Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Rising smoke is coming out from Bundestag (image courtesy from HolgerZ on X))

German Lawmakers back CDU/CSU's Merz in 2nd Bundestag vote w/325 votes out of 630 lawmakers. ✔️ Friedrich Merz was elected as Germany’s chancellor in a second-round parliamentary vote on Tuesday, after failing to secure the necessary support earlier in the day. ✔️Merz needed at least 316 of the 630 members of parliament to vote in his favor. He received 325 votes. ✔️The German Dax stock market index pared losses after the result of the second vote

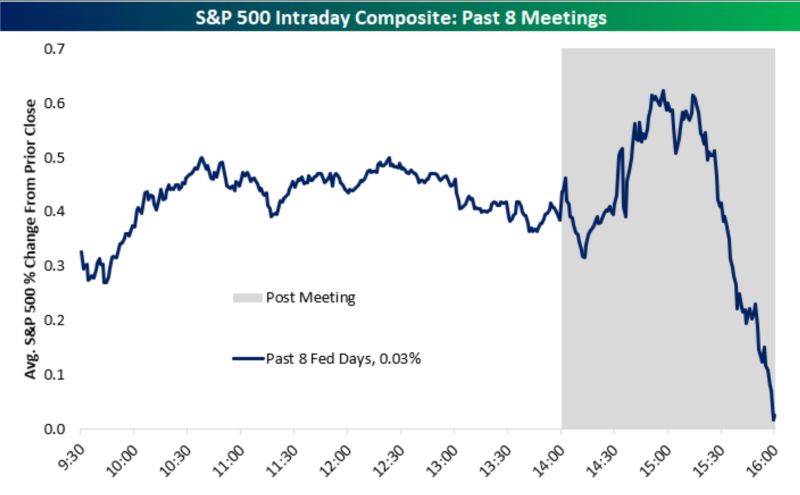

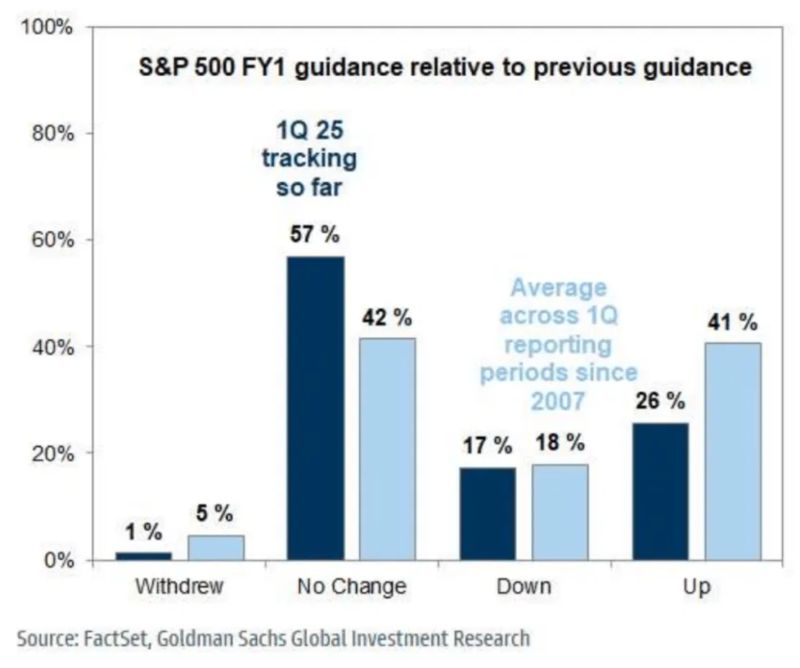

So far very few US earnings downgrades...

Source: GS, Ronnie Stoeferle @RonStoeferle

U.S. rejects Japan's exemption from "reciprocal" tariffs - Kyodo

▶️ The United States has refused Japan's full exemption from not only a 10 percent "reciprocal" tariff but a country-specific tariff in recent negotiations, sources close to the matter said Monday. ▶️ U.S. officials including Treasury Secretary Scott Bessent told Japan's top negotiator Ryosei Akazawa in their meeting in Washington last week that the administration of President Donald Trump intends to put only a cut in the 14 percent country-specific tariff, suspended through early July, on the negotiating table, the sources said. ▶️ The U.S. side stressed in the second round of the negotiations that it will only consider extending the 90-day suspension or lowering the 14 percent tariff depending on the progress of their talks, according to the sources.

The recent outperformance of european vs. US equities in context

Source: Michel A.Arouet, @Augur Infinity

German benchmark index Dax slips, as Merz falls short of majority in initial German parliament vote.

Friedrich Merz failed to be elected German chancellor Tuesday, after he fell short of securing a majority in a shock first-round parliamentary vote. Merz needed at least 316 votes to become chancellor and only 310 members of parliament voted in his favor. Germany’s Bundestag has a total of 630 members. The result marks an unanticipated setback for Merz who was widely expected to secure the necessary votes and be officially sworn in later in the day. After the result of the vote was announced the parliamentary session was halted to allow for discussion of next steps. The German Dax stock market index extended losses to trade around 1.4% lower by 10:07 a.m. London time. A second vote needs to take place within 14 days, according to the German constitution, with an absolute majority needed once again. There are also protocols in place in case the second vote also fails to elect a chancellor. Source: CNBC, Bloomberg, HolgerZ

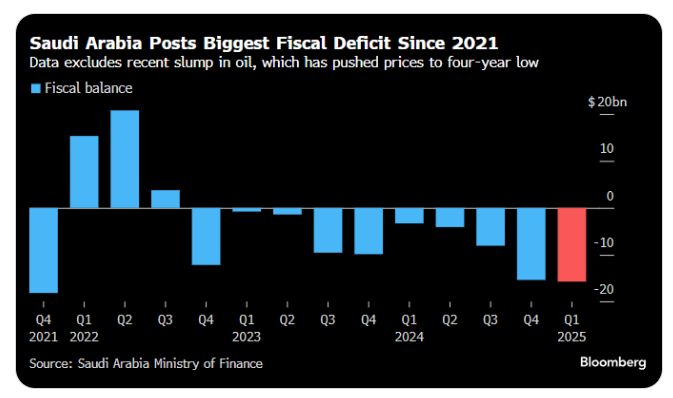

Saudiarabia posted a $16 bn budget deficit in the first 3 months of 2025

That's already well over half of the $27 bn the government had budgeted for the entire year. Oil averaged $75 in the first quarter of 2025 -- it's now near $60 Source: Ziad Daoud @ZiadMDaoud, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks