Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

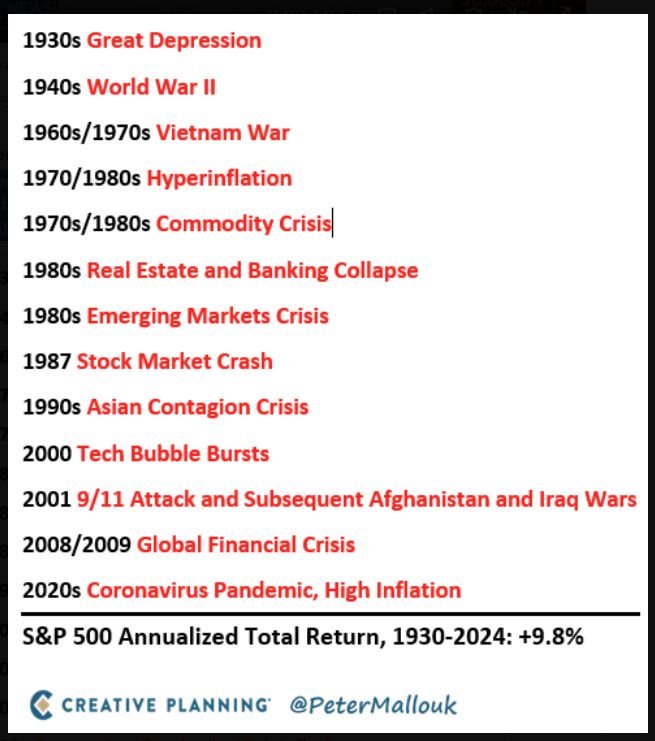

Well said by Peter Mallouk

"It’s been a rough year so far for US equity markets, but we’ve been through much worse in the past and gotten through it. We’ll get through this as well. As Abraham Lincoln once said: This, too, shall pass.”

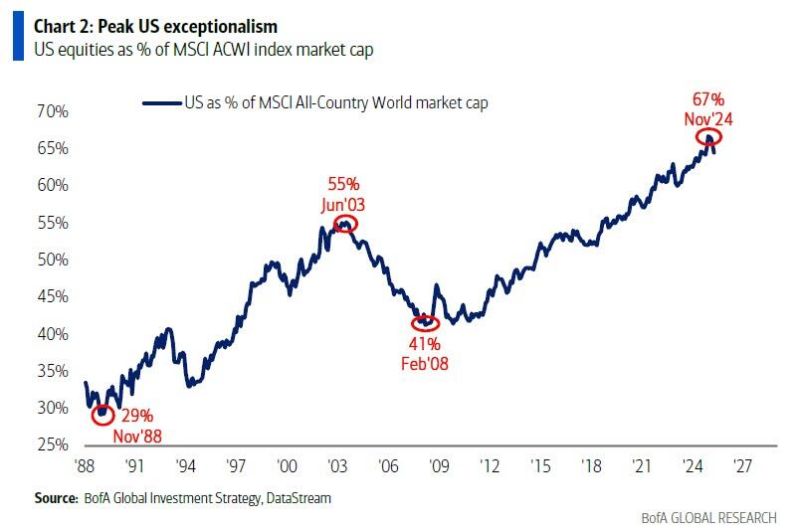

Has a new secular BEAR MARKET begun in the US?

The US share in the global stock market has fallen 3-4 percentage points since its November 2024 peak of 67%. This comes as the US has significantly underperformed other markets this year. Many investors are not ready for this.. Source: BofA, Global Markets Investor

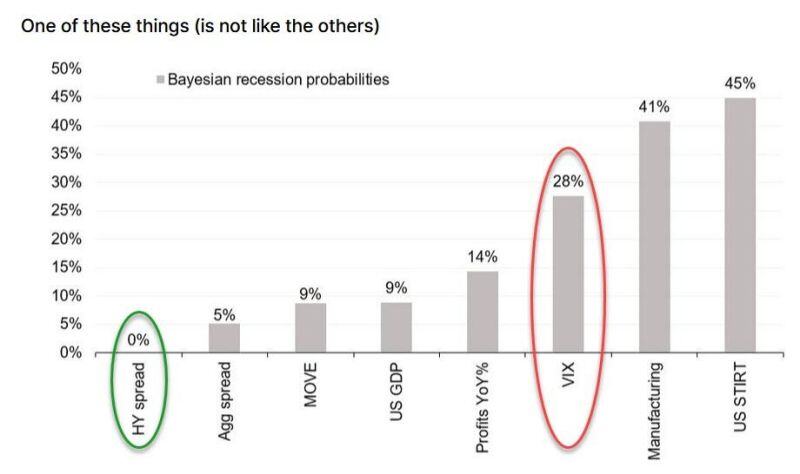

🔴 The VIX Is Pricing In A Recession, While Junk (Still) Sees Zero Risk

➡️ SocGen's Jitesh Kumar writes that high yields spreads remain below 4%, and "we have never been in recession with high yield spreads below 4.5% (data going back to 1987)." In other words, US HY credit spreads are pricing in 0% recession probability. ➡️ However while credit remains complacent, one asset is starting blast a recession warning siren: according to UBS trader Antonya Allen, the VIX is now pricing in a recession. Which one will be correct? Source: SocGen, www.zerohedge.com

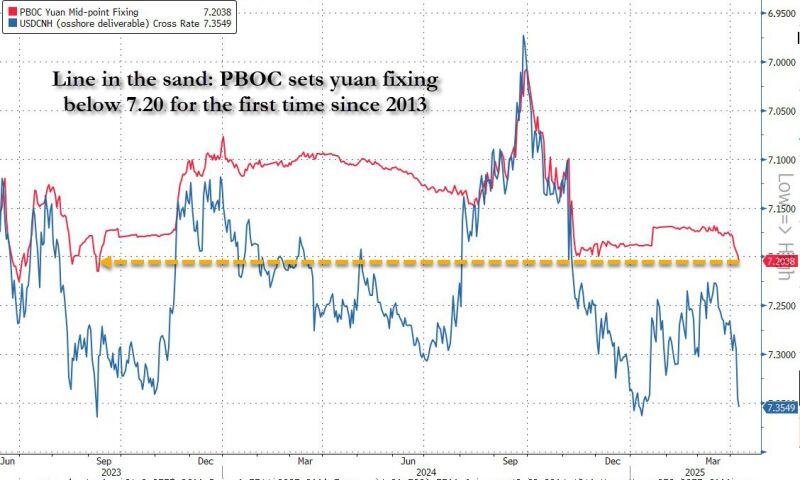

Here's another retaliation from china...

Beijing just crossed a line in the sand. The PBOC fixing was on the other side of the closely watched 7.20 "devaluation" line, first time since 2023. Offshore yuan tumbles and is about to hit a record low against the USD. Source: zerohedge

Ray Dahlio

"Don't Make the Mistake of Thinking That What's Now Happening is Mostly About Tariffs" "At the moment, a huge amount of attention is rightly being paid to the newly announced tariffs and their significant impacts on markets and economies. But very little attention is being paid to the circumstances that caused them—and to the even bigger disruptions likely still ahead. Don’t get me wrong: these tariff announcements are important developments. But most people are overlooking the much larger forces that are driving just about everything, including the tariffs. In my latest article, I discuss what I believe is far more important to keep in mind: we’re witnessing a classic breakdown of the major monetary, political, and geopolitical orders. This kind of breakdown happens only once in a lifetime—but it has happened many times in history, when similarly unsustainable conditions were in place".

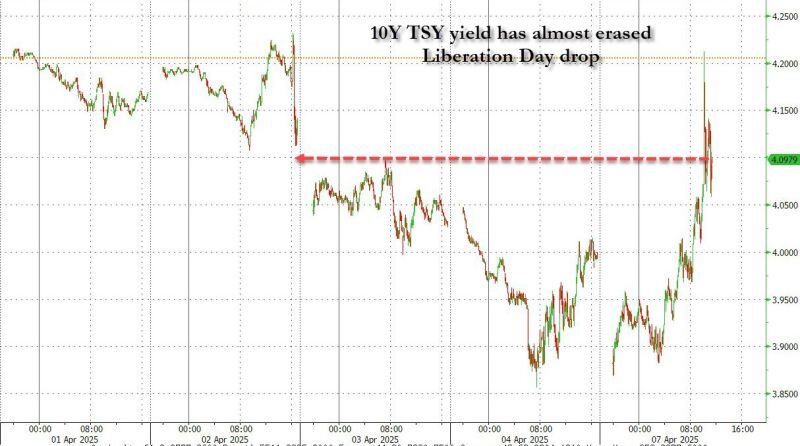

Oups! When the trade war clashes with the yield war..

It seems that china is ready to retaliate by weaponizing US Treasuries‼️As the US threatens to impose ADDITIONAL Tariffs on China of 50%, effective April 9th, China responds by selling another $50BN in Treasuries ‼️Oh by the way, the hashtag#yield on 10Ys is now almost unchanged from Liberation Day! 😨 Source: zerohedge, Bloomberg

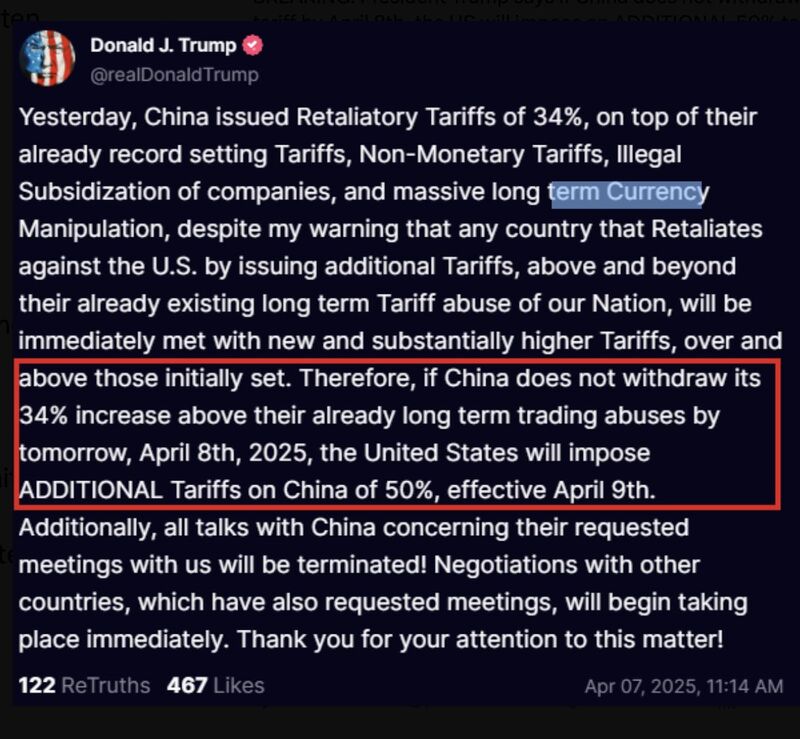

Trump now threatens China with 104% tariffs!

Trump is now threatening China with FURTHER 50% tariffs if China does not withdraw its 34% by today. 😱 104% tariff on China in 24 hours if no deal.

Investing with intelligence

Our latest research, commentary and market outlooks