Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

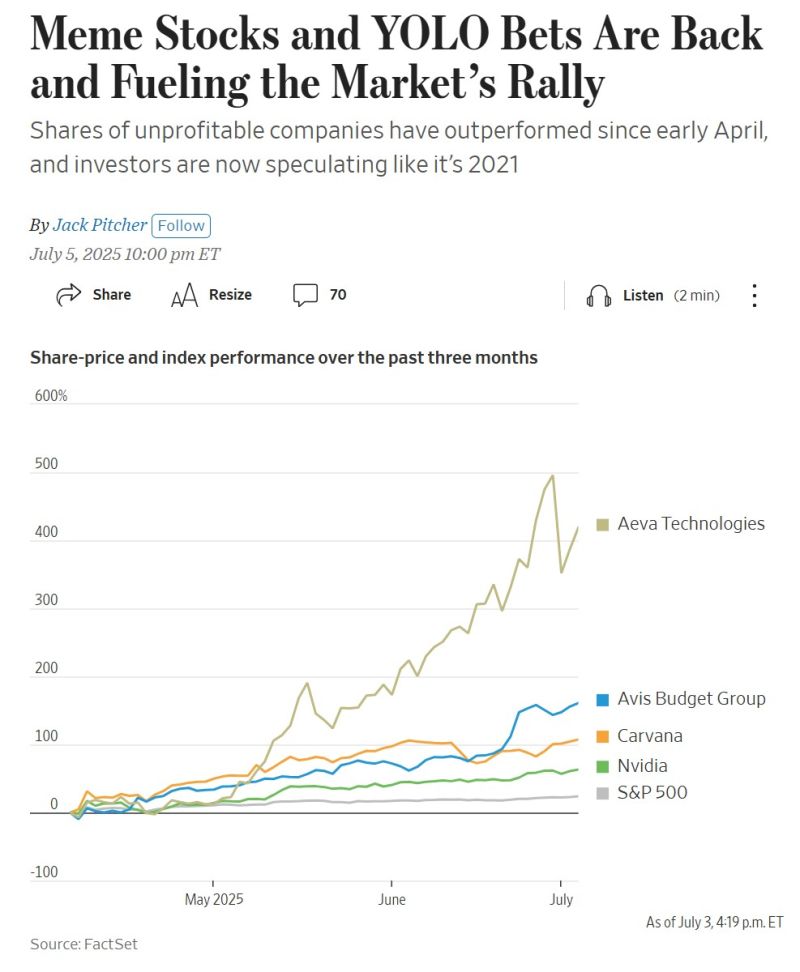

Everybody knows about the Mag7. But have you heard about the "Unprofitable 858" ???

Meme stocks and YOLO bets are back and fuelling the market’s rally. Shares of unprofitable companies have outperformed since April, and investors are now speculating like it’s 2021 again... Source: HolgerZ, WSJ

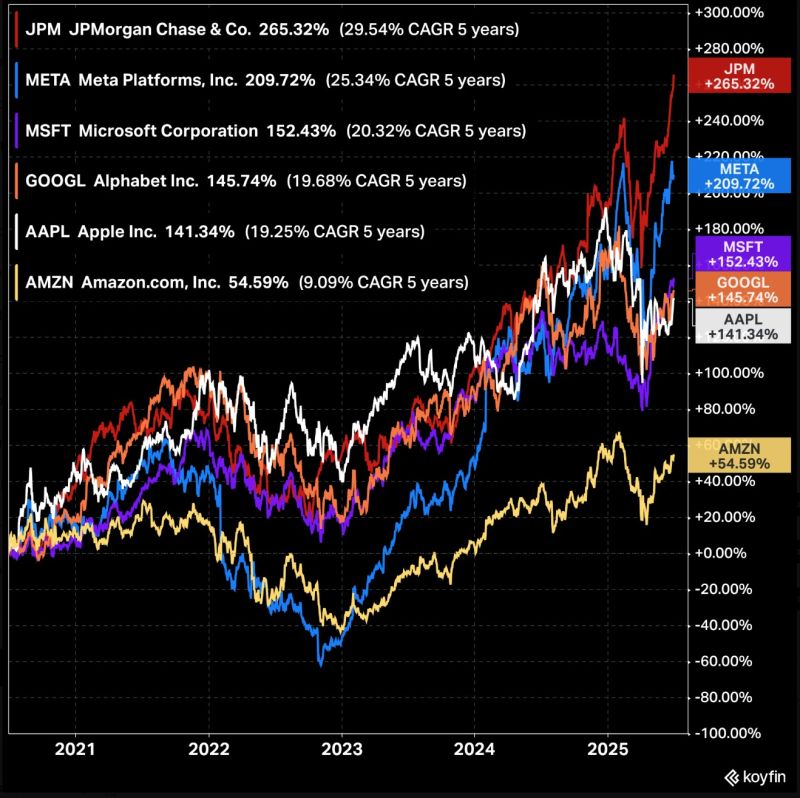

$JPM JPMorgan has outperformed 5 of the Magnificent 7 over the last 5 years.

Source: Koyfin

Does this chart signal a breakdown in the dollar, or is it preparing the ground for one of the most violent reversals in recent history?

$DXY is testing the lower bound of a multi-decade ascending channel, a level that has repeatedly marked inflection. Source: barchart

Value and growth are now even YTD

Source: Mike Zaccardi, CFA, CMT, MBA

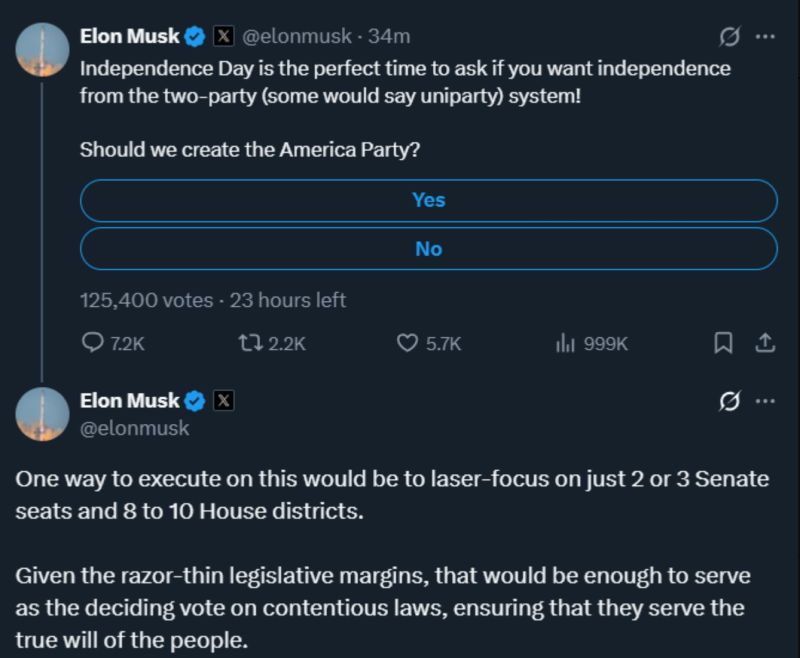

😨 ELON FLOATS BLUEPRINT FOR A NEW "AMERICA PARTY” POWER PLAY

Forget the presidency - Elon’s idea? Flip just enough seats to become the kingmaker. He’s talking 2–3 Senate races, 8–10 House districts. That’s it. @elonmusk : "Given the razor-thin legislative margins, that would be enough to serve as the deciding vote on contentious laws, ensuring that they serve the true will of the people." ▶️ This can be seen as "Minority leverage". Not a party to win; a party to decide who does. All it "America party" ‼️ Source: @elonmusk thru Mario Nawfal on X

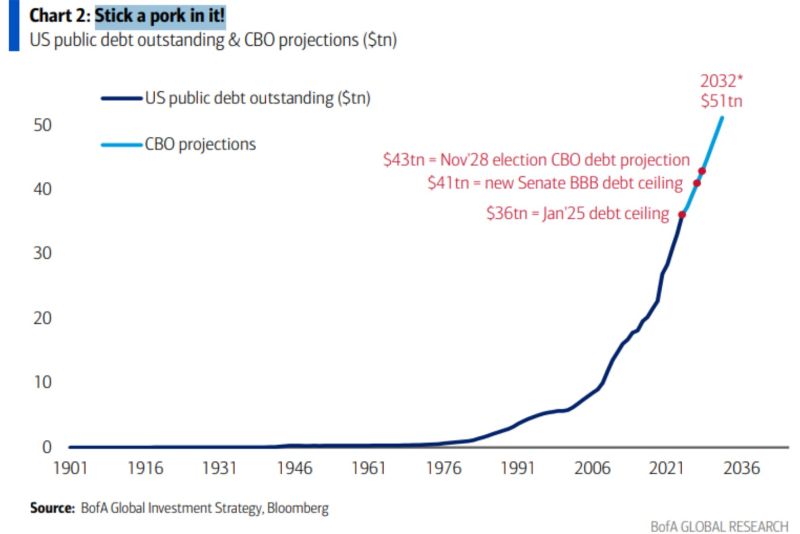

The sky is the limit... Hartnett BofA

Porky Big Beautiful Bill set to raise US debt ceiling $5tn to $41tn. Source: BofA thru Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks