Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔵 Here are the key takeaways from President Donald Trump's "lavender carpet" visit to Saudi Arabia yesterday:

✔️ Economic Deals and Investments: Trump secured a $600 billion investment commitment from Saudi Arabia into the U.S. economy, focusing on sectors like AI, energy, infrastructure, and defense. This included a $142 billion arms deal, described as the largest defense cooperation agreement in U.S. history, covering air and missile defense, maritime security, and more. Additional deals involved U.S. companies like Google, Oracle, and Boeing, with Saudi investments in AI data centers and energy infrastructure. ✔️Lifting Sanctions on Syria: Trump announced the lifting of U.S. sanctions on Syria, in place since 1979, to support the country’s reconstruction under its new leadership following the fall of Bashar al-Assad. This decision was made at the request of Saudi Crown Prince MBS and was celebrated in Syria as a step toward economic recovery. Trump also planned a brief meeting with Syria’s new president, Ahmed al-Sharaa, in Riyadh.

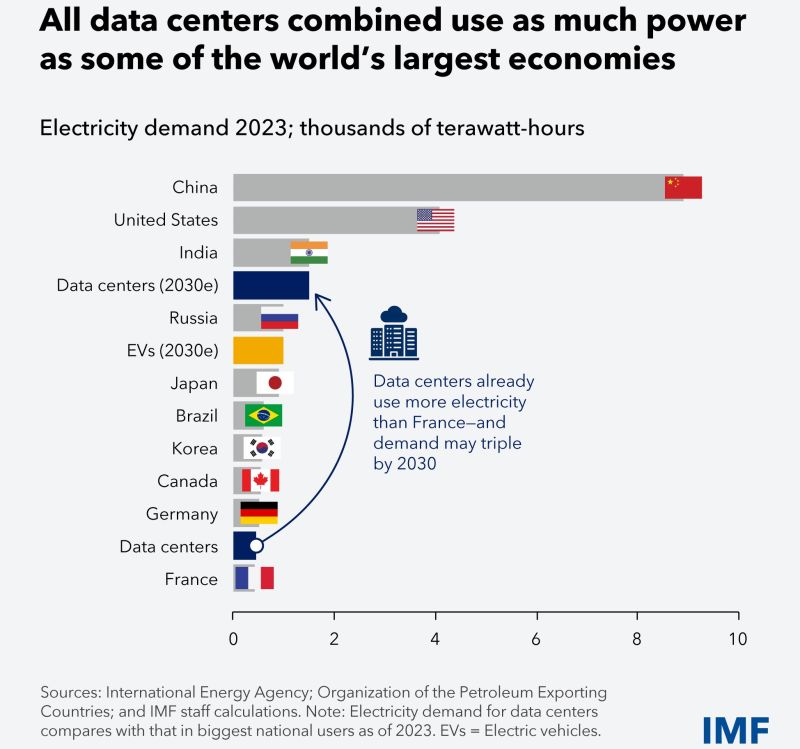

All data centers combined use as mich power as some of the world's largest econnomies

Source: IMF

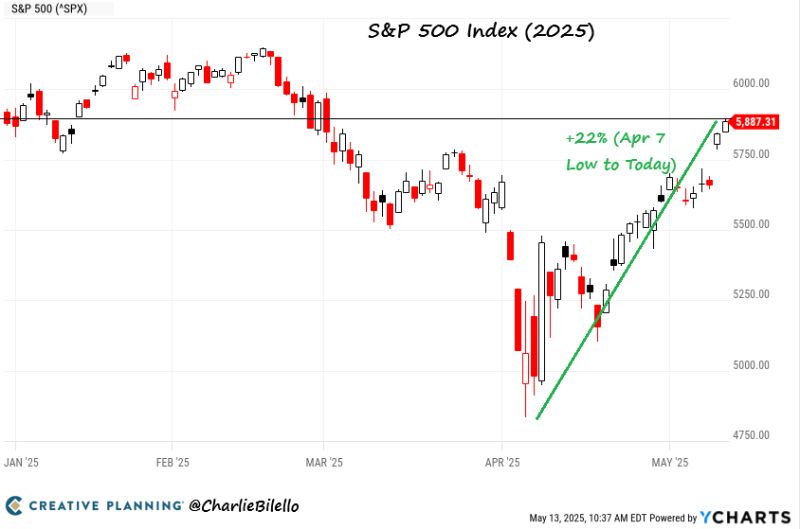

Recession Cancelled?

McDonald's $MCD to hire 375,000 workers this summer 🚨🚨🚨 Source: Barchart, CNBC

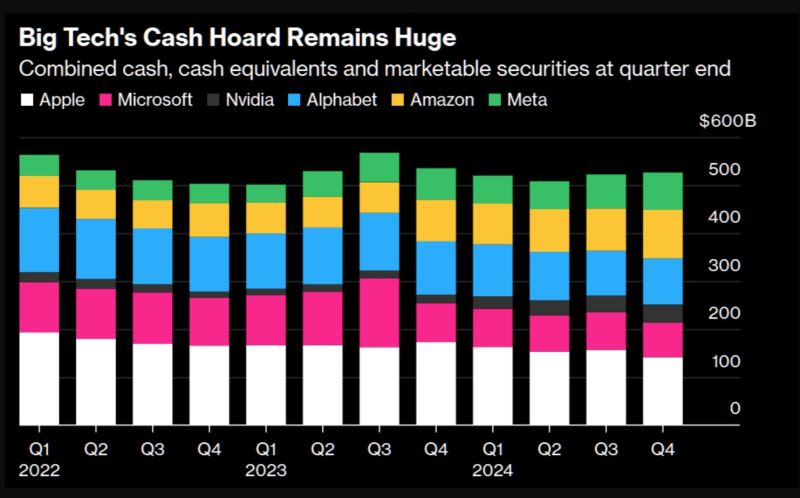

📢 The return of capital is back in focus

➡️ The Cap return story is more impressive now than ever. Companies managing to invest in growth AND return capital. Some even protecting the margin by lowering OPEX. Best of 2 worlds or even triple positive whammy. 1. Microsoft remained steady at $3.5 billion. 2. Meta ramped up to $13.4 billion (from $0 last quarter). 3. Google executed $15.1 billion in buybacks and raised its program to $70 billion. 4. And the standout: Apple repurchased $25 billion and authorized an additional $100 billion. Source: The Market Ear, Bloomberg

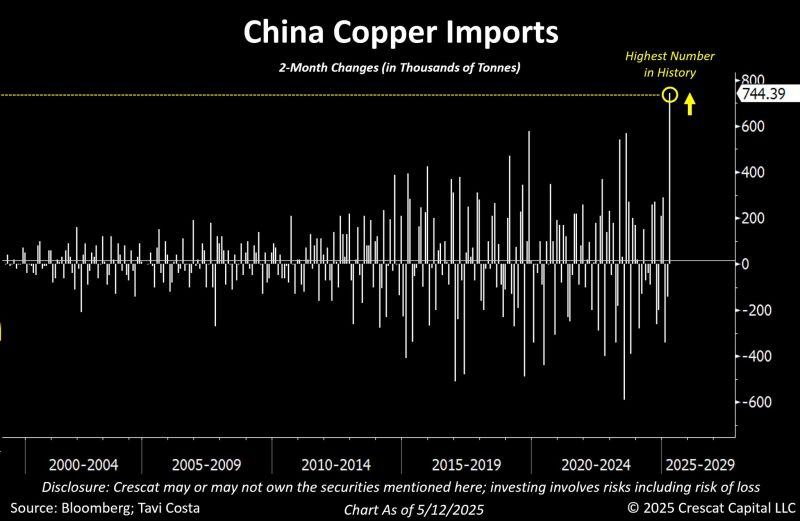

China has just reported its largest two-month copper imports in history.

The world remains firmly entrenched in a deglobalization trend. Even if we got a (temporary) US-China trade deal over the week-end, this foes not change the The push to secure strategic metals is just one manifestation of this broader shift unfolding in the markets. Source: Tavi Costa, Bloomberg

House tax proposal is out.

$4T in Tax Cuts $1.5T in Spending Cuts 👉 Another $2.5T added to the deficit. 🟢 Amazing for stocks, gold, and bitcoin. 🔴 Terrible for bonds Same old story as always. Source: Spencer Hakimian on X, Bloomberg

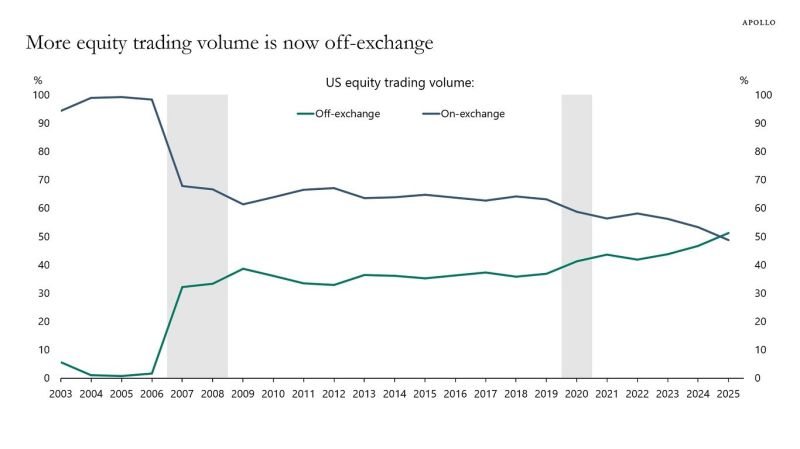

Dark pools are a bigger and bigger part of the stock market, now eclipsing volume at exchanges

Source: Markets & Mayhem, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks