Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

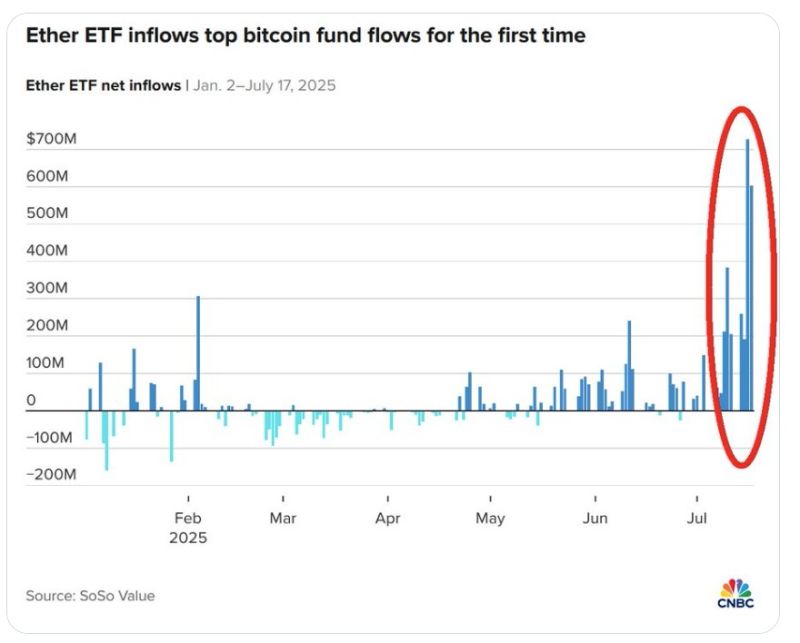

Ether ETFs saw $534 million in inflows on Tuesday, the 4th largest on record.

BlackRock alone bought $426 million. That’s now 13 straight days of inflows, totaling over $4 BILLION. Investors including Wall Street are going ALL IN on cryptos. Source: Global Markets Investor

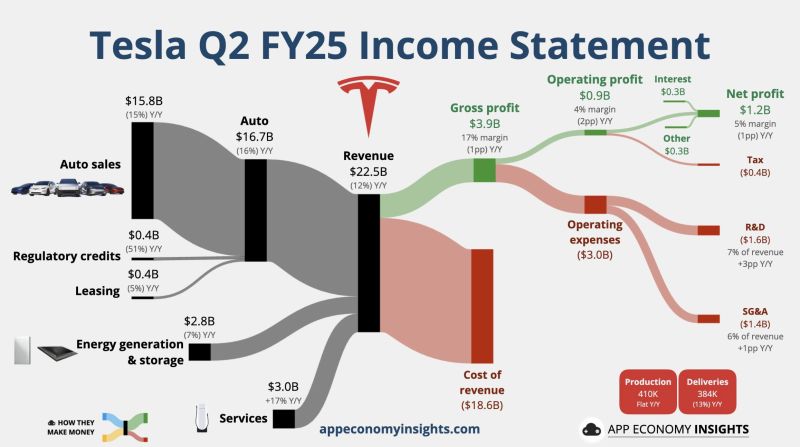

Tesla just posted a double miss for Q2:

~EPS: $0.40 vs $0.42 est ~REV: $22.50B vs $22.79B est Still, the stock $TSLA was up +1% in after-hours trading Here are the details: • Revenue -12% Y/Y to $22.5B ($0.4B beat). • Gross margin 17% (-1pp Y/Y). • Operating margin 4% (-2pp Y/Y). • Capex +5% Y/Y to $2.4B. • Free cash flow -89% Y/Y to $0.1B. • Non-GAAP EPS $0.40 (in-line). Source: App Economy Insights

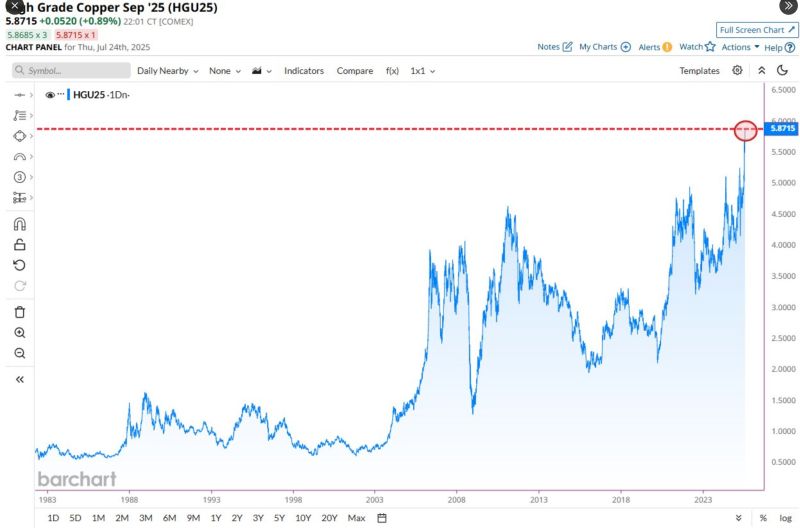

Copper soars to highest closing price in history 📈📈

Source: Barchart

The US president will spend about an hour at the central bank, as he looks to pressure its chair Jay Powell to cut interest rates more aggressively.

Source: FT

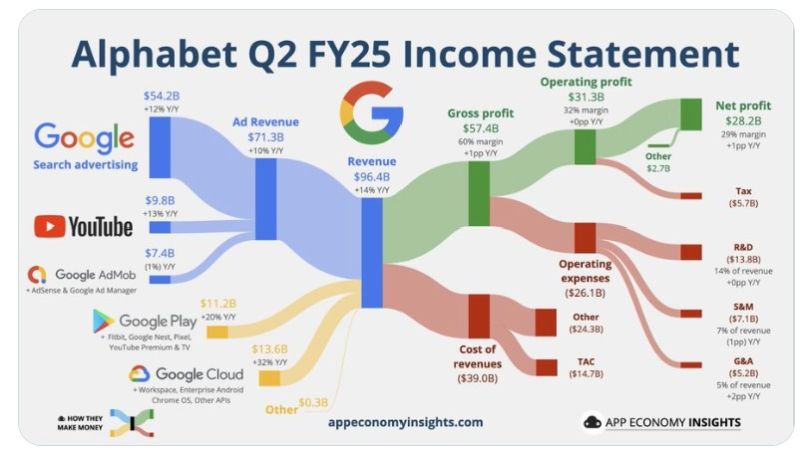

Alphabet reported second-quarter results on Wednesday that beat on revenue and earnings.

The company increased its capital expenditures forecast for 2025 to $85 billion, up $10 billion from February, due to “strong and growing demand for our Cloud products and services.” The company’s overall revenue grew 14% year over year, higher than the 10.9% Wall Street expected. Here are the details ($GOOG Alphabet Q2 FY25): • Revenue +14% Y/Y to $96.B ($2.5B beat). • Operating margin 32% (flat Y/Y). • EPS $2.31 ($0.12 beat). ☁️ Google Cloud: • Revenue +32% Y/Y to $13.6B. • Operating margin 21% (+9pp Y/Y). ▶️ YouTube ads +13% to $9.8B. Source: CNBC, App Economy Insights

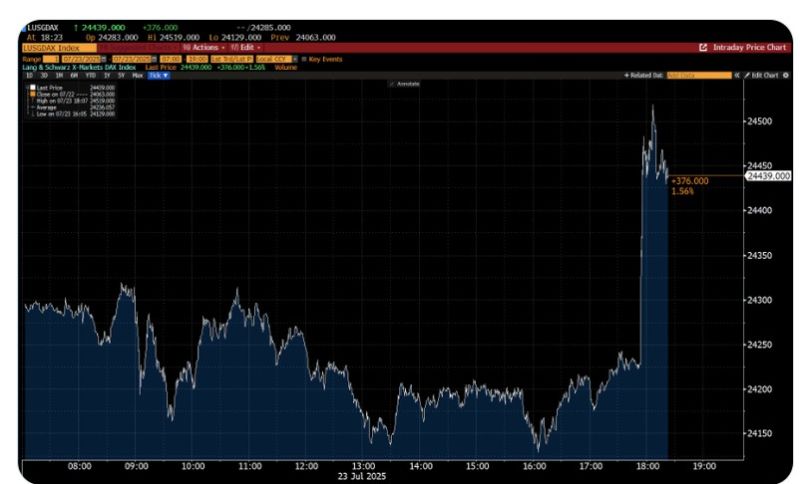

German benchmark index Dax jumps in AH trading after headlines the EU and the US are progressing toward an agreement that would set a 15% tariff for most products.

Member states could be ready to accept a 15% tariff and EU officials are pushing to have that cover sectors including cars. Steel and aluminium imports above a certain quota would face the 50% duty. Source: Bloomberg, HolgerZ

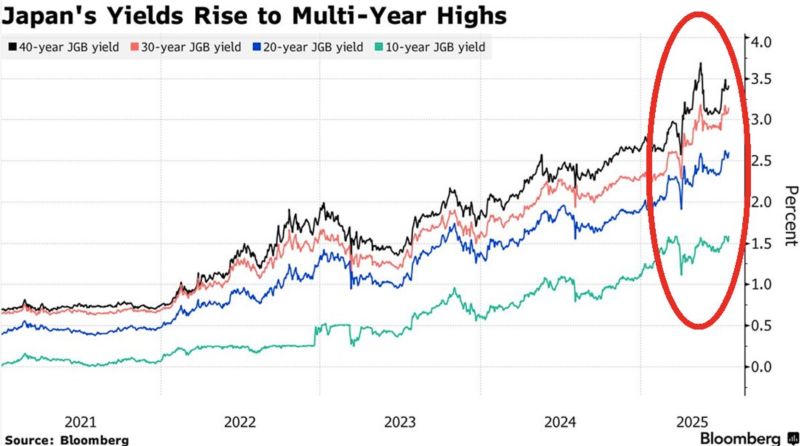

This is a GLOBAL DEBT CRISIS: Japan’s 40-year bond auction just saw its weakest demand since 2011.

The bid-to-cover ratio fell to 2.127. Yield surged to a record 3.375%. Cracks are forming in the world’s 3rd-largest bond market. Source: Bloomberg, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks