Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The rise in Japanese 30-year yields is getting some attention but one should not forget the sharp move higher across the entire US Treasury curve, which is probably the real elephant in the room.

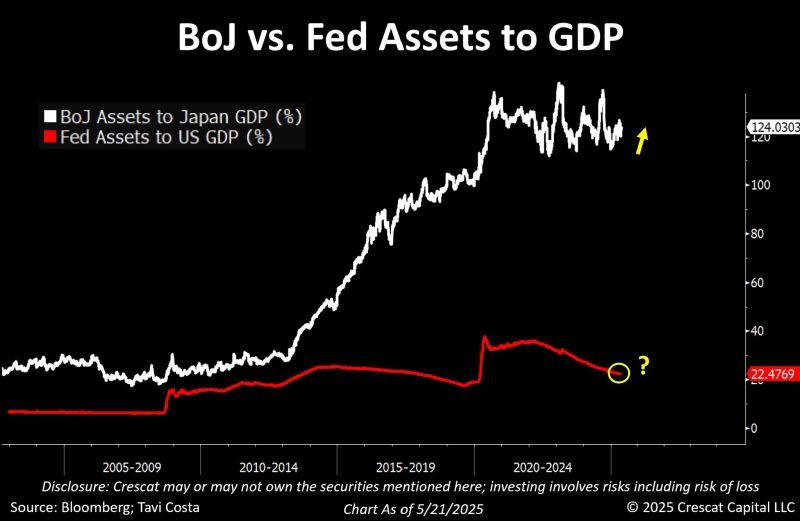

I tend to agree with Tavi Costa that the US will need at some point to implement yield curve control. We should thus see Fed assets as a percentage of GD starts rising again. Maybe Bitcoin and Gold are starting to price something like this Source: Tavi Costa, Bloomberg

What a wild chart...

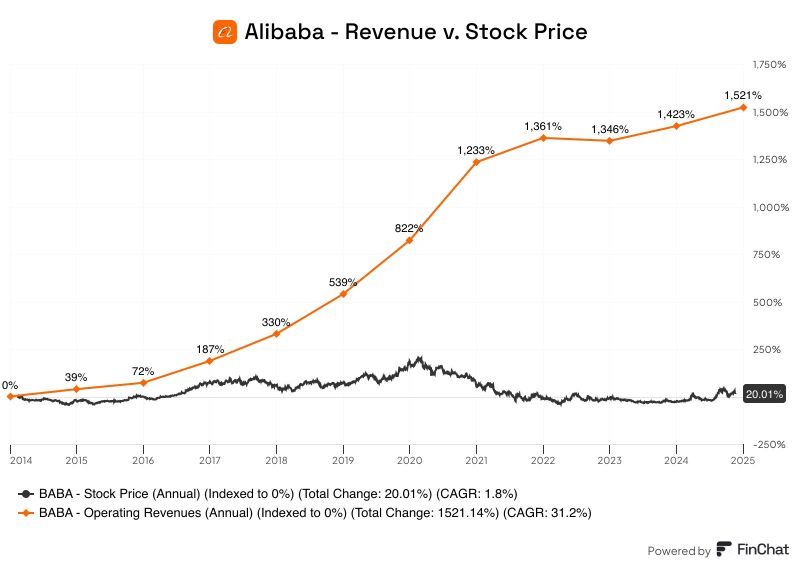

Alibaba Revenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_ioRevenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_io

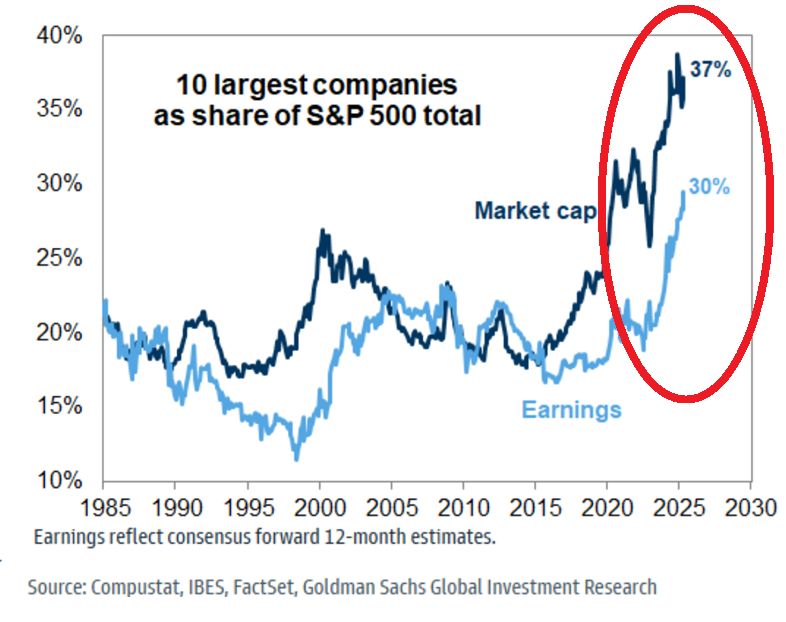

‼️Market concentration BUBBLE has risen once again:

The top 10 stocks' market cap share in the S&P 500 is now 37%. This is 10 percentage points above the highest point recorded during the Dot-Com Bubble. By comparison, their earnings share is 30% Source: Global Markets Investor, Goldman Sachs

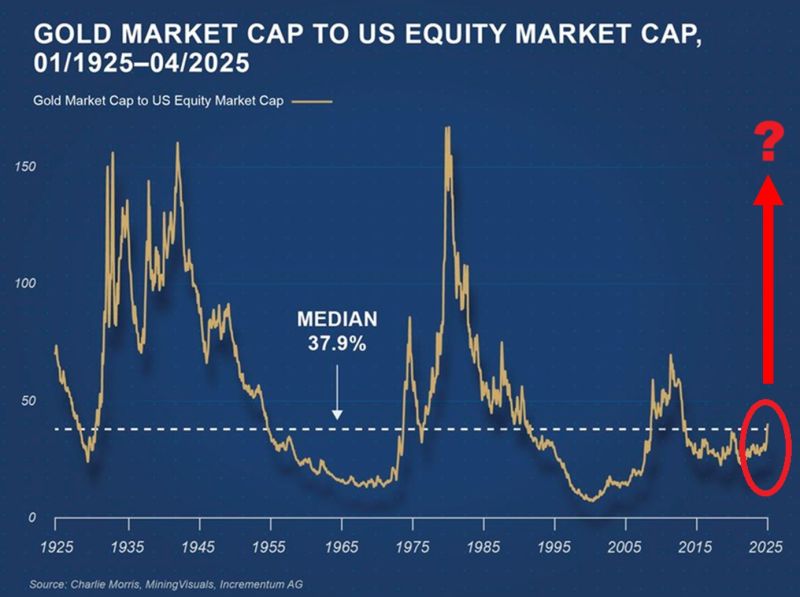

Gold market cap relative to the US equity market cap hit its highest level in 12 YEARS and is exactly at its long-term median.

Given the geopolitical and likely financial markets changes underway, will we see a repeat of the 1970s??? Source: Global Markets Investors, Incrementum AG

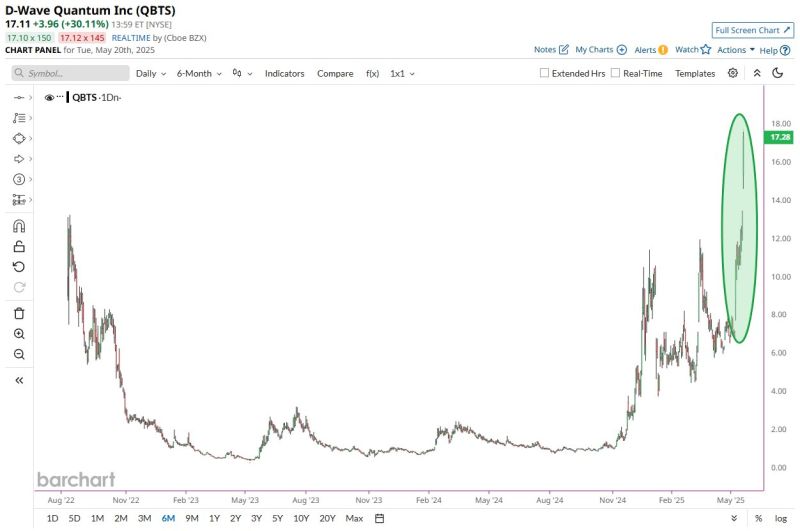

Absolute explosion for D-Wave Quantum $QBTS this month.

Multiple God Candles and a New All-Time High 📈📈 Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks