Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Grand opening coming soon! Trump orders reopening of Alcatraz prison for ‘most ruthless offenders’

▶️ Trump orders reopening of Alcatraz prison for ‘most ruthless offenders’ Plan to expand and reuse long-shuttered penitentiary off San Francisco described as ‘not serious’ by Nancy Pelosi ▶️ Donald Trump has said he is directing the administration to reopen and expand Alcatraz, the notorious former prison on an island off San Francisco that has been closed for more than 60 years. ▶️ California Democrats called the idea “absurd on its face” and part of the US president’s strategy of political distraction. Other officials pointed to the closure of the prison complex in 1963, known for its brutal conditions, due to operational expense and the high number of (unsuccessful) escape attempts. ▶️ “Alcatraz closed as a federal penitentiary more than 60 years ago. It is now a very popular national park and major tourist attraction. The president’s proposal is not a serious one,” the California Democratic congresswomen and former House speaker Nancy Pelosi said. ▶️ In a post on his Truth Social site on Sunday evening, Trump wrote: “For too long, America has been plagued by vicious, violent, and repeat Criminal Offenders, the dregs of society, who will never contribute anything other than Misery and Suffering. When we were a more serious Nation, in times past, we did not hesitate to lock up the most dangerous criminals, and keep them far away from anyone they could harm. That’s the way it’s supposed to be.” Source: Gunther Eagleman™ on X, The Guardian

India has proposed zero-for-zero tariffs on U.S. auto parts and steel, according to Bloomberg

Amid continued trade talks with Washington, India has reportedly proposed to charge zero tariffs on steel, auto components and pharmaceuticals from the US on a reciprocal basis. According to a report by Bloomberg quoting people familiar with the development, the reciprocal tariffs have been offered up to a certain quantity of imports from the US. Beyond the set limit, imported industrial goods would attract the regular level of duties, the sources said. The offer was reportedly made by trade officials from the Indian side who visited Washington in late April to expedite negotiations on a bilateral trade deal. A deal is expected to be closed by autumn this year, the report quoted the sources as saying.

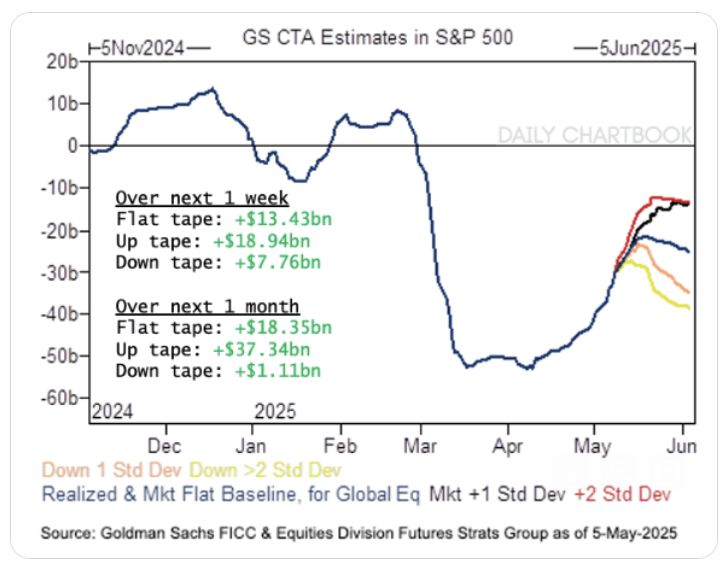

According to Goldman Sachs, CTAs are projected to buy US stocks in EVERY SINGLE SCENARIO over the next week and month.

Source: Barchart

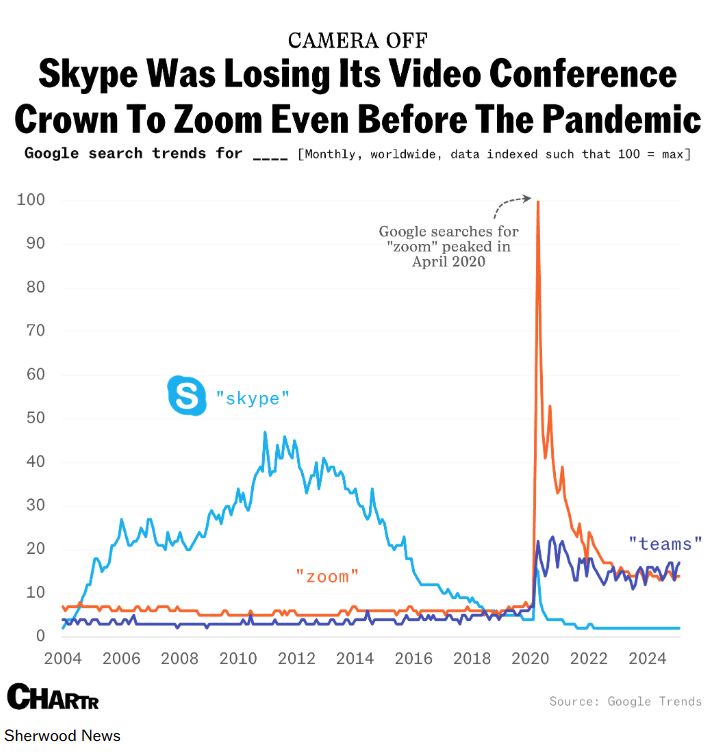

It’s official: video call platform Skype, once one of the world’s most popular websites and an icon of the 2000s internet era, is no longer be available.

▶️ Founded in 2003, Skype quickly became one of the largest video and voice call carriers globally, counting 52 million active users just two years after launch. The company was acquired by Microsoft in 2011 for $8.5 billion, integrating the service with its other products like Xbox and Windows devices. ▶️While the rise of other video conferencing services like Zoom during the pandemic — as well as the introduction of Windows 11 in 2021, which had Microsoft’s Teams app integrated by default — can be pointed to as the beginning of the end for Skype, Google Search data suggests that the platform had been losing ground for some time. ▶️Skype will now be replaced with the free version of Microsoft Teams, with users maintaining their message history, group chats, and contacts — but, per The Verge, Skype’s domestic and international call carrier services will be lost with the move. Source: Chartr

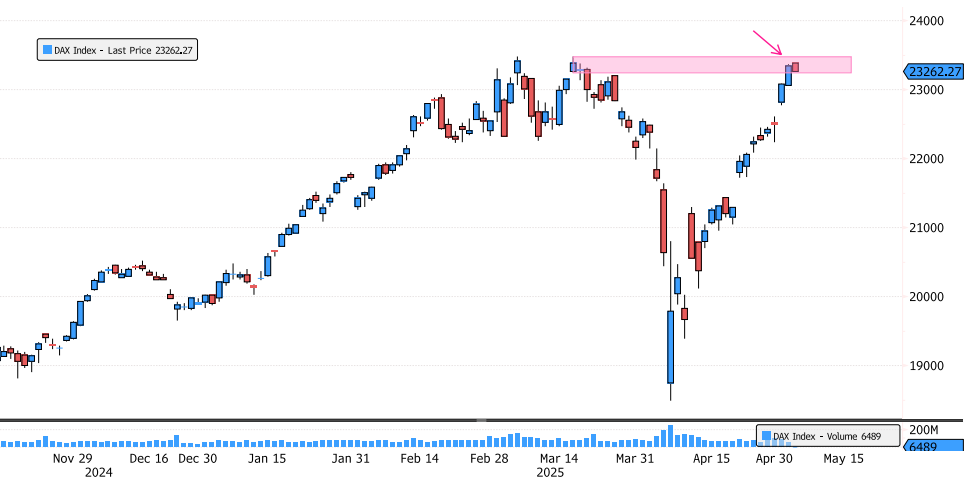

DAX Index Reaching Ultimate Supply Zone

The DAX Index has now rebounded 26% since the lows! Will the market be able to break through the last supply zone between 23,240-23,476? Keep an eye on the price action and support at 23,133. Source: Bloomberg

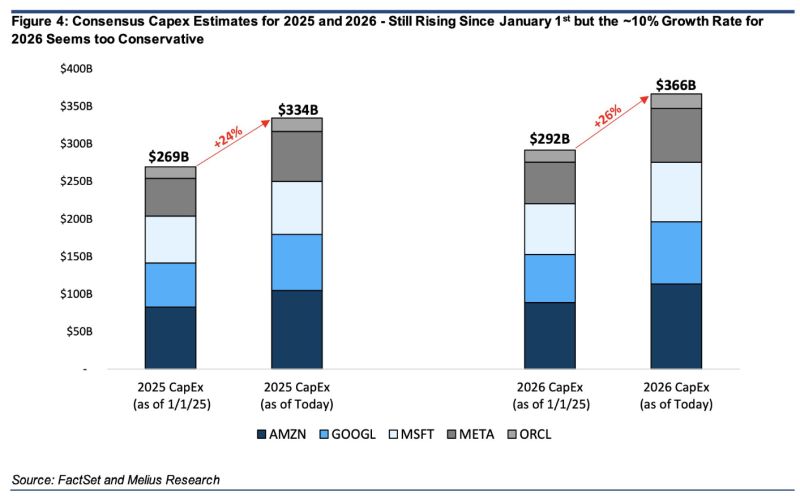

The latest earnings reports offer some reassurance that capital spending (capex) remains strong, says Melius’s Reitzes.

Hyperscalers haven’t cut back on their investments, which is good news for AI-related stocks like Nvidia, Broadcom, and Arista Networks. Source: HolgerZ, Melius Research

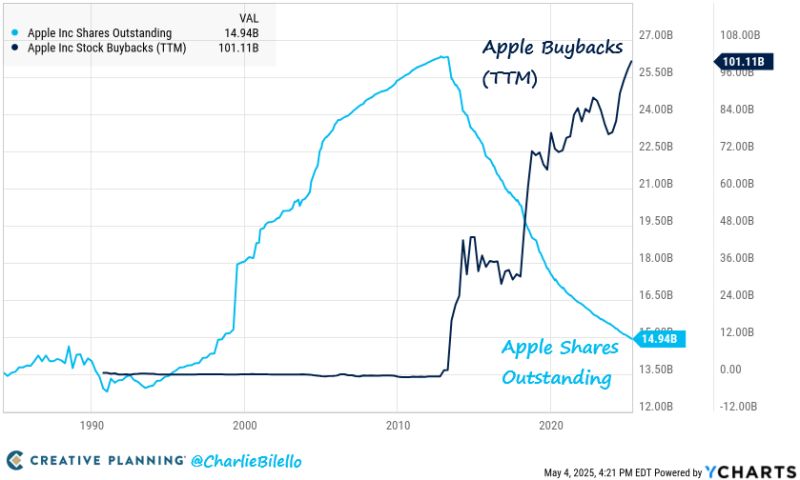

Apple has bought back $693 billion in stock over the past 10 years, which is greater than the market cap of 488 companies in the S&P 500

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks