Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

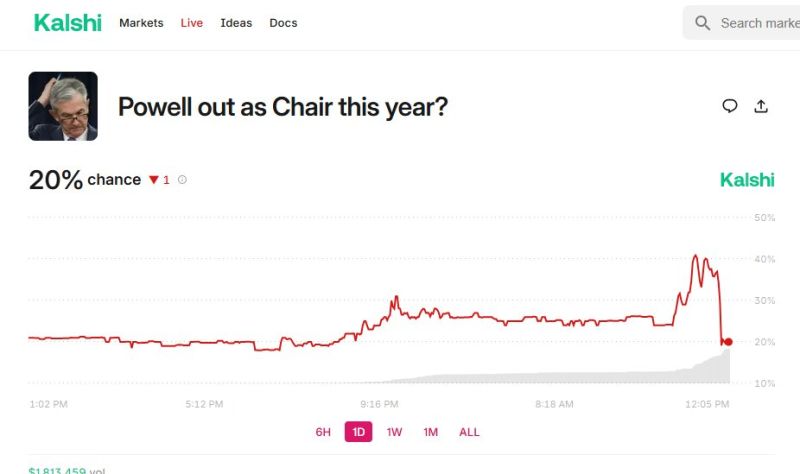

Pop n drop... Powell canned odds from 20% to 40% to 20%

Source: Mike Zaccardi, CFA, CMT, MBA

This is the 12-month return potential of some of your favourite AI-related stocks calculated based on spread between consensus price target and current share price.

Consensus seems to be missing the Palantir story, at least for now (this is a partial list) Source: David Ingles, Bloomberg

The U.S. Senate has approved the GENIUS Act with an overwhelming bipartisan vote.

👉This marks the first time the Senate has ever cleared a major piece of crypto legislation after years in which key Democratic members blocked the advancement of such legislation. 👉The bill heads to the House of Representatives, where its next steps remain uncertain while leading lawmakers work out a strategy for passage. The overwhelming bipartisan passage of the U.S. Senate's hashtag#stablecoin bill, with a 68-30 final vote that saw a huge surge of Democrats joining their Republican counterparts on Tuesday, sets a new high-water mark of hashtag#crypto policy efforts in the U.S. as the legislation now heads to the House of Representatives. The major Democratic backing for the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS) Act helps give it momentum as it lands in the other chamber, where House lawmakers can either vote on it as written or pursue changes that will require a final round in the Senate before it can head to President Donald Trump's desk. As written, the bill would set up guardrails around the approval and supervision of U.S. issuers of stablecoins, the dollar-based tokens such as the ones backed by Circle, Ripple and Tether. Firms making these digital assets available to U.S. users would have to meet stringent reserve demands, transparency requirements, money-laundering compliance and regulatory supervision that's also likely to include new capital rules. Source: coindesk

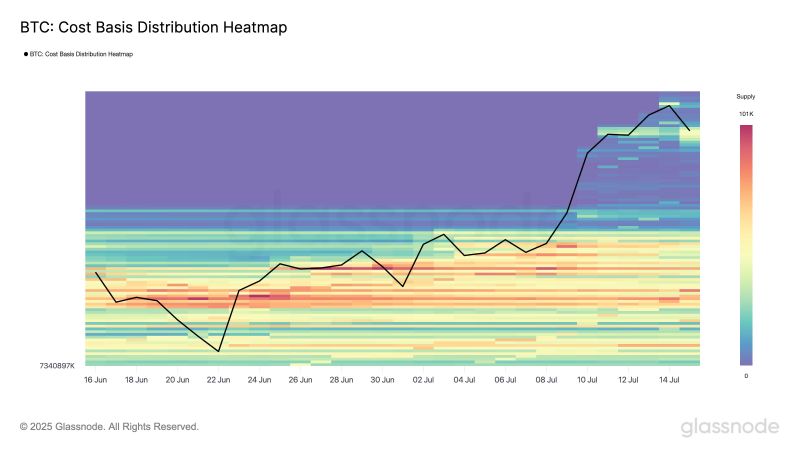

Cost Basis Heatmap shows investors stepped in aggressively on the dip

They accumulated ~196.6K $BTC between $116K–$118K. That’s over $23B in value added near the local top, signalling strong conviction and possible positioning for further upside. Source: Glassnode

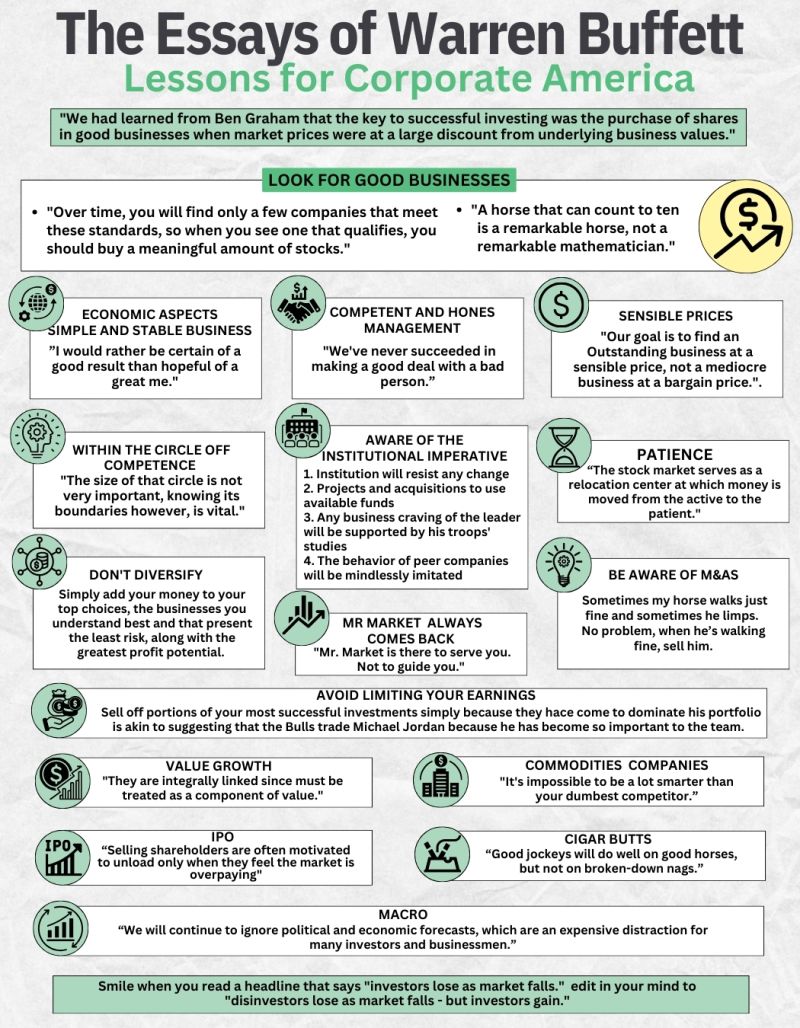

Investing advice by Warren Buffet.

At $4.3bn, equity-trading revenue for Q2 was about $600mln more than what analysts were expecting and $100mln above Q1. Source: HolgerZ, Bloomberg

Cantor Fitzgerald close to $4 billion SPAC deal with Adam Back "to buy billions of dollars" of Bitcoin.

FT >>> "Brandon Lutnick, son of US commerce secretary Howard Lutnick, is nearing a roughly $4bn deal with an early bitcoin supporter to buy billions of dollars in the digital tokens using a vehicle backed by Cantor Fitzgerald. Cantor Equity Partners 1, a blank cheque vehicle that raised $200mn in cash in an initial public offering in January, is in late-stage talks with Adam Back, founder of crypto trading group Blockstream Capital, to buy more than $3bn in the digital currency, according to two people briefed on the talks. The deal, which mirrors a $3.6bn crypto buying venture Brandon Lutnick struck with SoftBank and Tether in April, would advance Cantor Fitzgerald’s strategy of using publicly listed shell companies to buy bitcoin as it aims to take advantage of a surge in digital currency prices amid US President Donald Trump’s deregulatory push. Howard Lutnick handed control of Cantor Fitzgerald to his children in May. Back is in discussions to contribute as much as 30,000 bitcoin to Cantor Equity Partners 1, worth more than $3bn. It would be part of a broader deal with the blank cheque company in which it would raise as much $800mn in outside capital to make further purchases of the digital currency, putting the overall deal at more than $4bn". Source: FT

🚨Earlier today, just before Bloomberg/CNBC/CBS reported that Trump wants to fire Powell asap, June US Producer Inflation came in below estimates

It came lower than expectations of all 50 forecasters in Bloomberg’s survey. ▶️ June US PPI annual inflation rises 2.3%, below expectations for 2.5%. ▶️ Core PPI inflation increased 2.6% Y/Y, compared to forecasts for a gain of 2.7%. THIS IS THE LOWEST LEVEL SINCE SEPTEMBER 2024 The last time PPI was at this level, the Fed was cutting 50bps before the election. Source: Bloomberg, Geiger Capital

Looking at today's market action when Bloomberg announced that the White House said they discussed about firing Powell, it seems that Deutsche Bank was right...

Maybe Trump & Bessent watched the market and decided to immediately "TACO"...

Investing with intelligence

Our latest research, commentary and market outlooks