Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚀 Here comes the "Trump Put"...

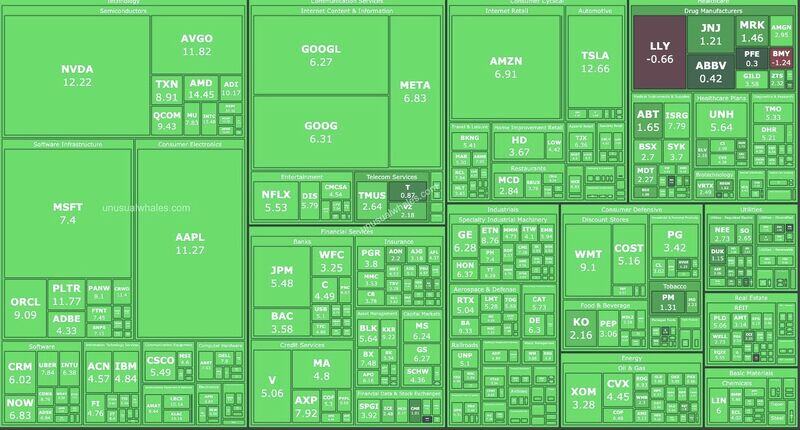

Dow surges 2,400 points for biggest rally in 5 years Trump tariffs drop to 10% universal rate for all countries except China for 90 days. Here are the GOOD, the BAD and the UGLY 👇 : ➡️ THE GOOD: This is (at least temporarily) putting an halt to the cyclical bear market which was in the midst of turning into a full-blown financial crisis. ➡️ THE BAD: Who can deal with such volatility and unpredictability? Investors started the day trying to understand the risks of the basis trade unwinding and now they have to handle the biggest rally for the Dow in 5 years... What about CEOs and CFOs? At this stage it is impossible for them to make any plans about capex, hiring or M&As. All of this will have consequences on the risk premium required by investors. It will also have consequences on economic growth and employment.

The World's biggest Importers

Source: Visual Capitalist

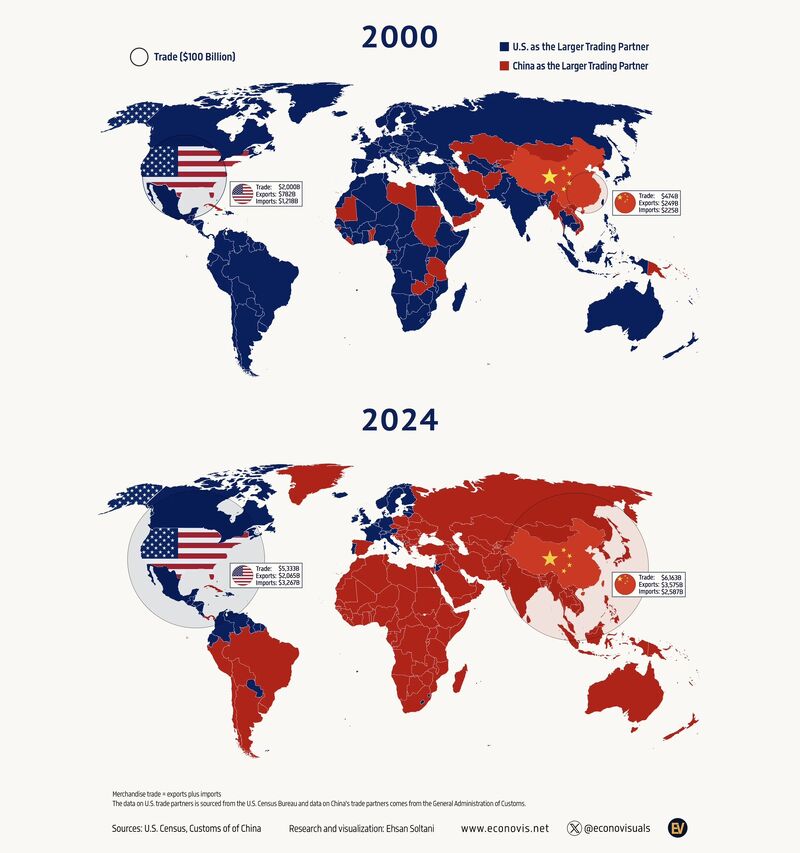

Today's global trade reality.

In Blue -> Countries for which the US is the largest trading partner In Red -> Countries for which china is the largest trading partner (as measured by exports + imports)

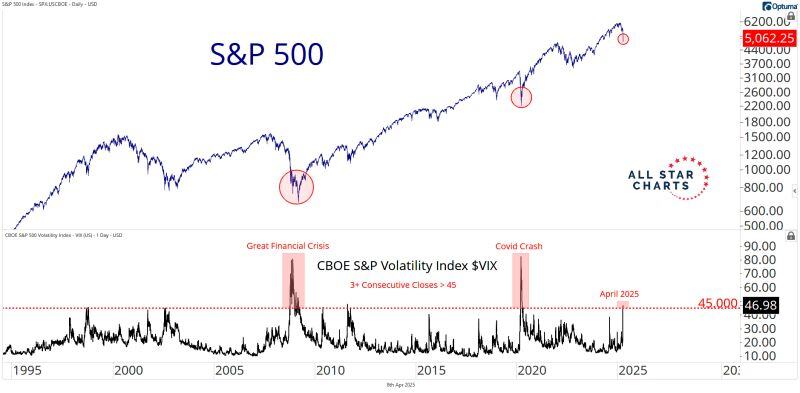

Third consecutive close of the $VIX > 45.

That’s only happened in three bear cycles: 🔻 2008 🔻 2020 🔻 2025 Source: Alfonso De Pablos, CMT, Alfcharts

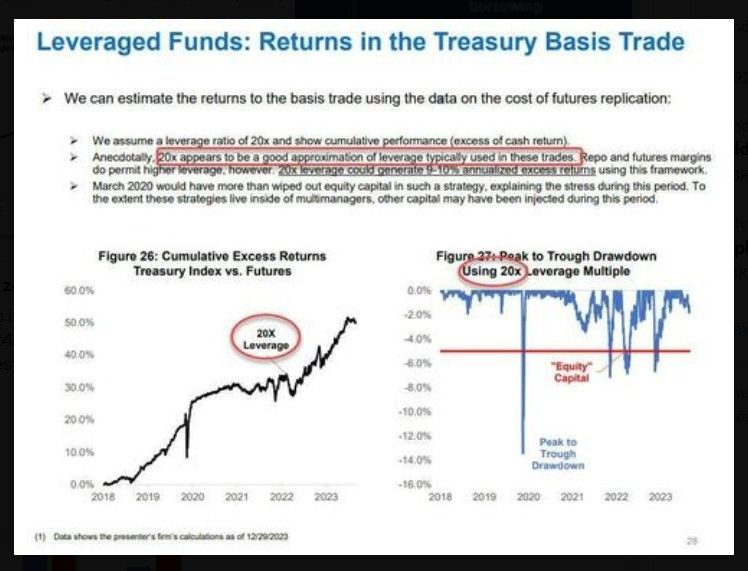

Do you remember LTCM???

According to a zerohedge article, the leverage on Treasury basis trades - which is by far the most popular trade among big hedge funds - is anywhere between 20x (Treasury Board Advisory Committee estimate) and 56x (Fed estimate); on a VaR basis LTCM was an amateur... Source: www.zerohedge.com

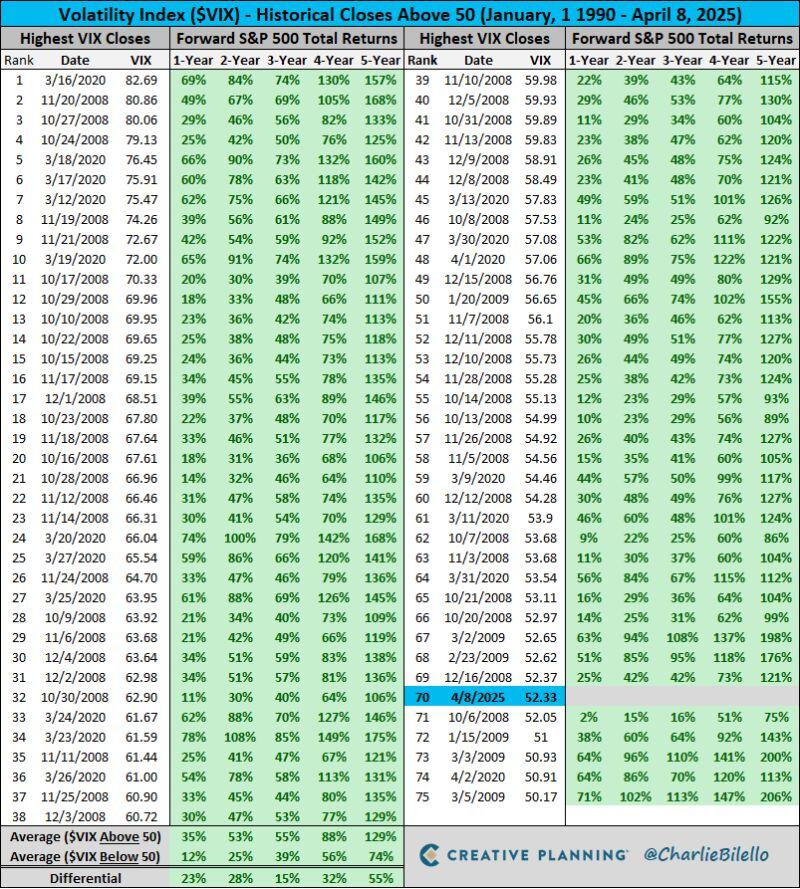

The $VIX closed above 50 today which is in the top 1% of historical readings.

What has happened in the past following closes above 50? S&P 500 gains over the next 1, 2, 3, 4, 5 years every time with above-average returns overall. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks