Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

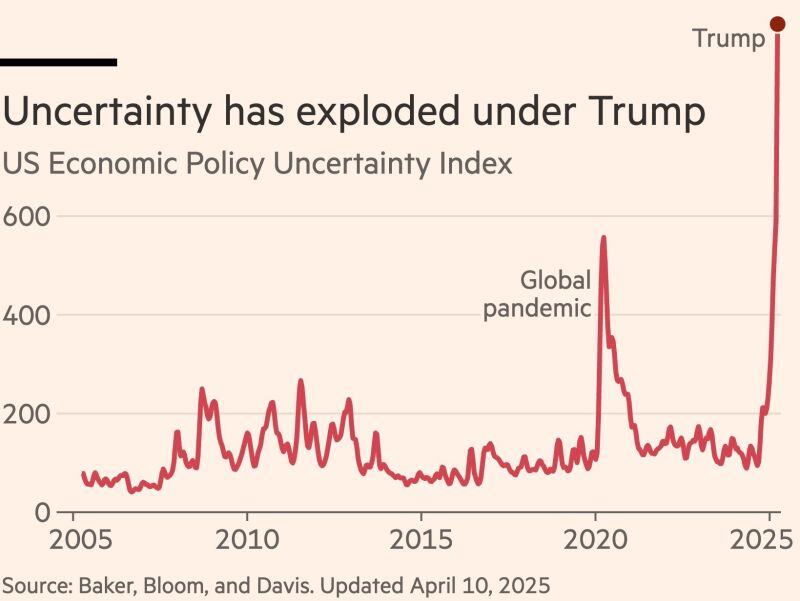

Markets are dumping the dollar in Asia as the Dollar Index $DXY plunges below 100

Euro = 1.13 Yen = 143 Swissie = 0.8194 Source: zerohedge

USA CDS spread are blowing out, now trading wider (worse) than France and South Korea (and almost as bad as Italy and Greece)...

Source: zerohedge

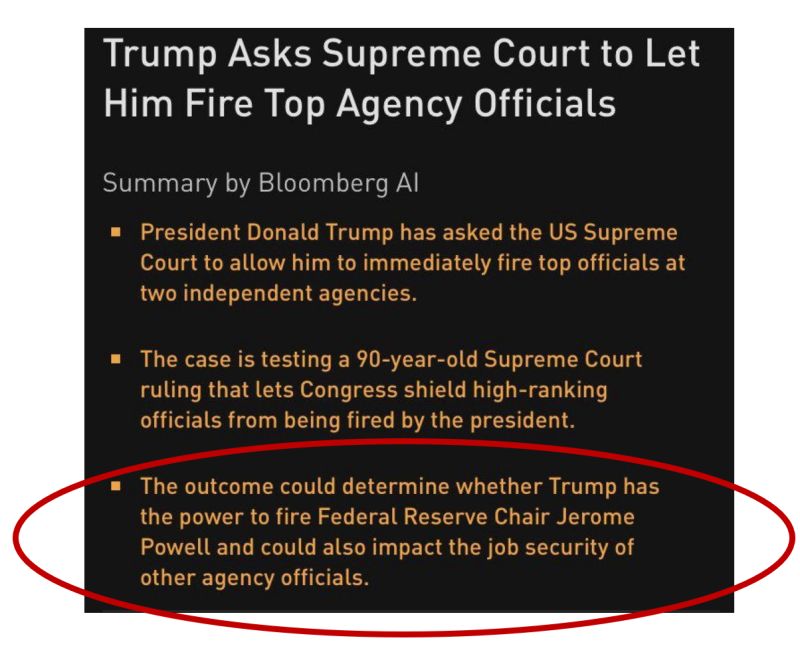

🔴 BREAKING: PRESIDENT TRUMP JUST ASKED THE SUPREME COURT FOR THE AUTHORITY TO FIRE FEDERAL RESERVE CHAIR JEROME POWELL

Source: Bloomberg

The only person that can lose you money in the stock market?

Yourself. Source: Compounding Quality

Just a reminder that this story was leaked on Monday, and then denied by the White House.

Source: James Chanos @RealJimChanos

CBOE Volatility Index $VIX drops by more than 35%, its largest decline in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks