Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan PM Ishiba Vows To 'Stay On' Despite Ruling Coalition Facing Major Loss; Exit Polls Show

The governing coalition of Prime Minister Shigeru Ishiba is likely to lose a majority in the smaller of Japan's two parliamentary houses in a key election Sunday, according to exit polls, worsening the country's political instability. Voters were deciding half of the 248 seats in the upper house, the less powerful of the two chambers in Japan's Diet. Ishiba has set the bar low, wanting a simple majority of 125 seats, which means his Liberal Democratic Party, or LDP, and its Buddhist-backed junior coalition partner Komeito need to win 50 to add to the 75 seats they already have. That would mean a big retreat from the 141 seats they had before the election. The LDP alone is projected to win from 32 to 35 seats, the fewest won by the party, which still is the No. 1 party in the parliament. Source: www.zerohedge.com

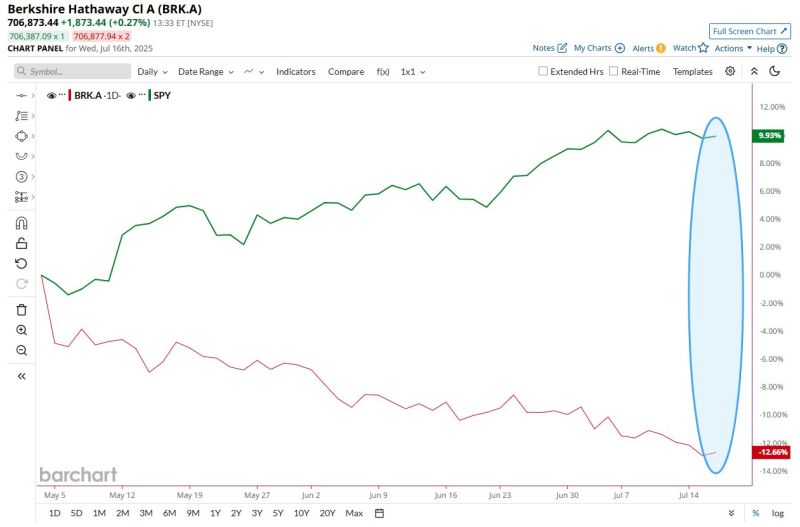

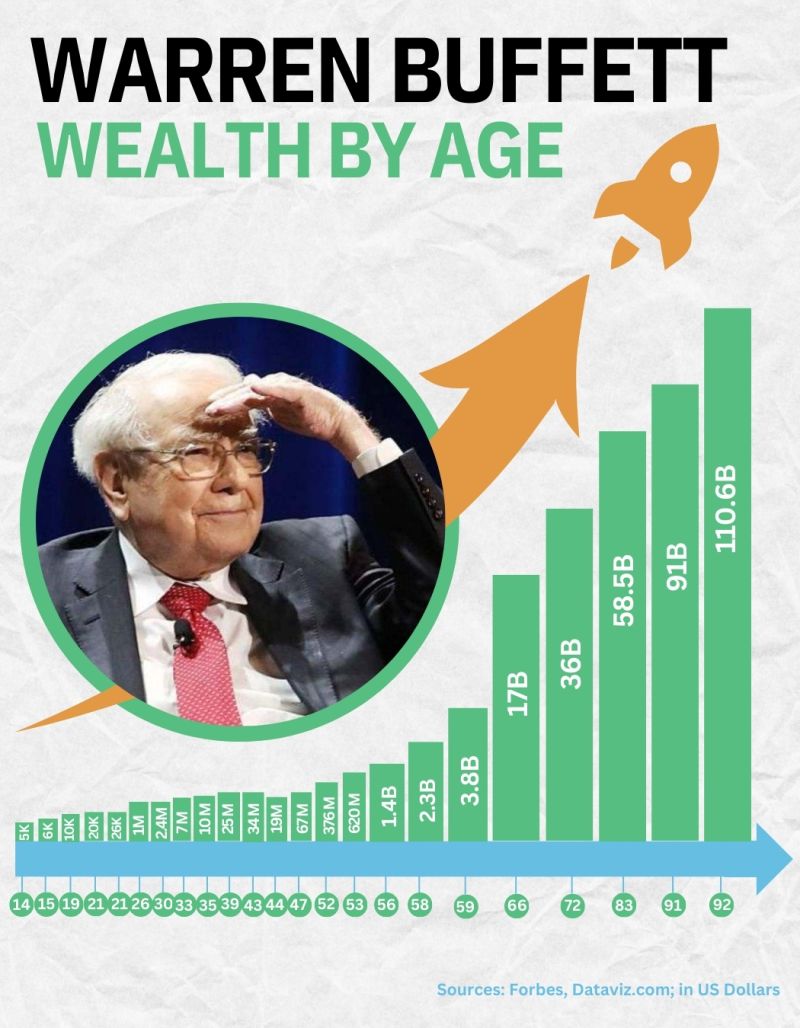

Berkshire Hathaway is now underperforming the S&P 500 by almost 23 percentage points since Warren Buffett announced his retirement 📉📉

Source: Barchart

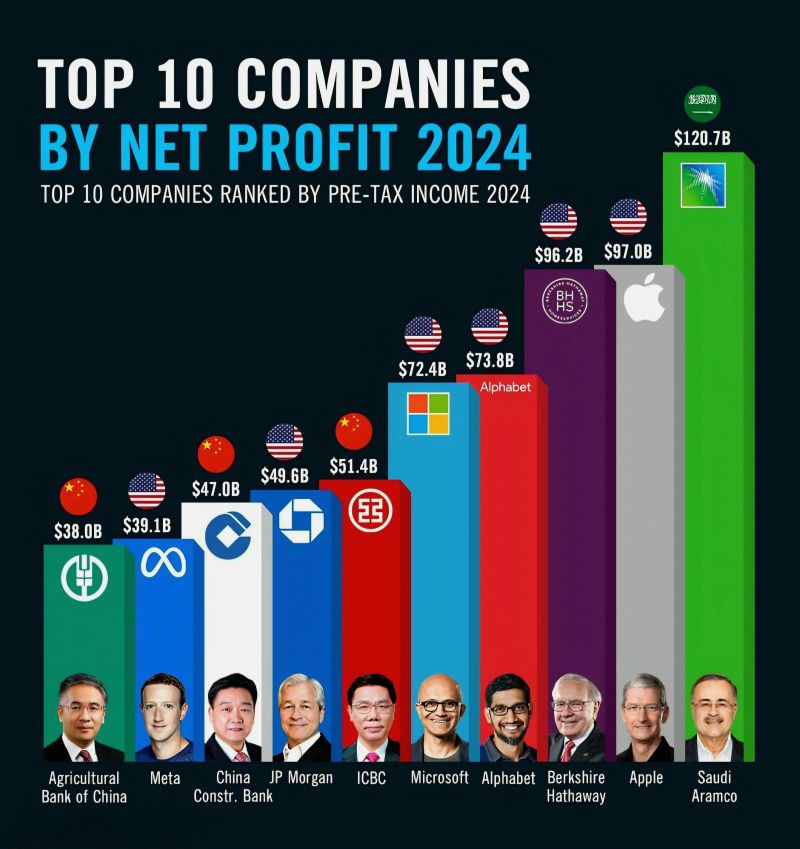

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

Investing with intelligence

Our latest research, commentary and market outlooks