Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

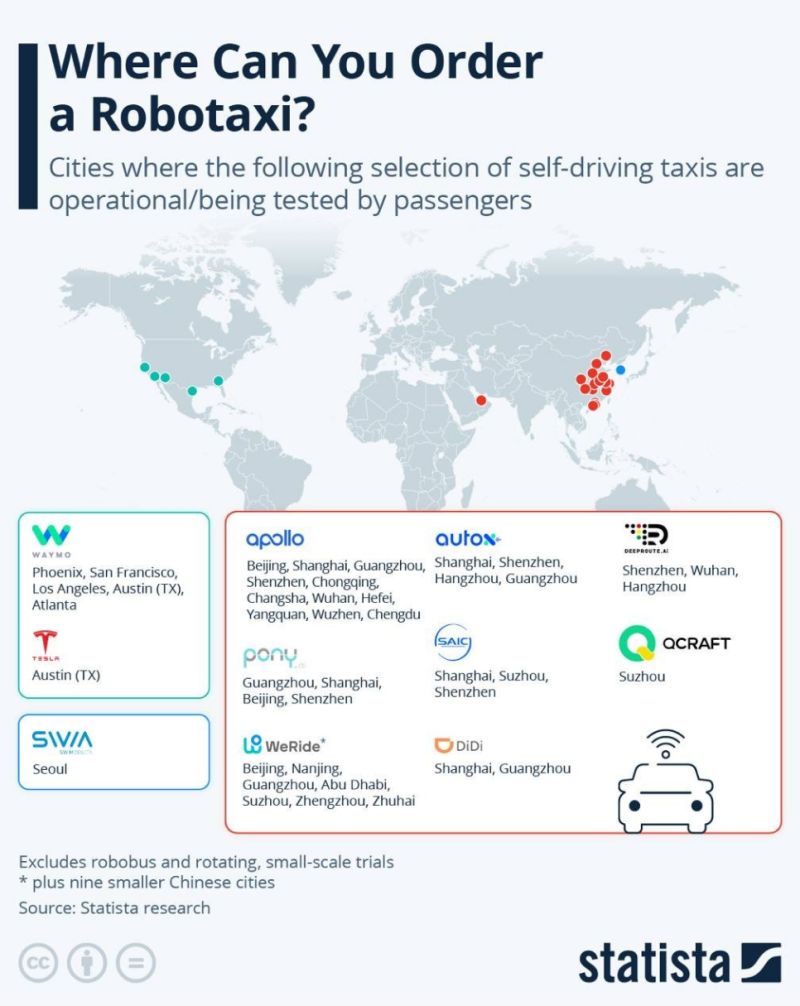

ROBOTAXIS ARE ALREADY OUT THERE

You can literally order a car with no driver in Phoenix, Shanghai, or even Seoul. No driver, no small talk, just you, a robot, and your questionable playlist. This isn’t sci-fi. From Austin to Abu Dhabi, robotaxis are creeping onto real streets. Watch your Uber driver sweat. Source: Statista thru Mario Nawfal on X

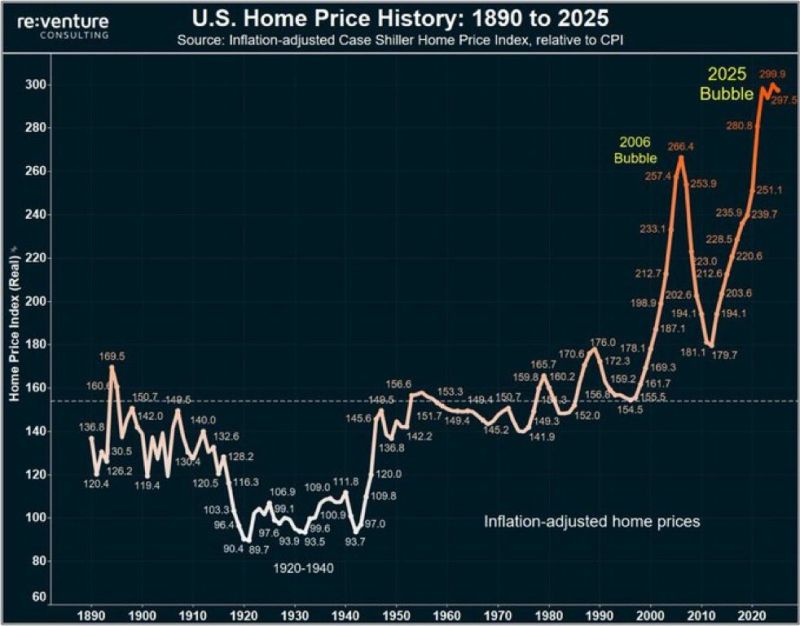

U.S. Housing Market has reached its most unaffordable level in history 🚨🚨

Source: Barchart, re:venture

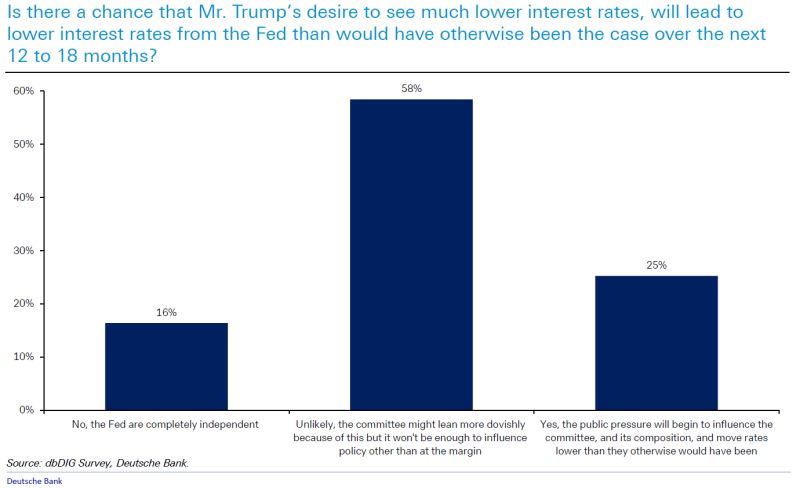

Only 16% of respondents in a recent Deutsche Bank survey believe the Fed is completely independent, with 25% seeing political pressure leading to lower rates.

Source: DB thru Liz Abramowicz

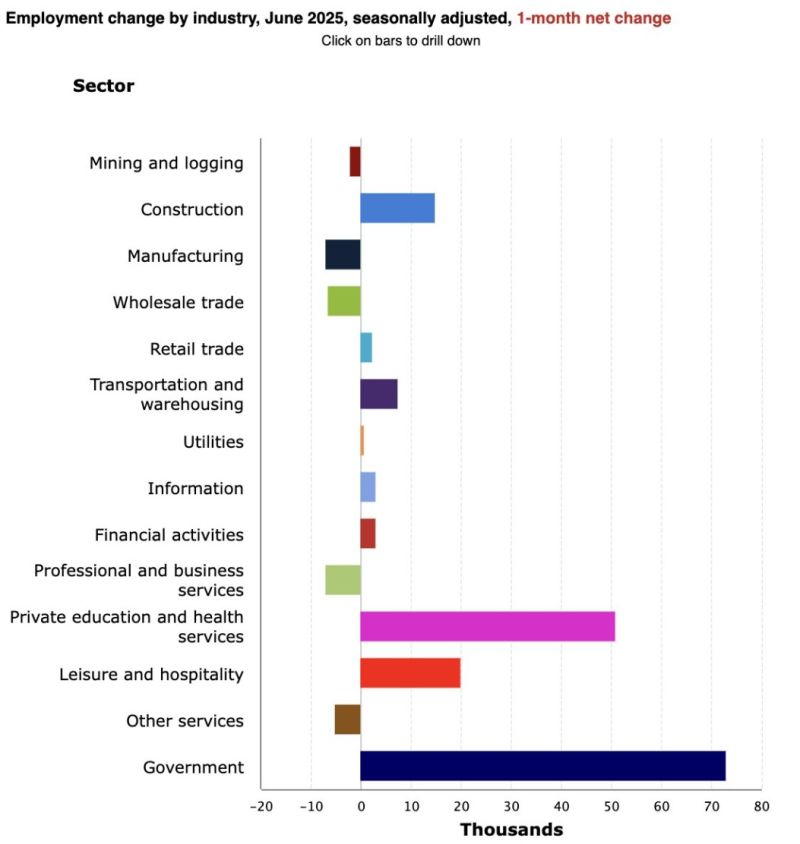

Notable: Coming back to yesterday's US non farm payrolls

-> The 147,000 job gains in June were almost all (over 75%) in healthcare and government. Government: +73,000 Healthcare: +39,000 The government job gains looked like this: State gov't education +40,000 State gov't non-education +7,000 Local gov't education +23,000 Local gov't non education +10,000 Federal gov't -7,000 Source: Heather Long on X

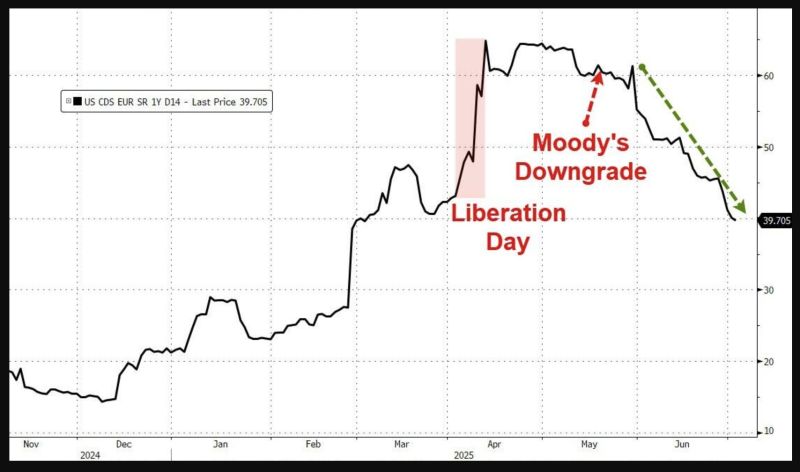

It seems the world is becoming MORE comfortable with USA sovereign risk once again...

(below US CDS) Source: Bloomberg, www.zerohedge.com

UK gilt yields have retraced a significant portion of Wednesday’s sharp widening.

This follows, and is in reaction to the Prime Minister’s strong public support for Rachel Reeves in last night’s interview with the BBC’s Nick Robinson. Source: Bloomberg, Mo El Erian

Key U.S. Economic Indicators Hitting New Highs

1. Stocks: all-time high 2. Home Prices: all-time high 3. Bitcoin: all-time high 4. Money Supply: all-time high 5. National Debt: all-time high 6. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" 7. Fed: expected to cut rates between 1x and 2x this year 8. The US Treasury is skewing issuance further to bills (Fiscal QE) Source. Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks