Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

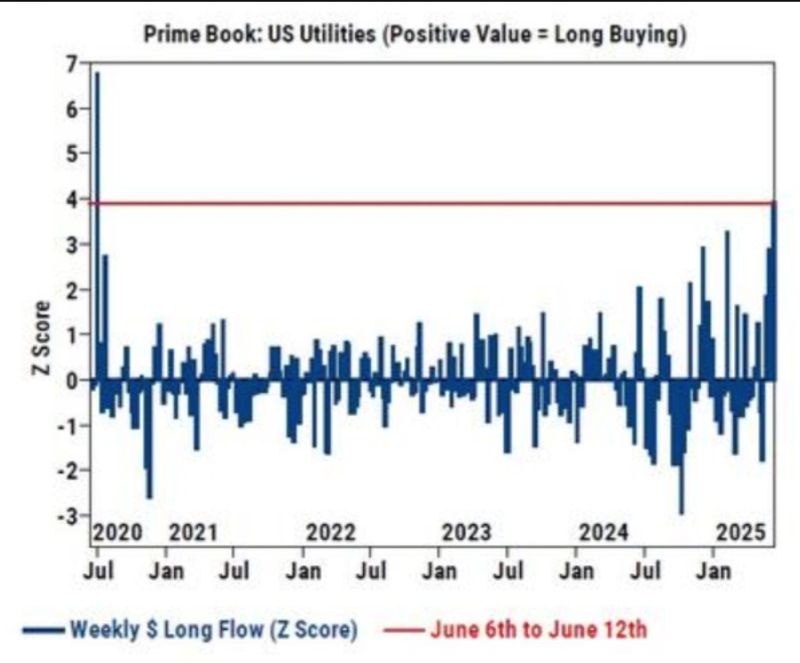

Hedge Funds are loading up on Utility Stocks at the fastest pace in 5 years

source : barchart

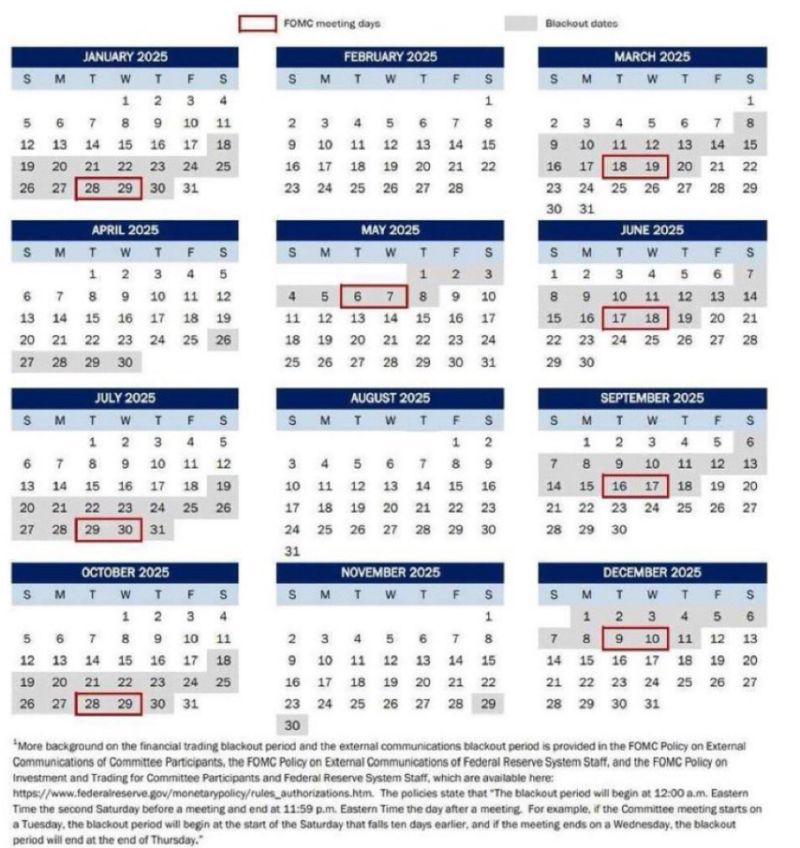

Blackout Period

Watch out for Jerome Powell's remarks this Wednesday.Then — the Fed enters a new phase:The blackout period ends Thursday, meaning Fed officials will be free to speak again starting Friday. source : evan

Oil drops on signs conflict may space Iranian crude production

Oil fell as the conflict in the Middle East has so far avoided disrupting crude production and the Wall Street Journal reported that Iran privately expressed willingness to deescalate hostilities with Israel. West Texas Intermediate tumbled as much as 4.9%, after spiking higher at the open, after the newspaper said Tehran would be open to returning to the negotiating table as long as the US doesn’t join the attack. The development quelled fears that a protracted conflict would engulf a region that produces around a third of the world’s crude. Source: Bloomberg

From checkout lanes to blockchain?

Walmart, Amazon, and Expedia exploring stablecoins? Major retailers are looking into issuing or using stablecoins to streamline payments, cut fees, and accelerate settlement—especially across borders according to the WSJ. Their next move may hinge on the Genius Act, a bill aiming to create a clear U.S. regulatory framework for stablecoins. Source : wsj

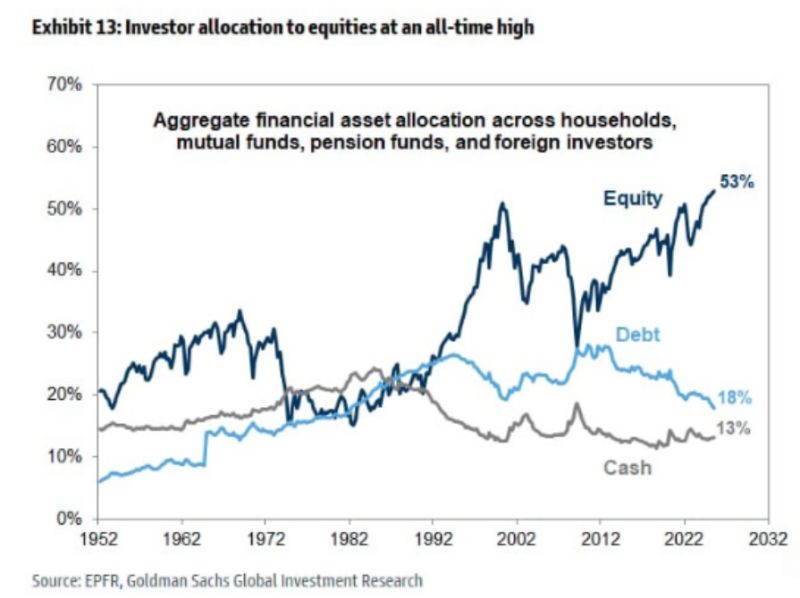

Investors are now “all-in” on equities — with the highest stock allocation on record.

The only time it came close? Right before the Dot-Com bubble burst. 👀 source : goldman sachs, barchart

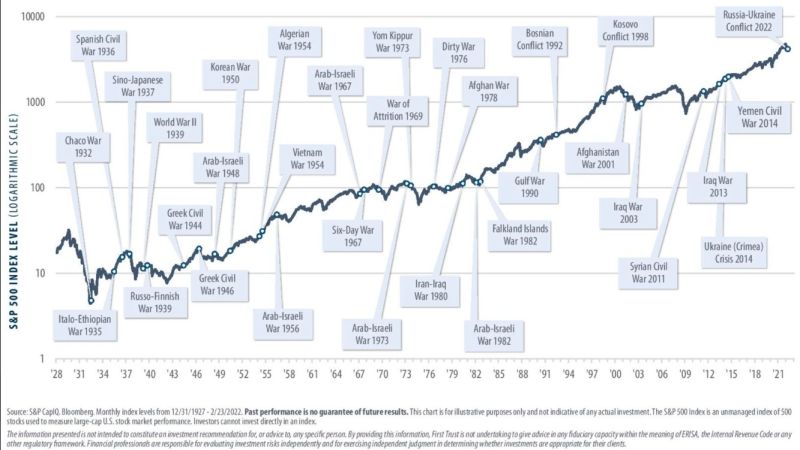

The long-term story of the S&P 500 — through the war, the fear, the crisis

source : s&p, bloomberg

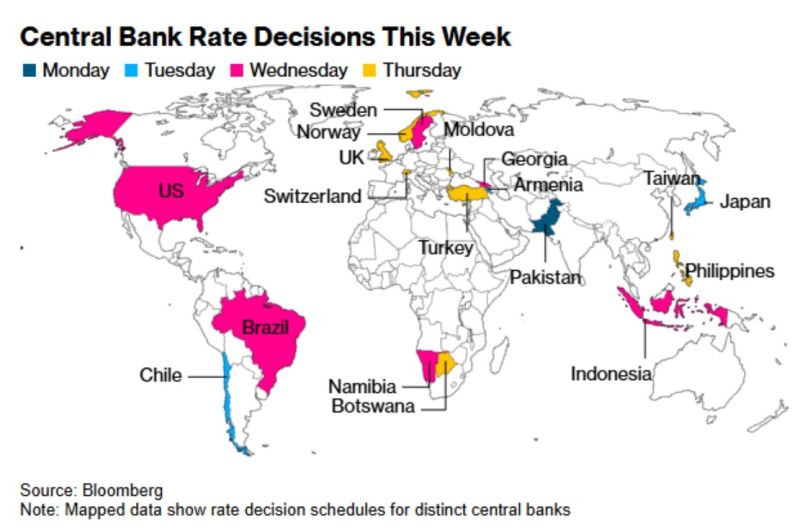

Central Bank Rate Decisions This Week

source : Bloomberg

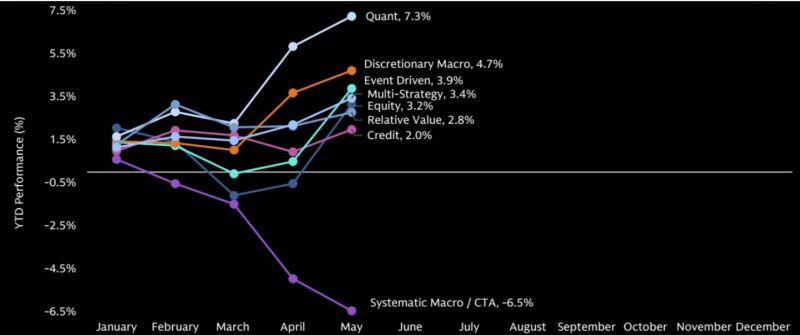

Year-to-date performance by Hedge Fund strategy

source : tme, GS prime brokerage

Investing with intelligence

Our latest research, commentary and market outlooks