Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Hong Kong Monetary Authority said it used HK$9.4bn ($1.2bn) of its reserves to buy Hong Kong dollars on the open market.

It acted after the local currency dropped past HK$7.85 per US dollar, the weak end of the band within which it is allowed to trade. The move will drain liquidity from the banking system and pushed up interbank lending rates on Thursday, potentially threatening a carry trade that has allowed investors to borrow cheaply in the city’s currency before investing in higher-yielding US debt securities. Source: FT https://lnkd.in/evksjsp9

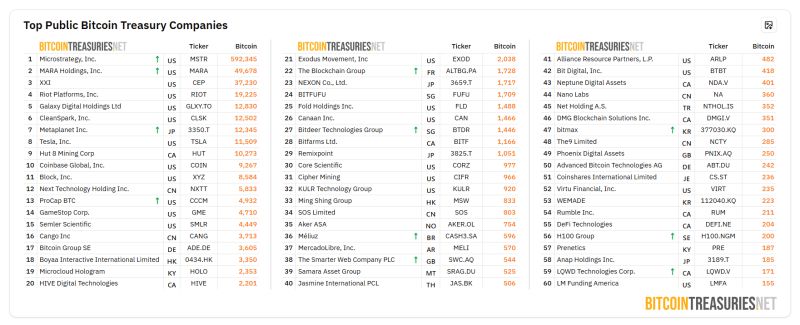

Emerging markets $EEM are breaking out to 3-year highs.

Source: Ross J Brown RJB Financial Direction Limited

Remember IBM?

Over the past 5 years, it has outperformed: • Microsoft • Apple • Google Source: Brew markets

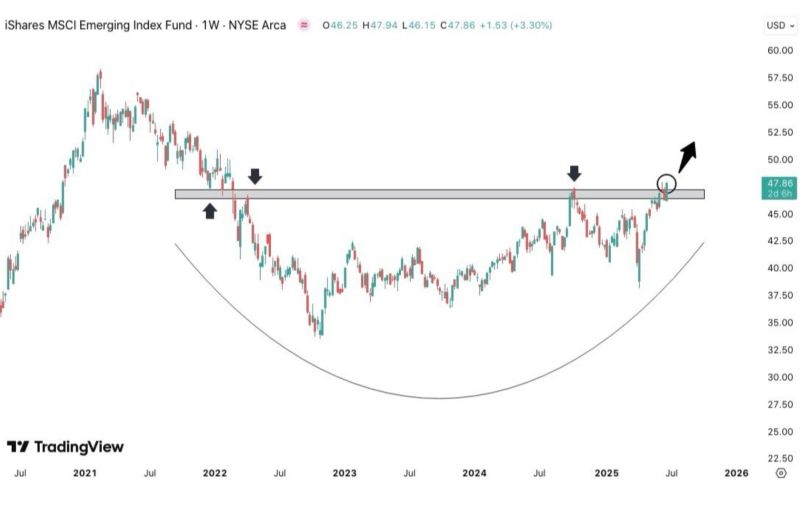

BREAKING: US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility.

Source: Bitcoin Archive @BTC_Archive

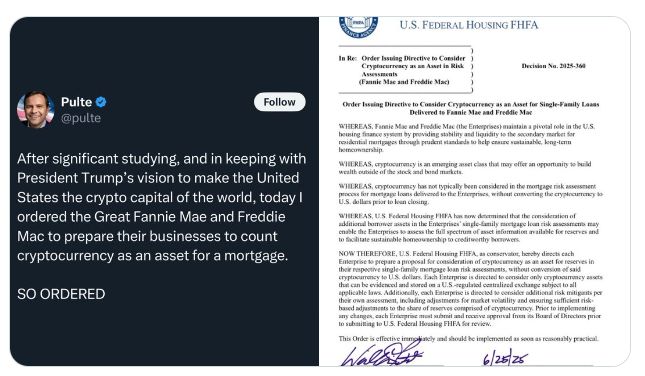

BREAKING 🚨: U.S. Dollar

The lowest close since March 2022 for the U.S. Dollar Index $DXY on track its 📉📉 Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks