Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

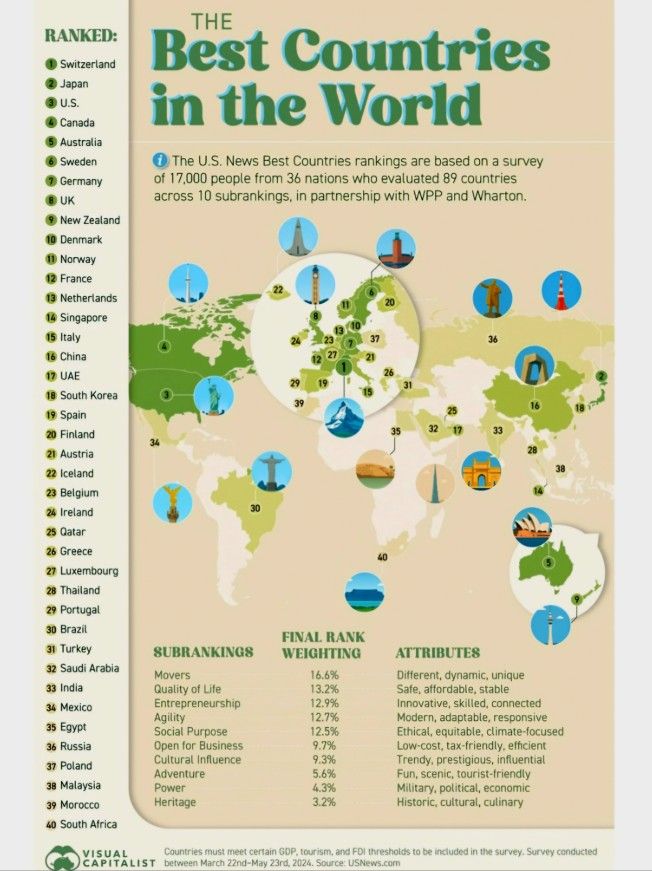

The Best Countries in The World (according to a survey conducted by US News in partnership with WPP and Wharton)

The U.S. News Best Countries rankings are based on a survey of 17,000 people from 36 nations who evaluated 89 countries across 10 subrankings, in partnership with WPP and Wharton. ATTRIBUTES Different, dynamic, unique Safe, affordable, stable Innovative, skilled, connected Modern, adaptable, responsive Ethical, equitable, climate-focused Low-cost, tax-friendly, efficient Trendy, prestigious, influential Fun, scenic, tourist-friendly Military, political, economic Historic, cultural, culinary Countries must meet certain GDP, tourism, and FOI thresholds to be included in the survey. Survey conducted between March 22nd-May 23rd, 2024. Source: USNews. com, Visual Capitalist

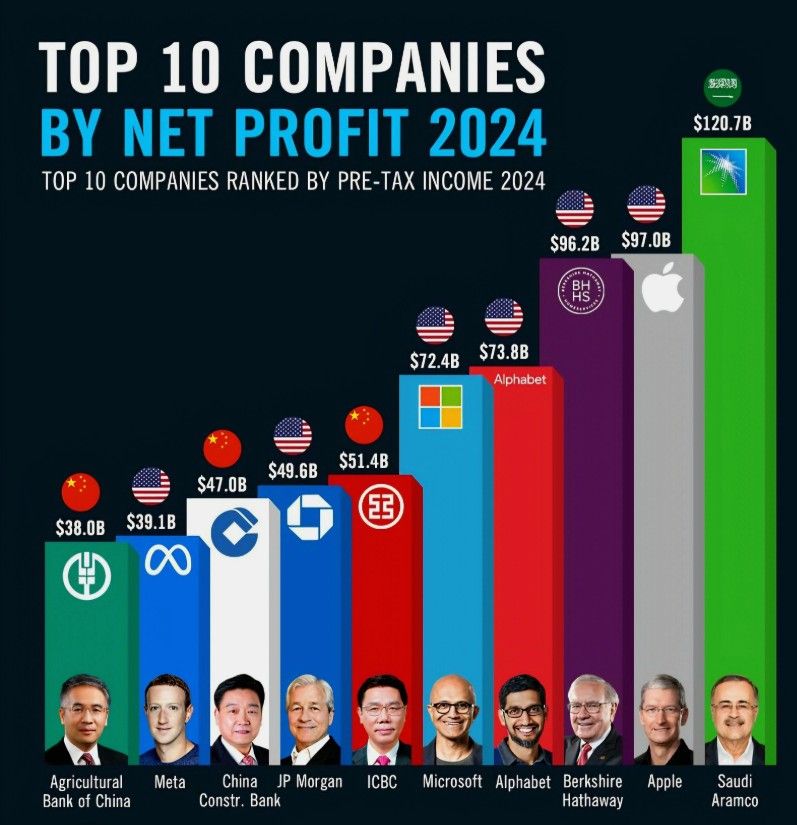

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

Majority of Fed Officials Leaning Against July Interest-Rate Cut -

Bloomberg

JUST IN: China unveils 0.6 cm mosquito-like spy drone designed for stealth missions.

Source: BRICS News

Party like it's 2021?

Goldman Non-Profitable hashtag#Tech Index has gained 50% since the April low. Source: Bloomberg, Goldman Sachs

Treasury Secretary Scott Bessent asked Republicans in Congress on Thursday to remove the so-called “revenge tax” from President Trump’s “big, beautiful” bill

The provision would grant Trump the authority to tax foreign holdings of US investments as a way to retaliate against countries imposing new taxes on US companies operating overseas. Bessent argued that the provision, known as Section 899, was no longer necessary after the Trump administration reached a deal with G7 nations at last week’s summit to exempt US companies from a 15% global corporate minimum tax championed by the Biden administration. “After months of productive dialogue with other countries on the OECD Global Tax Deal, we will announce a joint understanding among G7 countries that defends American interests,” the Treasury secretary wrote on X. “President Trump paved the way for this historic achievement.” Source: New York Post

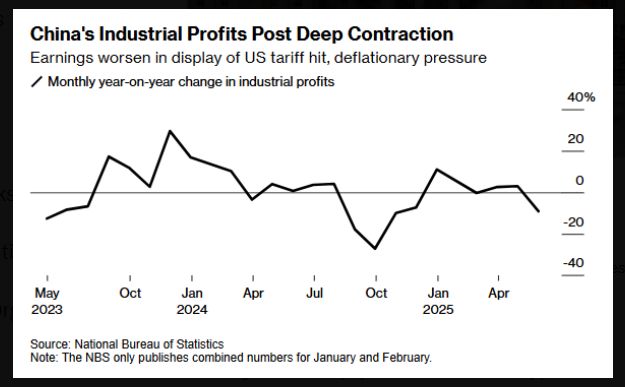

China’s industrial profits sink on US Tariffs, deflation woes - Bloomberg

China's industrial firms saw their profits drop the most since October, illustrating weakness in an economy strained by higher US tariffs and lingering deflationary pressure. Industrial profits fell 9.1% last month from a year earlier, according to data released Friday by the National Bureau of Statistics.

U.S. Durable Goods Orders Soar Much More Than Expected In May - thanks to huger aircraft orders from the Middle East.

New orders for U.S. manufactured durable goods spiked by much more than expected in the month of May, according to a report released by the Commerce Department on Thursday. The report said durable goods orders soared by 16.4 percent in May after tumbling by a revised 6.6 percent in April. Economists had expected durable goods orders to surge by 8.5 percent compared to the 6.3 percent slump that had been reported for the previous month. Excluding a substantial increase in orders for transportation equipment, durable orders climbed by 0.5 percent in May after coming in unchanged in April. Ex-transportation orders were expected to come in flat. Here is the surge in aircraft (Boeing) orders following Trump's trip to the middle east Source: zerohedge @zerohedge, RTTNews

Investing with intelligence

Our latest research, commentary and market outlooks