Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

PRESIDENT TRUMP JUST SAID:

- WE ARE THINKING ABOUT NO TAXES ON CAPITAL GAINS ON HOUSES Source: Evan

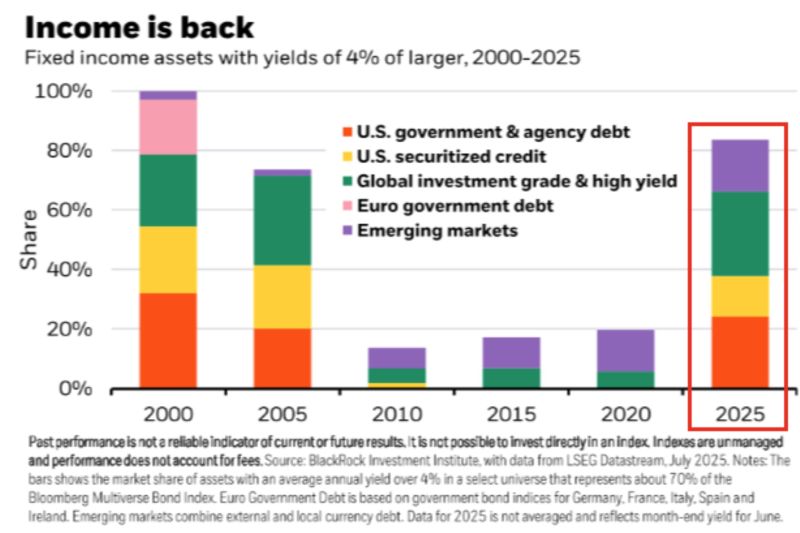

More than 80% of fixedincome assets yield above 4%.. income is back.

Source: BlackRock thru Mike Zaccardi, CFA, CMT, MBA

Breaking news:

The US House Speaker has shut the congressional chamber until September, as Donald Trump’s allies seek to contain a spiralling crisis over the administration’s handling of the Epstein case. Source: FT

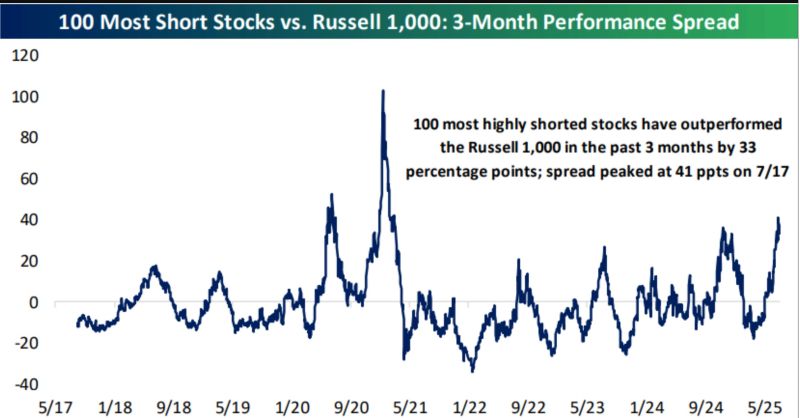

The 100 most shorted stocks in the Russell 1,000 are up 52% over the last three months and have beaten the index by 33 percentage points.

Not quite "meme-stock mania" from 2020/2021 but definitely elevated. Source: Bespoke

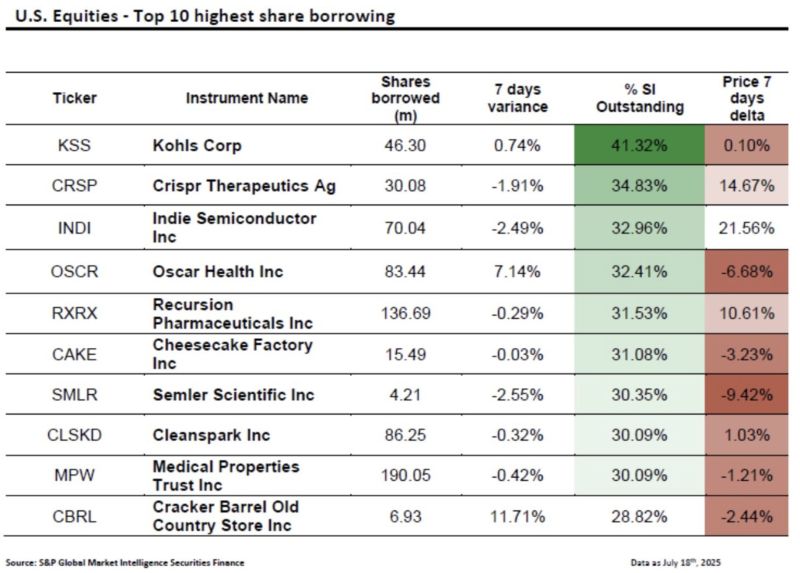

The meme stock frenzy is making a comeback.

Retail investors seem to be targeting the most shorted stocks again — one by one. Kohls is the new darling Source: HolgerZ, S&P Global

BREAKING >>>

U.S. President Donald Trump on Tuesday stateside announced that he had completed a “massive Deal” with Japan, that involves “reciprocal” tariffs of 15% on the country’s exports to the U.S. Nikkei 225 index is up more than 3pct on the news! In a post on Truth Social, Trump also said that Japan will invest $550 billion dollars into the United States, adding that the U.S. will “receive 90% of the Profits.” Trump also said that Japan will “open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things.“ The U.S. president added that the deal would also create “Hundreds of Thousands of Jobs.” Source: CNBC

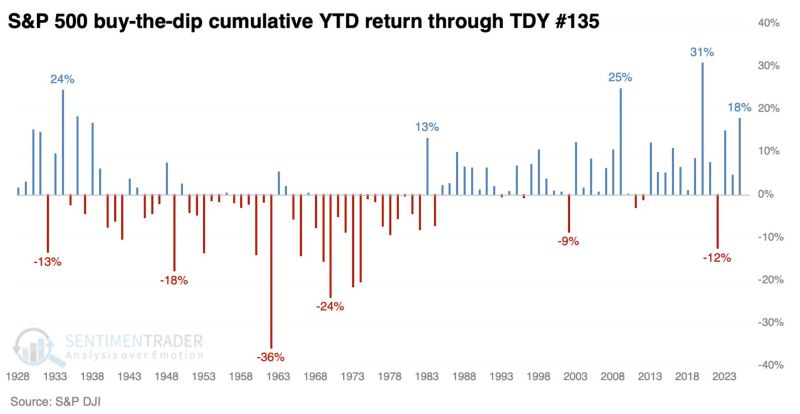

'Buy the Dip' mentality remains strong.

So far this year, the cumulative gain by buying a down day in the S&P 500 and holding it only for the next session is +18% ... tied for the fourth-highest since 1948 Source: Kevin Gordon @KevRGordon

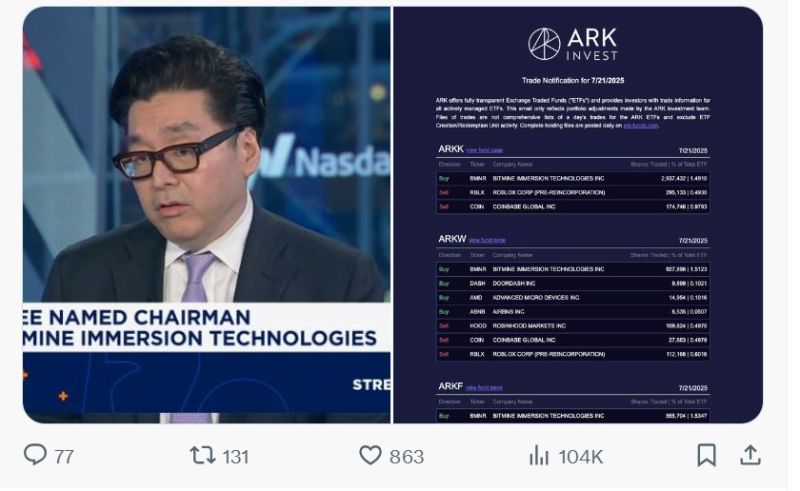

Cathie Wood and Ark Invest bought 4,421,034 shares of Tom Lee's new Ethereum Treasury Company $BMNR

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks