Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

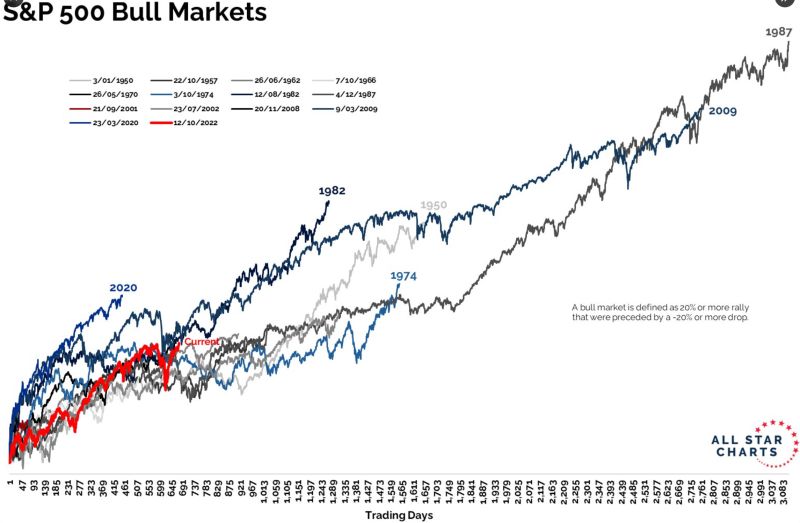

Current SP500 bull market vs. history by Grant Hawkridge on X

The S&P 500 is up 72.6% over 678 trading days since the 2022 low, below the average bull market gain of 153.7% over 1,145 days. We’re now in year 3, a phase that’s historically flat and choppy. This bull isn’t young, but it’s not stretched either. History still favors more upside… just not in a straight line.

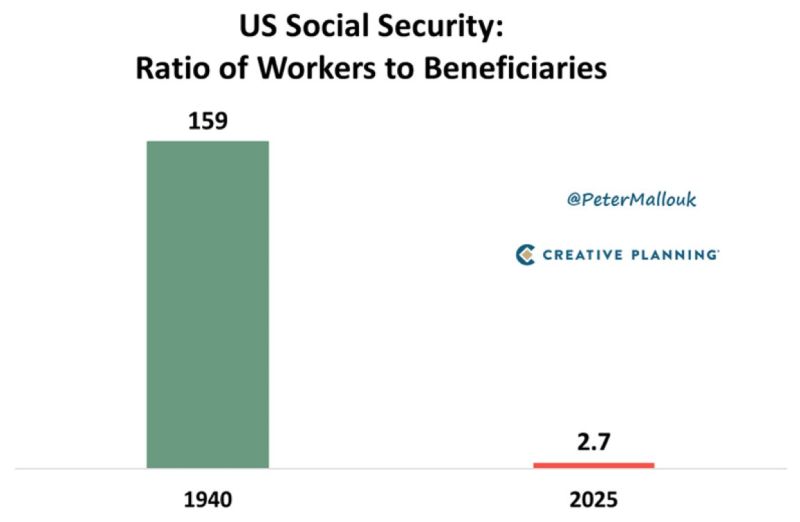

Why the Social Security math doesn’t work anymore: Why the Social Security math doesn’t work anymore:

When Social Security first started paying benefits in 1940, there were 159 workers putting money in for every 1 person taking money out. The ratio today is less than 3 to 1. Source: Peter Mallouk

BYD Entering Major Support Zone

Since the May high, BYD (1211 HK) has consolidated more than 20%! The stock is now entering a major support zone between 103-123. Additionally, BYD is back at the 61.8% Fibonacci retracement, which places it in the discount zone. Keep an eye on the price action over the next few days for potential developments. Source: Bloomberg

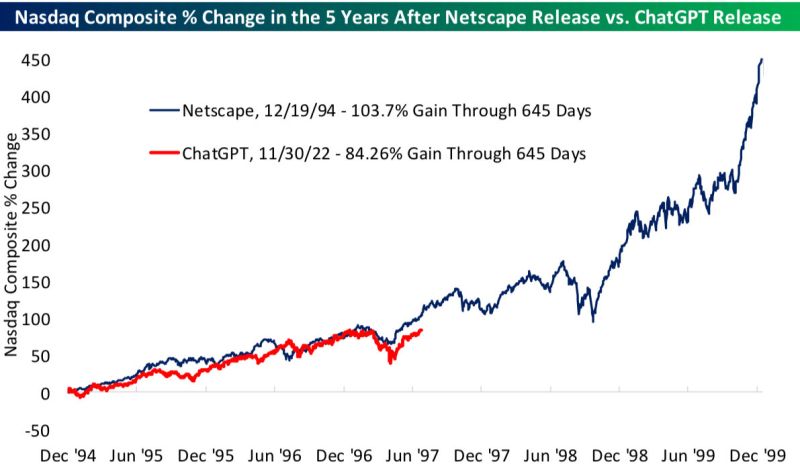

Here’s how the Nasdaq is tracking at 645 days since the release of ChatGPT versus the release of Netscape in December 1994.

Source: Bespoke @bespokeinvest

10 year returns of more than 2,000%

Bitcoin: +44,369% Nvidia: +31,323% AMD: +5,722% Shopify: +3,680% Broadcom: +2,478% Comfort Systems: +2,365% Axon Enterprise: 2,339% Texas Pacific Land: +2,310% MicroStrategy: +2,108%

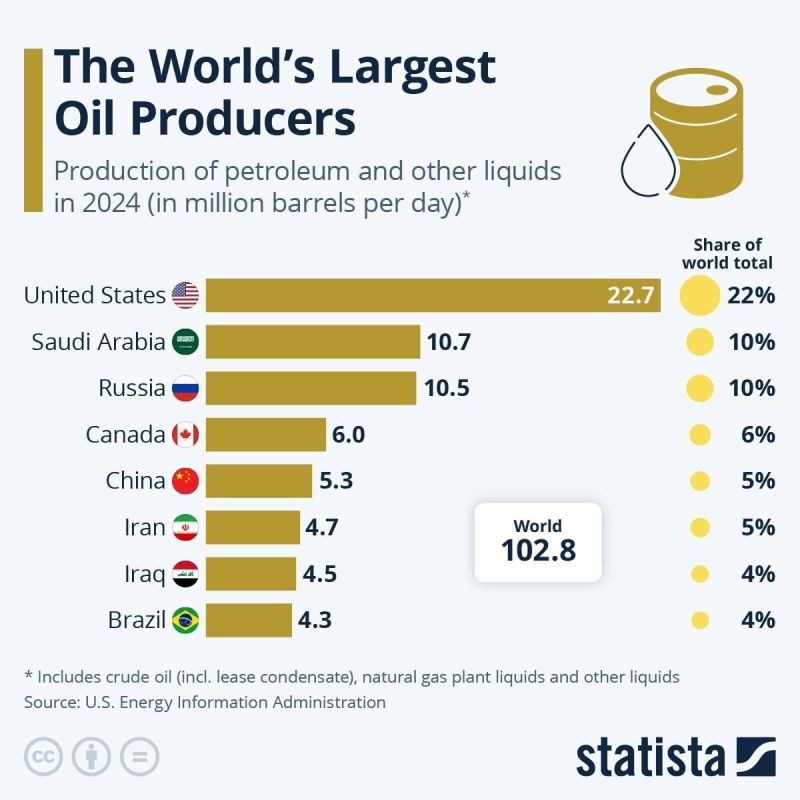

WHO RUNS THE OIL WORLD?

The US isn’t just flipping burgers - it's pumping 22.7 million barrels of oil a day, more than double Saudi Arabia or Russia. That’s 22% of the world’s supply. Saudi Arabia and Russia trail with 10.7 and 10.5 million barrels/day. Canada’s in 4th (6.0), followed by China (5.3), Iran (4.7), Iraq (4.5), and Brazil (4.3). Total world production? 102.8 million barrels a day. Which means the U.S. alone is doing over a fifth of the heavy lifting. Source: Statista thru Evan on X

President Trump says interest rates should be as low as 1% and we have a "stupid person" at the Fed.

Source: Stocktwits

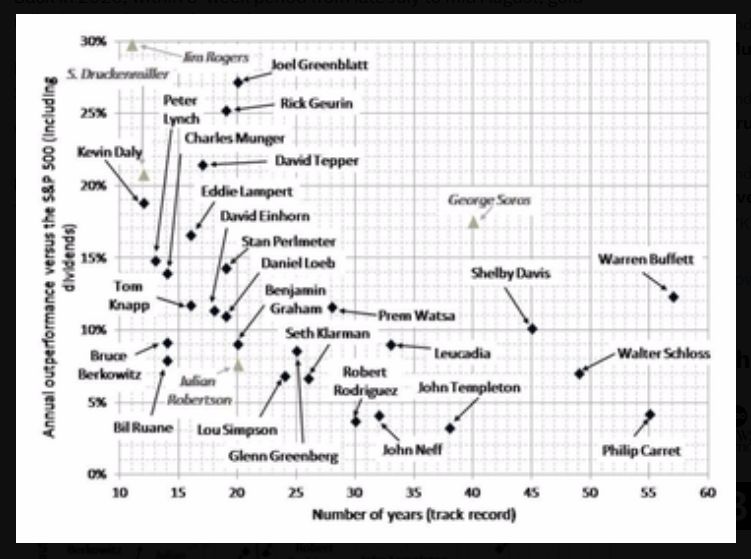

The GOATs of investing

Annual outperformance vs. sp500 / number of years (track record)

Investing with intelligence

Our latest research, commentary and market outlooks