Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What a mess... 🤡

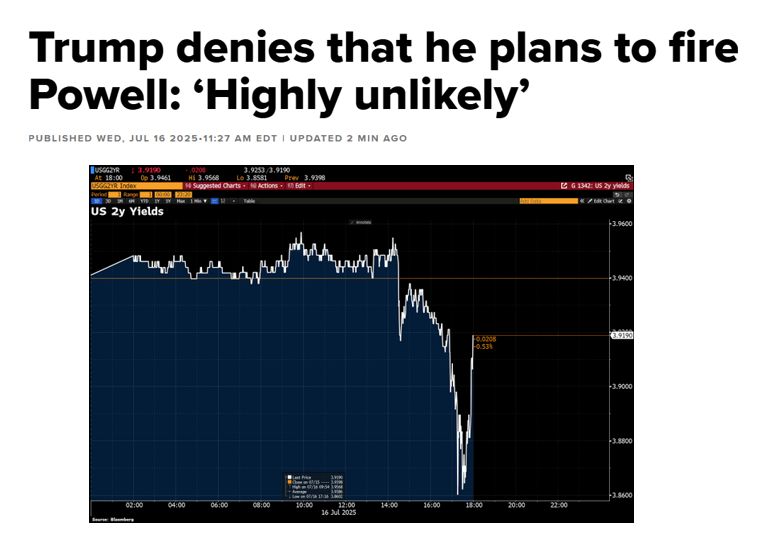

*TRUMP ON FED CHAIR POWELL: WE ARE NOT PLANNING ON DOING ANYTHING *TRUMP ON POWELL: WE GET TO MAKE A CHANGE IN 8 MONTHS US 2-year hashtag#yields bounced back after President Trump says his administration is “very concerned”, but “not planning on doing anything” about Fed Chair Jerome Powell. Source: CNBC, Bloomberg, HolgerZ

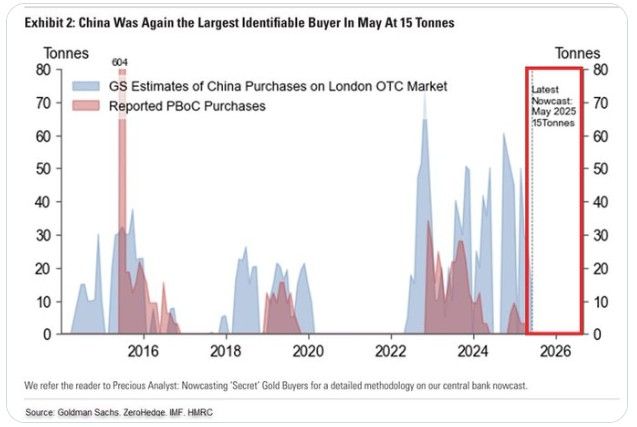

China continues to quietly acquire gold through the London market

China bought 15 tonnes of gold in May, according to Goldman Sachs estimates, 8 TIMES more than officially reported figures. Over the past year, China's monthly purchases have oscillated between 25-60 tonnes. Source: Global Markets Investors, Goldman Sachs

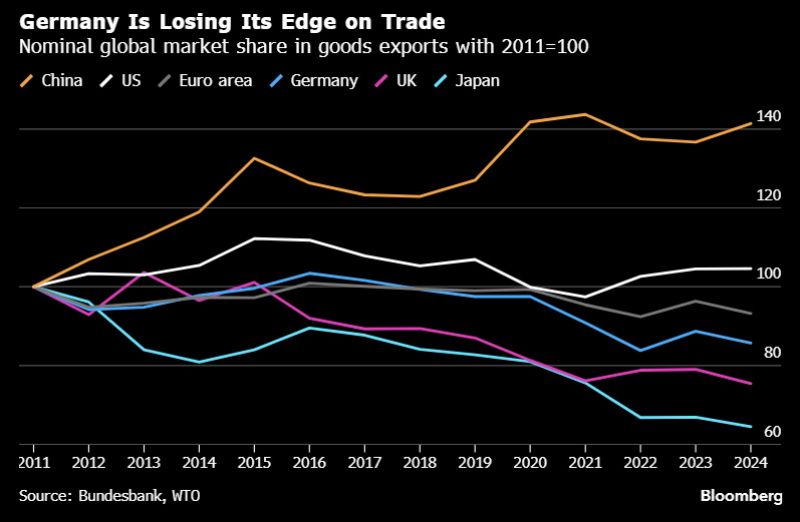

Germany is losing its edge on trade. The country’s share in global trade has been shrinking since 2017, w/losses accelerating after 2021, according to Bundesbank.

Over three-quarters of the decline from 2021 to 2023 was due to falling competitiveness – not Trump’s tariffs Source: HolgerZ, Bloomberg

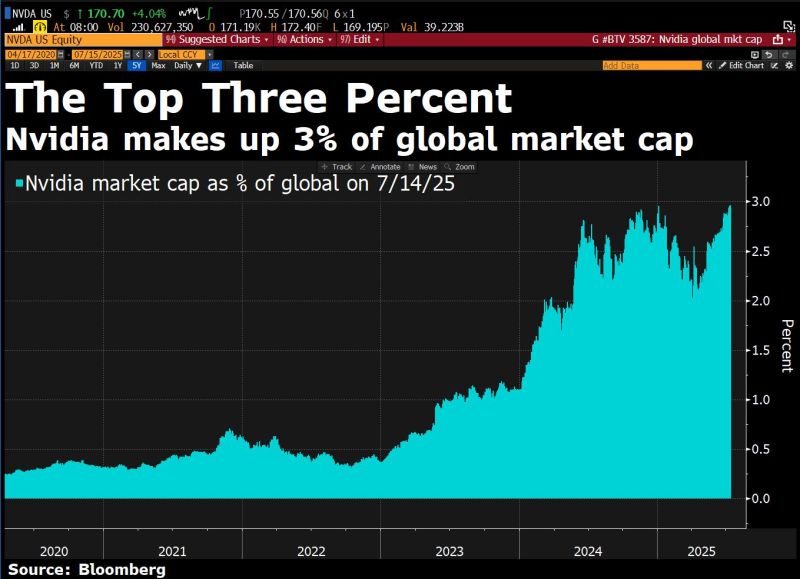

Nvidia is 3% of global market cap. The other 82,292 stocks (Bloomberg-tracked primary listings) make up the other 97%.

Source: David Ingles, Bloomberg

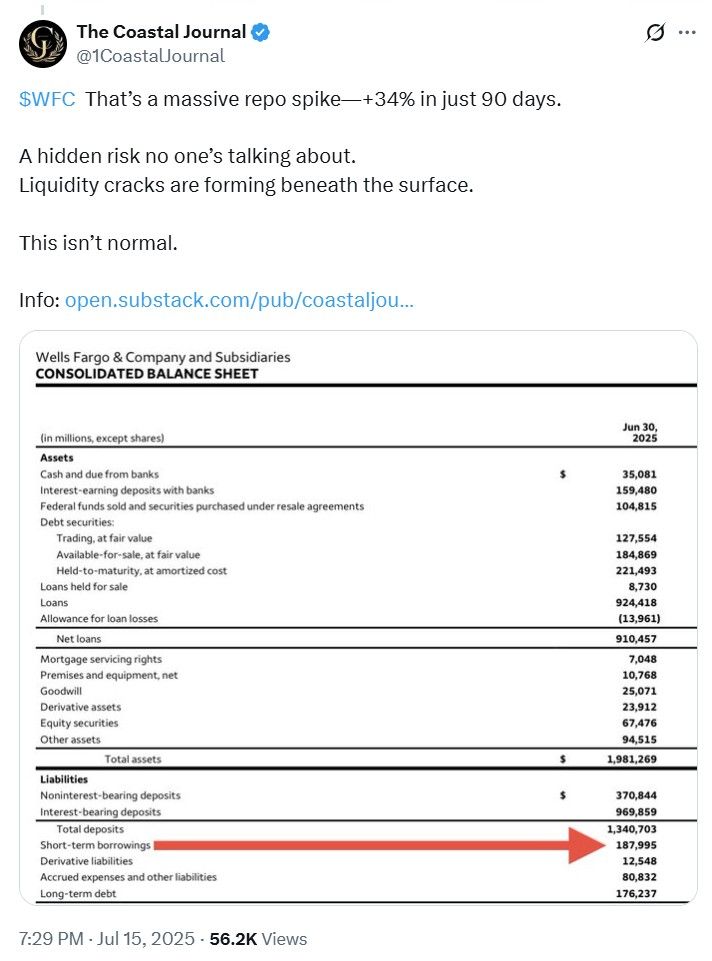

The Coastal Journal on X highlighted one important item published out of WellsFargo quarterly earnings results: a • $188B repo surge 📈 (+34%) in just 90 days.

While Wells Fargo $WFC beat earnings estimates, the stock is down -5.5% after market Are liquidity cracks are forming beneath the surface?

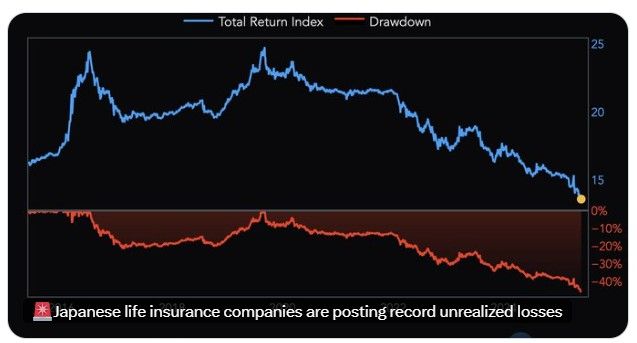

🔴 Japanese insurers' unrealized LOSSES are HUGE

▶️ The biggest insurers’ paper losses on their domestic bond holdings hit a record ¥8.5 TRILLION ($60BN) in Q1. 💥 Nippon Life, the largest insurer and the world’s 6th-largest saw ¥3.6TN ($25BN) LOSS. Source: Global Markets Investor

Cryptocurrency-related bills backed by US President Donald Trump failed to clear a key procedural step in the House of Representatives on Tuesday, despite the president’s public push for action.

Trump had urged Republican lawmakers to “get the first vote done this afternoon” on legislation to regulate payment stablecoins as part of a larger effort to pass crypto legislation before the August recess. In a Tuesday post on his social media platform Truth Social, Trump ordered all Republicans to vote yes on the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, a bill designed to regulate payment stablecoins in the US. House Speaker Mike Johnson reportedly said the chamber would take up another vote “this afternoon.”

Investing with intelligence

Our latest research, commentary and market outlooks