Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

UBS Showing Positive Reaction Above Major Support

UBS has retested the major support zone between 22.54-24.74 for the second time. The last retest in April saw an exaggerated move, with the stock dipping as low as 20.66, but it managed to close within the support zone, confirming its significance. This week, the price action has been positive, with the stock holding steady above support. Keep an eye on the 26.37 level—if the stock closes above this level on Friday, it would be a strong bullish signal. Source: Bloomberg

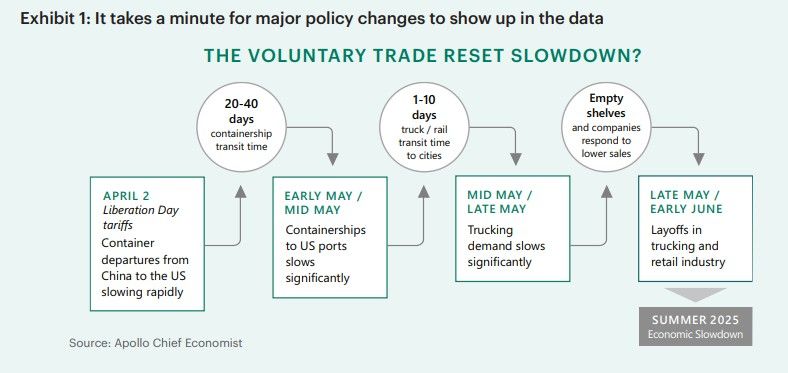

The voluntary trade reset slowdown - Apollo H2 outlook

Here's an extract: "The corporate response to the April 2 announcement of the administration’s reciprocal tariff strategy—referred to by President Trump as “Liberation Day”—has been unambiguous: For companies, new orders have fallen, capex plans have fluctuated, inventories were rising before tariffs took effect, and firms started revising down earnings expectations. For households, consumer confidence has sunk to record-low levels, consumers were front-loading purchases before tariffs began, and tourism has been slowing. In mid-May, Moody’s downgraded the US credit rating, increasing borrowing costs for both US consumers and firms. This voluntary trade reset slowdown (Exhibit 1) is a risk to the economic outlook. While both April and May inflation numbers were surprisingly subdued—the consumer price index rose just 2.4% year-over-year in May—the effects of Liberation Day were surely still working their way through the trade pipeline"

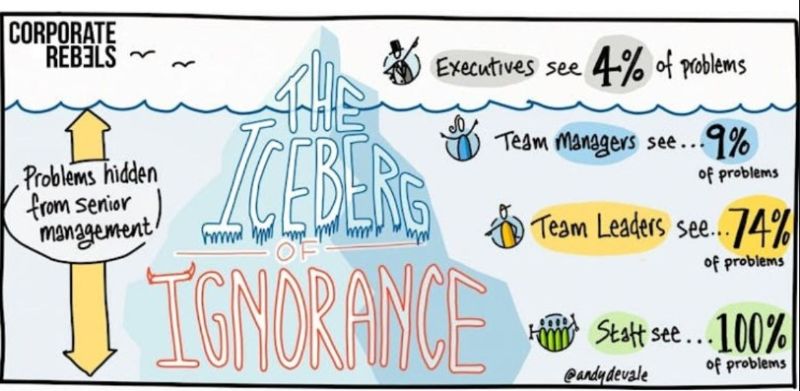

A nice post by Corporate Rebels: The iceberg of ignorance is killing your company.

▪️ Top execs see 4% of problems. ▪️ Team leaders see 74%. ▪️ Frontline staff see 100%. The point is clear: Critical info gets lost on the way up. Yet most leaders hide in offices, making decisions in a vacuum. Corporate Rebels has identified the following behaviour best leaders demonstrate: 👉 They walk the floor. 👉 They do the dirty work. 👉 They value frontline voices. 👉 They build trust, not fear. 👉 They make sure info flows freely. Very interesting. In a nutshell: " No trust? No truth. No truth? No progress".

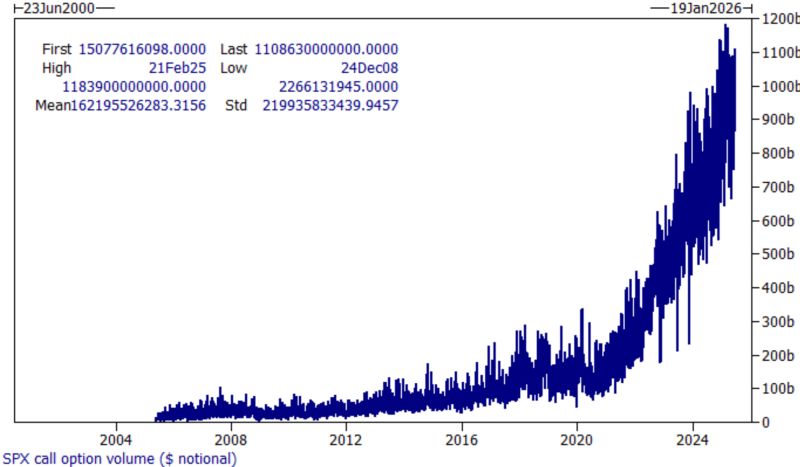

$SPX call option volume has surged to completely unprecedented heights over the last four years.

We see over $1.2 trillion in notional trading daily, with over 50% of that expiring the same day, and 75-80% within a week. Short-dated flows have a BIG influence on the market. Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks