Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Britons are being urged to stay home today between 11 a.m. and 3 p.m. because the temperature is set to reach... 24 to 26 degrees.

Isn't it too much?

US-China Trade (temporary) deal summarized

(see below table by Mike Zaccardi, CFA, CMT, MBA. 👉 As highlighted by a CNBC article >>> The new U.S.-China deal to temporarily cut tariffs is better than expected, providing near-term relief for investors. Under the deal, so-called reciprocal tariffs will drop from over 100% to 10% on both sides. The Trump administration will keep 20% fentanyl-related tariffs on China in place, meaning America’s total duties on Chinese imports will stand at 30% while the 90-day pause is effective. 👉 In a note to clients on Monday, Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management, said the deal unveiled in Geneva was better than anticipated, but uncertainty remained. “The magnitude of this tariff reduction is larger than expected,” he said, although he noted that it would be difficult for Beijing and Washington to reach a more concrete trade arrangement in just three months. “The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process,” Hui said. “We are still waiting for further details on other terms of this agreement, for example, whether China would relax on rare earth export restrictions.” Source: CNBC

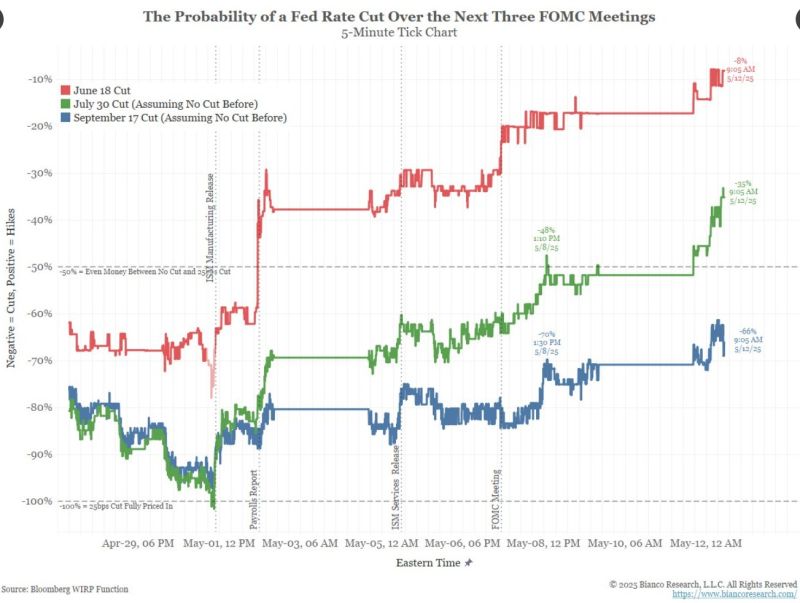

The number of Fed rate cuts continue to be revised downwards:

* June 18 (red) now 8% (92% no move) * July 30 (green) now 35% (65% no move) No cut is priced until September 17. And even that cut (blue) is disappearing. It was more than 100% ~10 days ago and is now 66% (34% no move) and continuing to fall. Source: Jim Bianco @biancoresearch

It is important to be able to say "NO".

The difference between successful people and really successful people is that really successful people say no to almost everything" - Warren Buffet

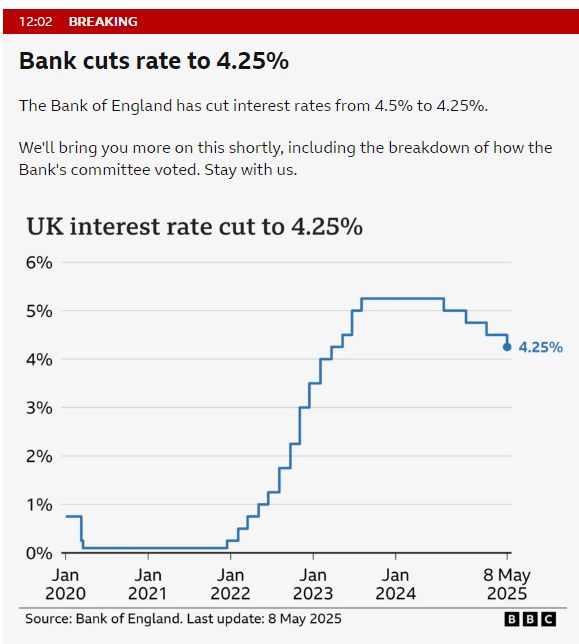

As expected, BoE cut rates by 25bps! (5-4 vote).

It came as Donald Trump hinted a UK-US trade pact was imminent. Some MIXED SIGNALS - Two members (Swati Dhingra and Alan Taylor) preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members (Catherine L Mann and Huw Pill) preferred to leave Bank Rate unchanged, at 4.5%.

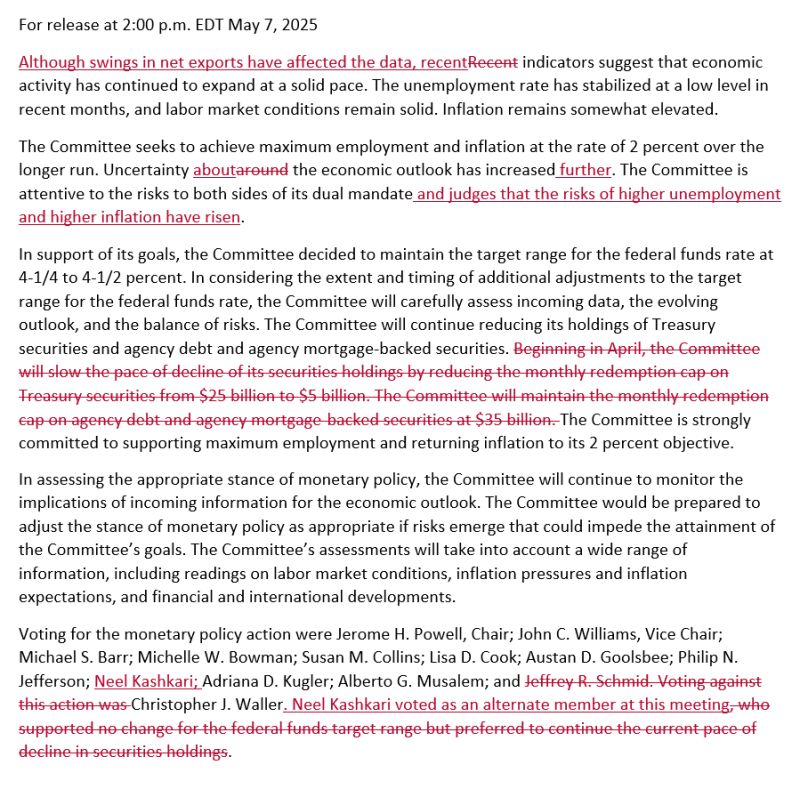

Fed leaves rates unchanged, as expected

“The committee … judges that the risks of higher unemployment and higher inflation have risen.” Powell is facing the worst outcome for a Fed President... The Federal Reserve's dual mandate is to promote two main economic goals: maximum employment and price stability... and uncertainty is on both sides How will President Trump react to this? ECB is cutting rates. PBOC as well as they see a disinflationary shock coming. Meanwhile, the Fed stays put. He is not going to like this...

Trump says he’d rescind global chip curbs amid ai restrictions debate -- bullish for $nvda 🤩

▶️ Nvidia shares rose on Wednesday on a report that the Trump administration plans to revise a set of chip trade restrictions called the “AI diffusion” rule. ▶️ The rule, which was proposed in the last days of the Biden administration, organizes countries into three different tiers, all of which have different restrictions on whether advanced AI chips like those made by Nvidia, AMD, and Intel can be shipped to the country without a license. ▶️ The Trump administration plans to rescind the rule, Bloomberg reported on Wednesday. The chip restrictions were scheduled to take effect on May 15. ▶️ Nvidia had no comment on the reported move by the Trump administration. ▶️ Chipmakers including Nvidia and AMD have been against the rule. AMD CEO Lisa Su told CNBC on Wednesday that the U.S. should strike a balance between restricting access to chips for national security and providing access, which will boost the American chip industry. Nvidia CEO Jensen Huang said earlier this week that being locked out of the Chinese AI market would be a “tremendous loss.” 🔴 However, this is more about Middle East than China. Indeed, the changes are taking shape as Trump readies for a trip to the Middle East, where a number of nations including Saudi Arabia and the UAE have bristled at restrictions on their ability to acquire AI chips. Source: Shay Boloor, CNBC

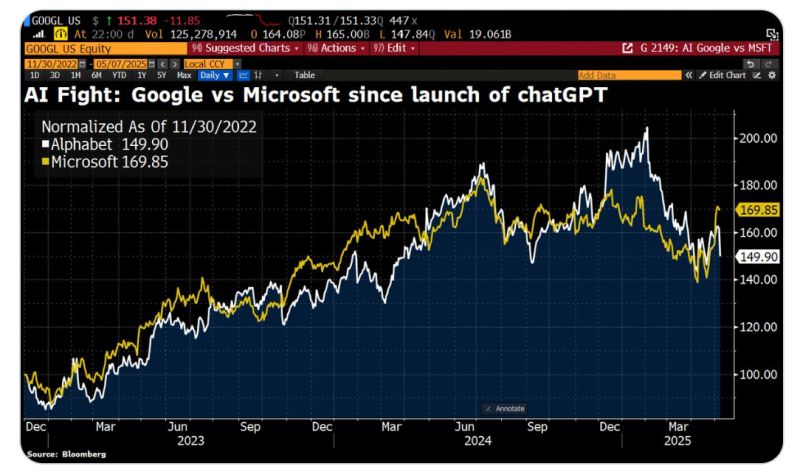

Alphabet shares tumble >7% on vibes.

Alphabet could be the next Eastman Kodak. Apple executive Eddy Cue revealed that the iPhone maker is exploring adding AI-powered search to its browser, after search activity in Safari declined for the first time ever in April. Apple is now considering alternatives to Google—including OpenAI, Perplexity, and Anthropic. "Today could mark a historic turning point in sentiment toward Alphabet," says Melius’s Reitzes. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks