Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

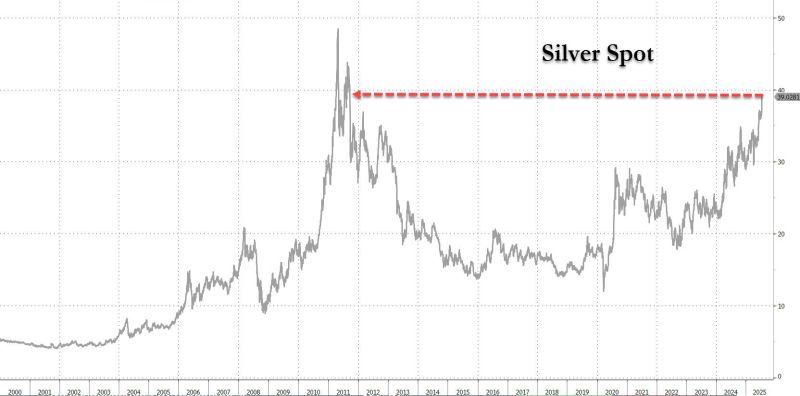

🚨 NEW YORK BEGGING FOR SILVER. LONDON CAN’T DELIVER.

Source: @MakeGoldGreat on X

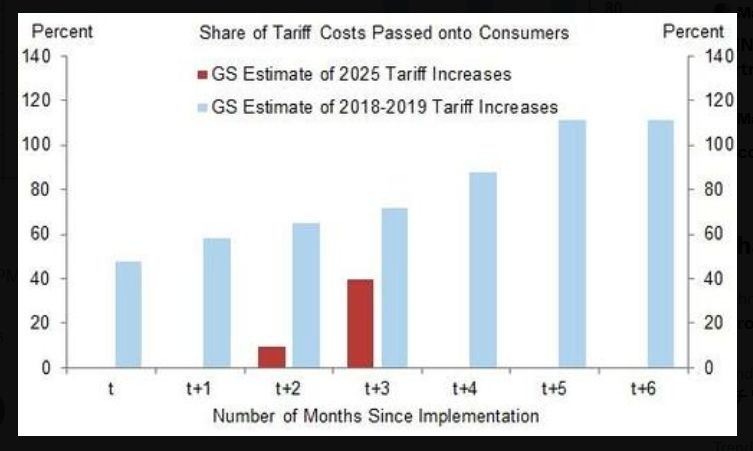

Goldman Sachs analysis suggests that the share of tariff costs that fell on consumers rose from 0% in the first month of implementation to 10% after two months.

It then rose to 40% after three months, it is still too early to see the full pass-through of tariffs on inflation. Source: Markets & Mayhem

The electrification theme in 4 charts

Platinum, palladium, copper, uranium. Four key metals in the electrification of everything. As highlighted by @DimitryFarberov on X, their quarterly charts are starting to come alive. • Copper just broke out of a 15+ year base • Platinum finally cleared its downtrend • Palladium trying to bottom at major support • Uranium still in its handle, consolidating after a huge move Different charts, same theme.

Silver surges above $39 for the first time since the first US downgrade in Aug 2011

Source: zerohedge

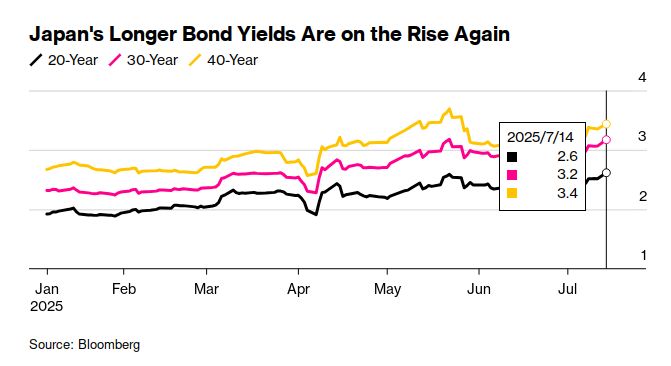

Yield on Japanese government hashtag#bonds are back to the highs they reached in May.

Japan was always held up by the MMT (Modern Monetary Theory) crowd as an example for how debt doesn't matter because governments can always cap yields. That view needs to be retired along with MMT. Fiscal space seems to be finite. Not infinite. Source: Robin Brooks, Bloomberg

Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

Source: Bitcoin archive

Investing with intelligence

Our latest research, commentary and market outlooks