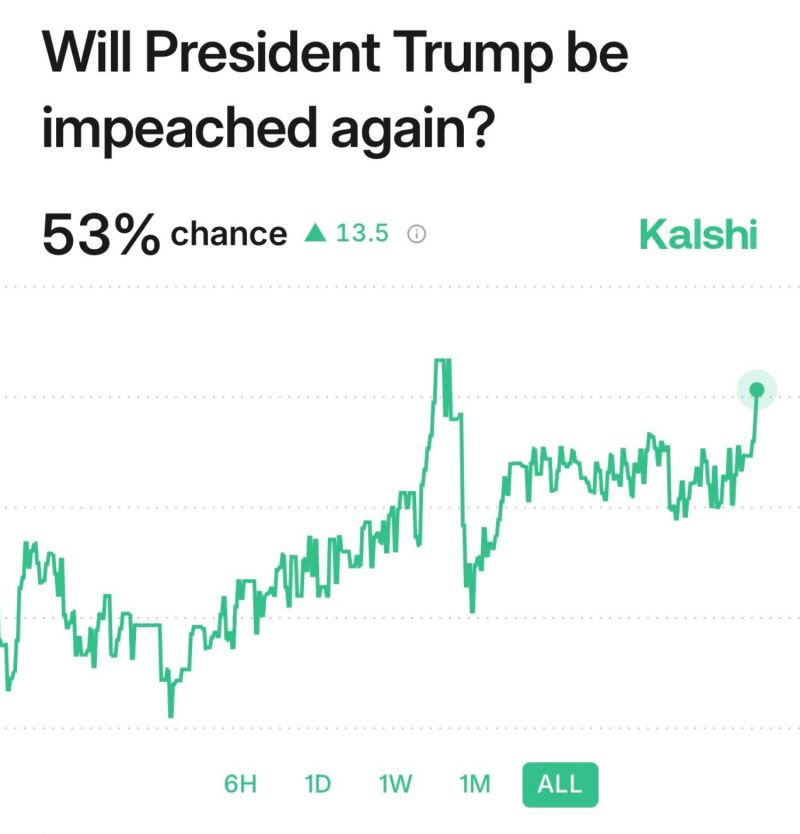

The betting odds of Trump getting impeached again are back to all time highs following the Epstein List news today.

According to the WSJ, The Justice Department told President Trump in May that his name is among many in the Epstein files. Source: Kalshi, SpencerHakimian

Investing with intelligence

Our latest research, commentary and market outlooks