Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

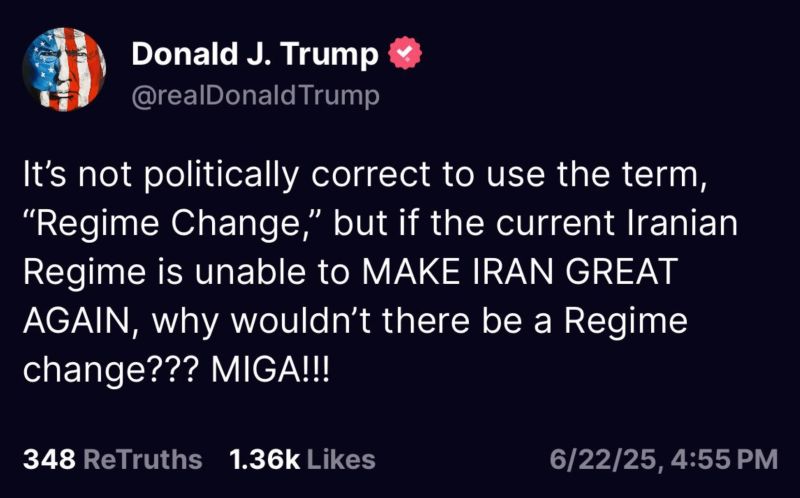

⚠️Middle East oil shipping costs are SPIKING:

Persian Gulf-Japan tanker rates hit $55k/day, the highest in over a year, while East Africa routes hit $40k, a multi-month peak. Costs doubled in 2 weeks amid the Israel-Iran conflict.

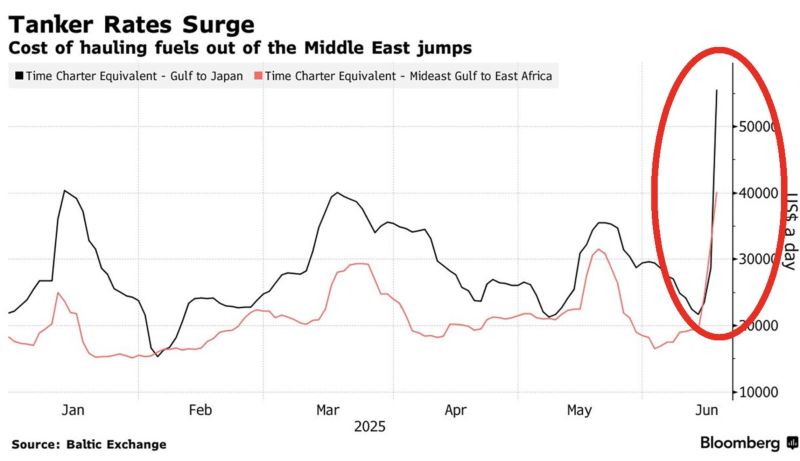

The US fiscal deficit is projected to hit a MASSIVE 9% of GDP by 2034.

Such deficits have never occurred outside of major crises and wars. This projection also assumes no recession and lower interest rates than currently. Source: BofA, Global Markets Investor, Moody's

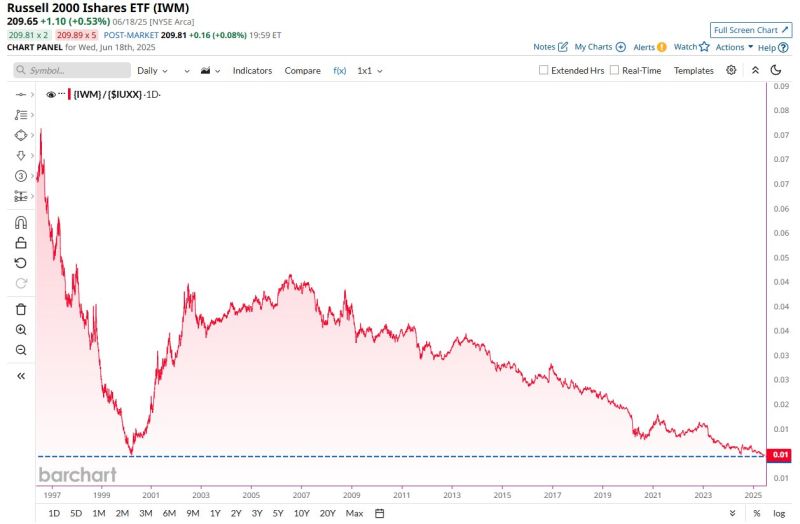

BREAKING 🚨: Small Cap Stocks

Small Caps $IWM are now underperforming Mega Cap Tech Stocks by the largest margin in history 📉📉 Source: Barchart

Long-term investing cheat code

Buying SP500 $SPY near the 200-week has basically been free money for 15 years. Wild. Source: Trend Spider

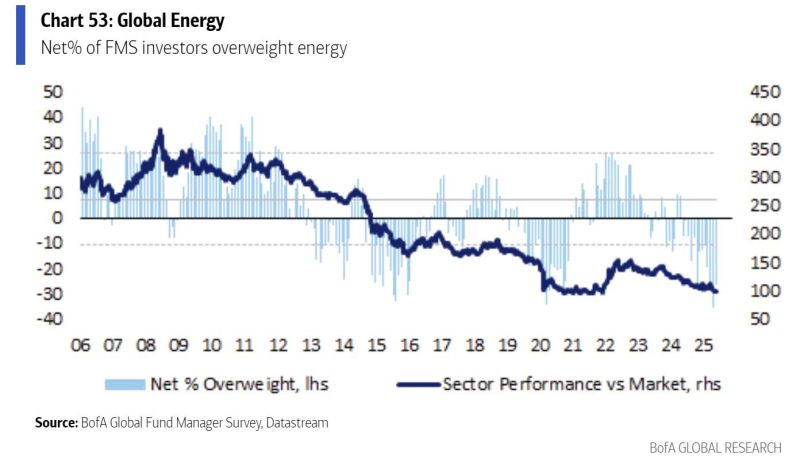

Investors hold very little exposure to energy stocks today, from a relative perspective.

This is often the kind of setup that leads to a meaningful shift in positioning. Source: Otavio (Tavi) Costa @TaviCosta, BofA

Investing with intelligence

Our latest research, commentary and market outlooks