Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 The US 10-year Treasury bond yield is on the rise.

espite the fact that the economy is slowing down. Despite the fact that inflation surprised on the downside recently. So what's going on? 😨 The US Treasury market is trying to absorb a flood of issuance without its historical buyers. 👉 Foreign official demand is weak. Domestic institutional & retail demand as well. And with the Fed still engaged in Quantitative Tightening. 📢 If this continues, consequences are well known: •Wider mortgage spreads (housing stress), •Lower bond market liquidity (bid-ask gaps widen), •Pressure on long-duration tech and utility stocks (+ the end of risk assets rebound) Note that the rise of US bond yields will not necessarily translate into dollar strength - we might see a similar correlation (stocks + bonds + dollar coming down at the same time) as observed a few weeks ago. Stay tuned Source: EndGame Macro on X

*IRAN READY TO SIGN DEAL WITH CONDITIONS: NBC CITING OFFICIAL

Source image below: Skynews

🚨BREAKING: Trump's $1.2T Qatar Deal - The BIGGEST deal in US-Gulf history.

➡️ Boeing and GE Aerospace Deal: The centerpiece of the agreements is a $96 billion deal with Qatar Airways for the purchase of up to 210 Boeing 787 Dreamliner and 777X aircraft, powered by GE Aerospace engines. This is described as the largest widebody aircraft order in Boeing’s history, expected to support approximately 154,000 U.S. jobs annually during production and delivery. ➡️ Defense and Security Investments: The deal includes a statement of intent for $38 billion in future investments in Qatar’s Al Udeid Air Base, as well as other air defense and maritime security capabilities, strengthening U.S.-Qatar security cooperation. ➡️ Other Commercial Agreements: Additional private sector deals include: McDermott’s $8.5 billion in energy infrastructure projects in Qatar. Parsons securing 30 projects worth up to $97 billion for engineering services. A joint venture between Quantinuum and Al Rabban Capital for up to $1 billion in quantum technologies and workforce development in the U.S.

US 30-year Treasury yield is flirting with the 5.0% handle once again...

The last time it was trading at this level, the US administration panicked. The entire world is now watching the world's largest bond market. Source: Global Markets Investor

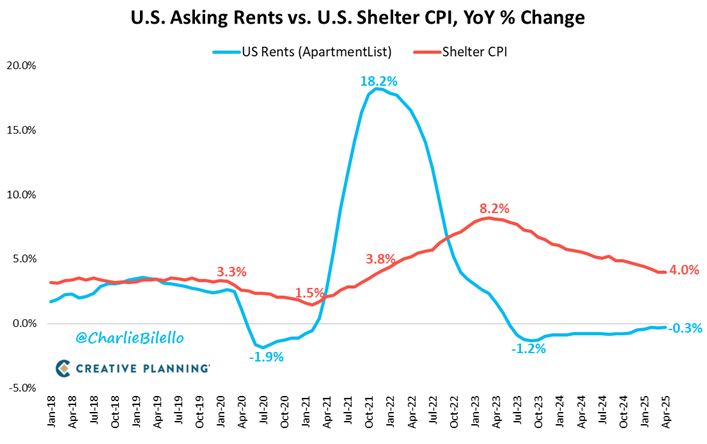

In the US, Shelter CPI has now moved down from a peak of 8.2% in March 2023 (highest since 1982) to 4.0% today (lowest since November 2021).

Given its long lag vs. real-time rental data, a continued move lower is expected which should lead to a continued decline in core inflation. Source: Charlie Bilello @charliebilello

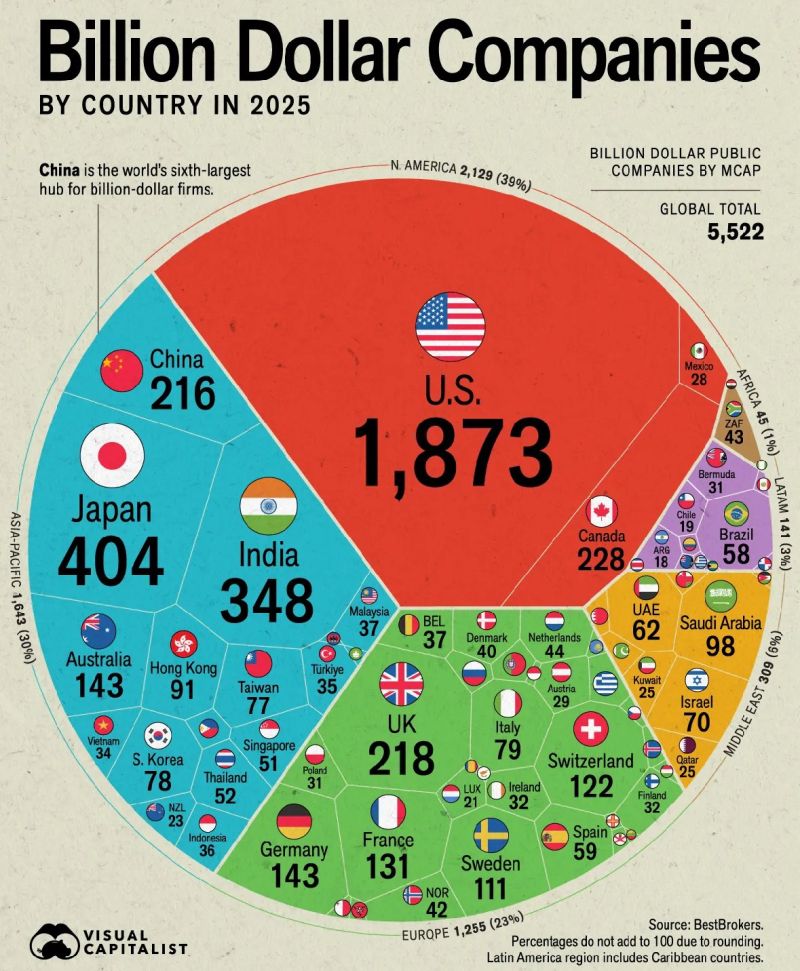

Here’s how many billion dollar companies there are in different countries around the world

Source: Blossom @meetblossomapp

Investing with intelligence

Our latest research, commentary and market outlooks