Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it...

ELON MUSK’S X IS REPORTEDLY PLANNING TO LAUNCH IN-APP TRADING & INVESTING

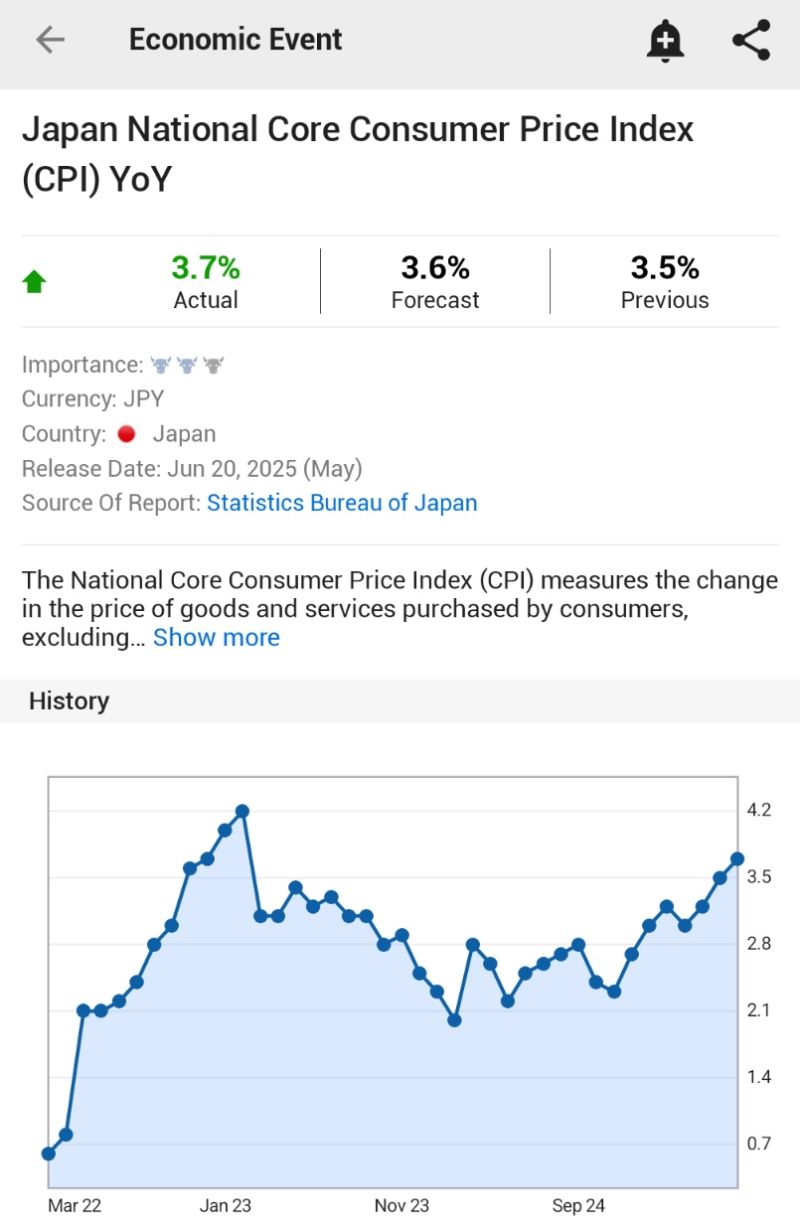

JAPAN MAY CORE CPI INFLATION RISES 3.7% Y/Y; EST. 3.6%; PREV. 3.5%

HIGHEST SINCE JANUARY 2023 $JPY Source: investing.com

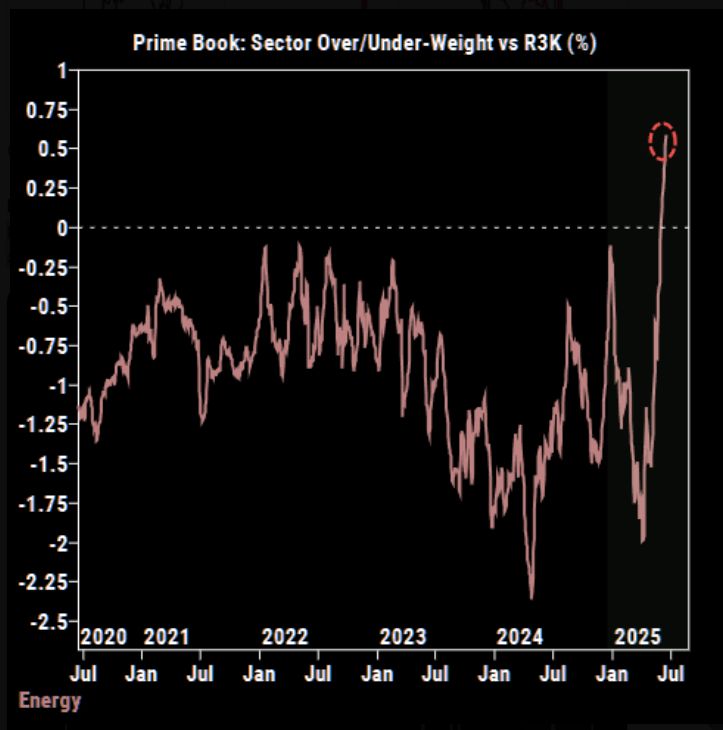

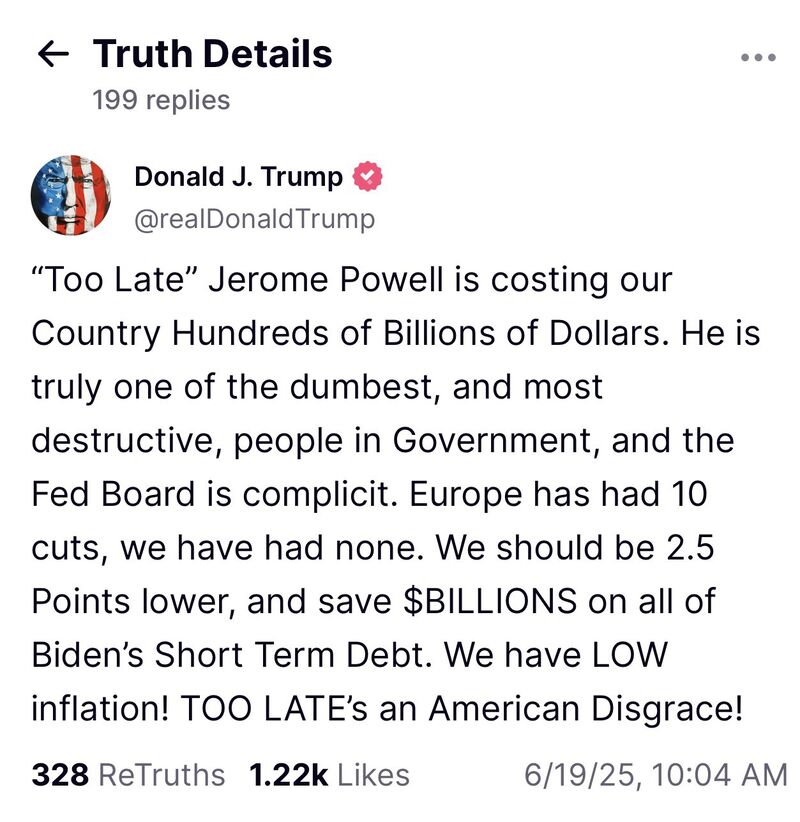

The next Fed Chair is going to be the biggest dove the world has ever seen...

Source: Spencer Hakimian on X

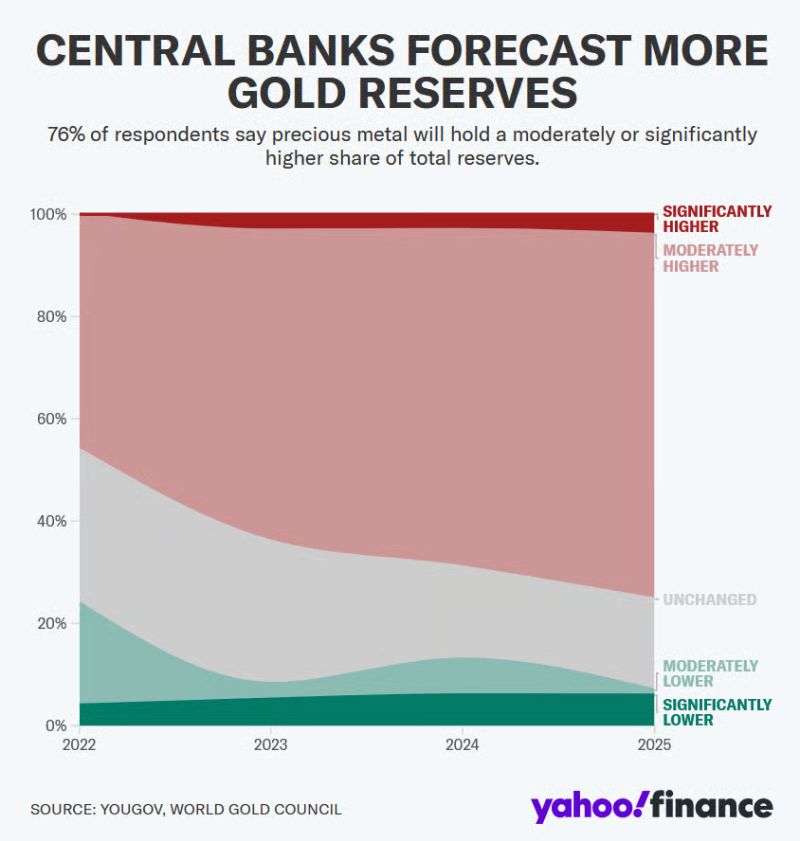

Central banks continue to DUMP the US Dollar for Gold:

95% of central banks expect global gold reserves to rise in the next year, according to a World Gold Council survey. A record 43% plan to boost their holdings. 73% expect USD reserves to decline over the next 5 years. Source: Global Markets Investor, Yahoo Finance

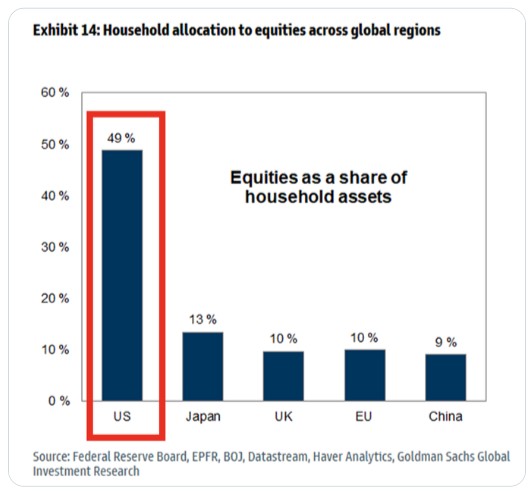

US households own WAY more stocks than in other major markets: US household allocation to equities sits at ~49%.

Source: @GlobalMktObserv

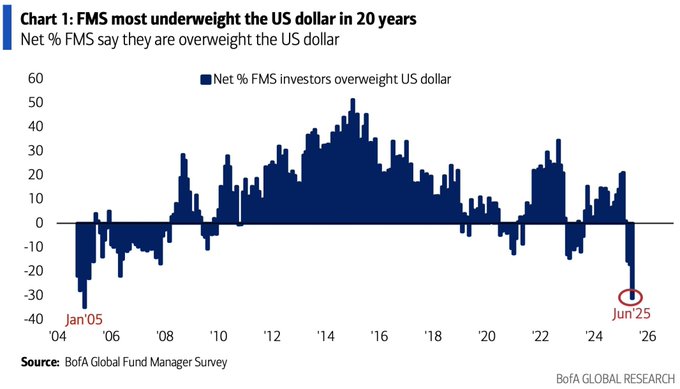

According to Bank of America's Fund Manager Survey, investors are more underweight on the US dollar than at any point in the past 20 years.

Source: @Schuldensuehner @BankofAmerica

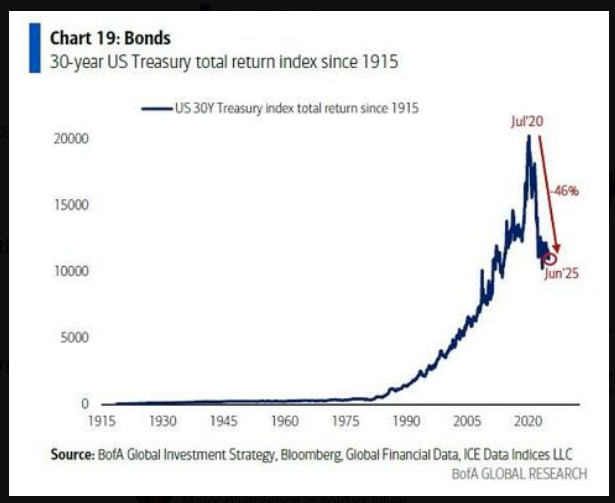

30-Year Treasury Bonds have now lost almost half their value over the last 5 years 📉

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks