Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it: Germany’s private sector economy unexpectedly returned to growth in June.

The composite PMI rose to 50.4, up from 48.5 in May, signaling a move back into expansion territory. Manufacturing – a key sector for Germany – saw its PMI climb to 49, the highest level since 2022. While still below the long-term avg of 51.6, it's a notable improvement. The sector appears to be benefiting strongly from falling interest rates, which may help explain why Germany is currently outperforming much of the rest of the Eurozone. Source: HolgerZ, Bloomberg

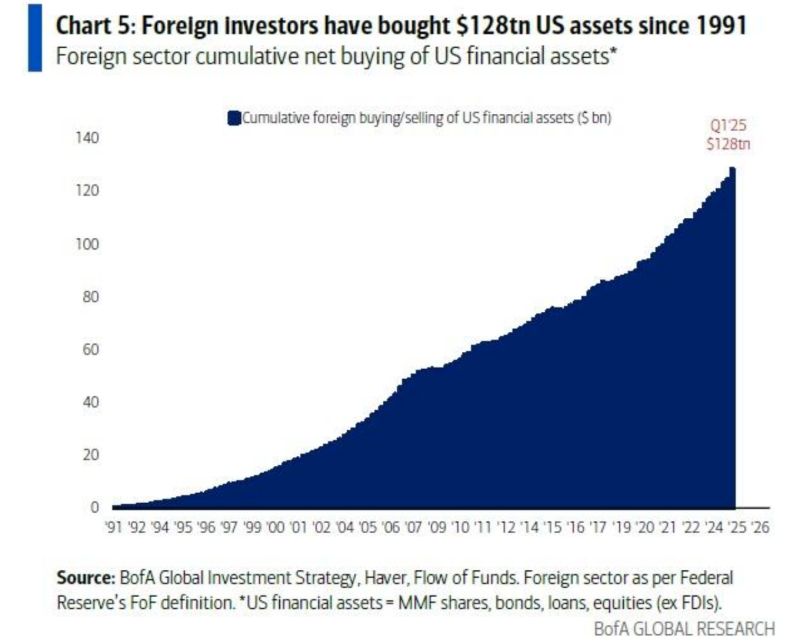

Foreign investors have bought a whopping $128 trillion of US assets over the last 34 years.

Source: BofA

Countries that are home to most millionaires

Source: Investywise

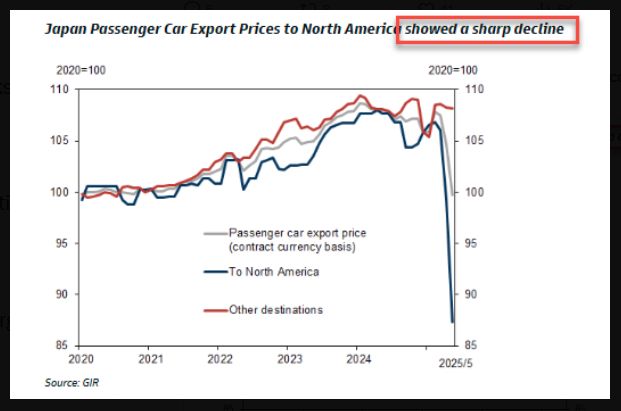

US Tariffs have massive negative consequences on Japan's car exports

Source: GIR, zerohedge

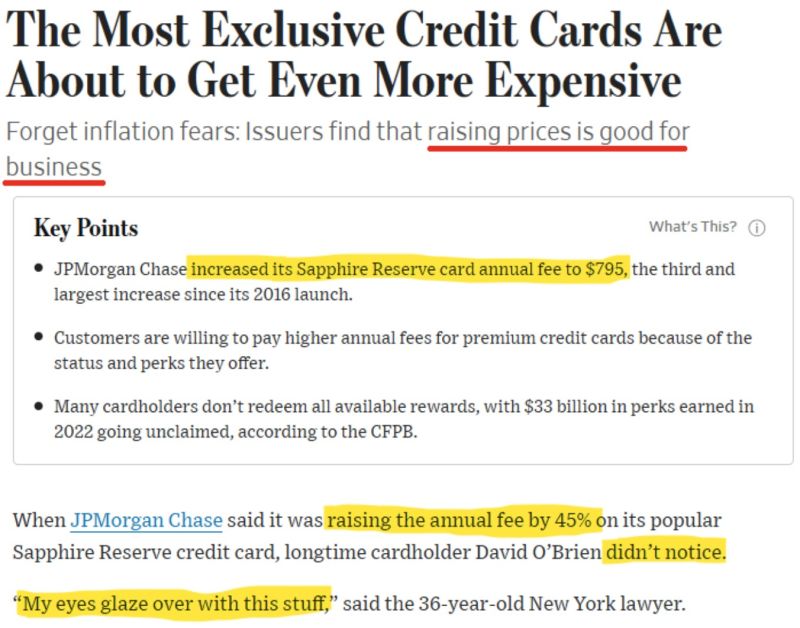

In case you missed it... here's another potential source of inflation

Source: Charlie Bilello

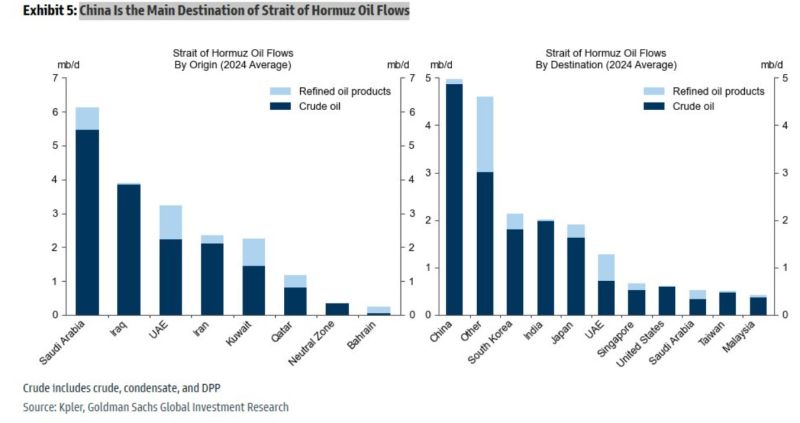

GS: China Is the Main Destination of Strait of Hormuz Oil Flows

Source: Mike Zaccardi, CFA, CMT, MBA

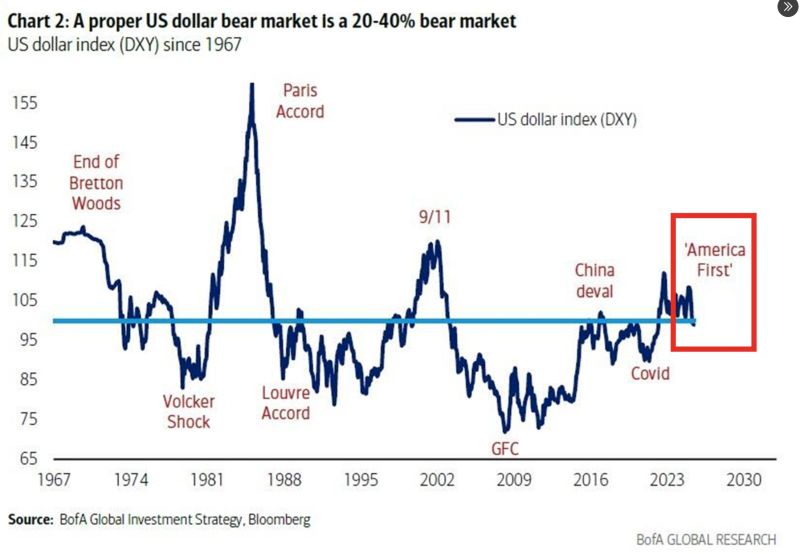

⚠️True US Dollar bear markets are usually 20-40%:

1970s (-30%) - End of Bretton Woods (USD delinked from gold) 1980s (-40%) - Plaza Accord (G7 nations devalued USD to reduce trade deficits) 2000s (-30%) - Post-9/11 policy shifts, Fed rate cuts The US Dollar is down 9% YTD.

Investing with intelligence

Our latest research, commentary and market outlooks