Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

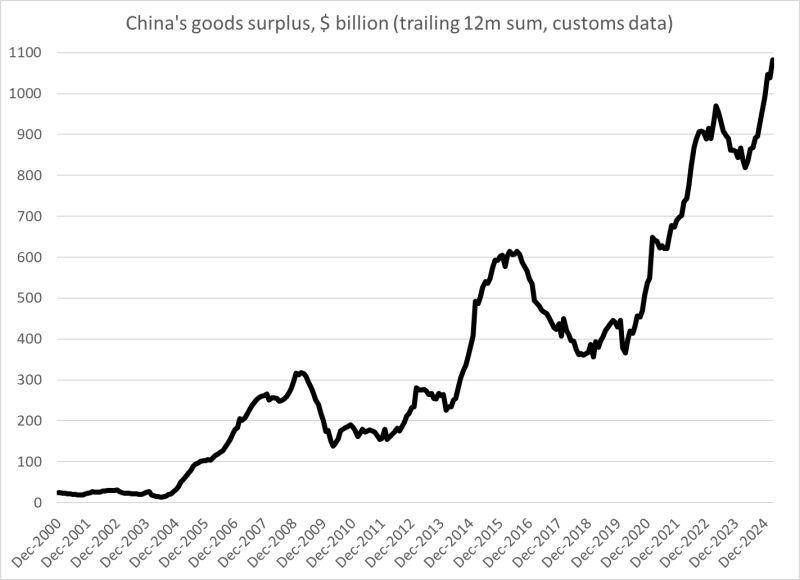

Crazy numbers coming out of China

A $100 billion (goods) surplus in March, a $275 billion goods surplus for q1 (up from $185 billion last year) and a surplus of nearly $1.1 trillion over the last 4 quarters... The easy explanation is tariff front running. But it seems "too easy" as an explanation. China's exports to the US and the EU look identical -- and there is no "reciprocal" tariff threat out of the EU. Same story with emerging markets: more exports and fewer imports. Source: Brad Setser @Brad_Setser on X

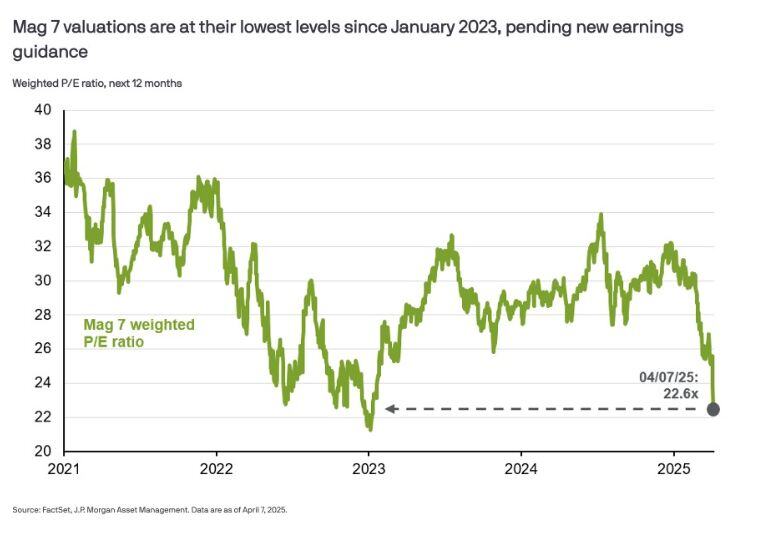

Mag7 stocks trade at the cheapest in more than 2 years

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi

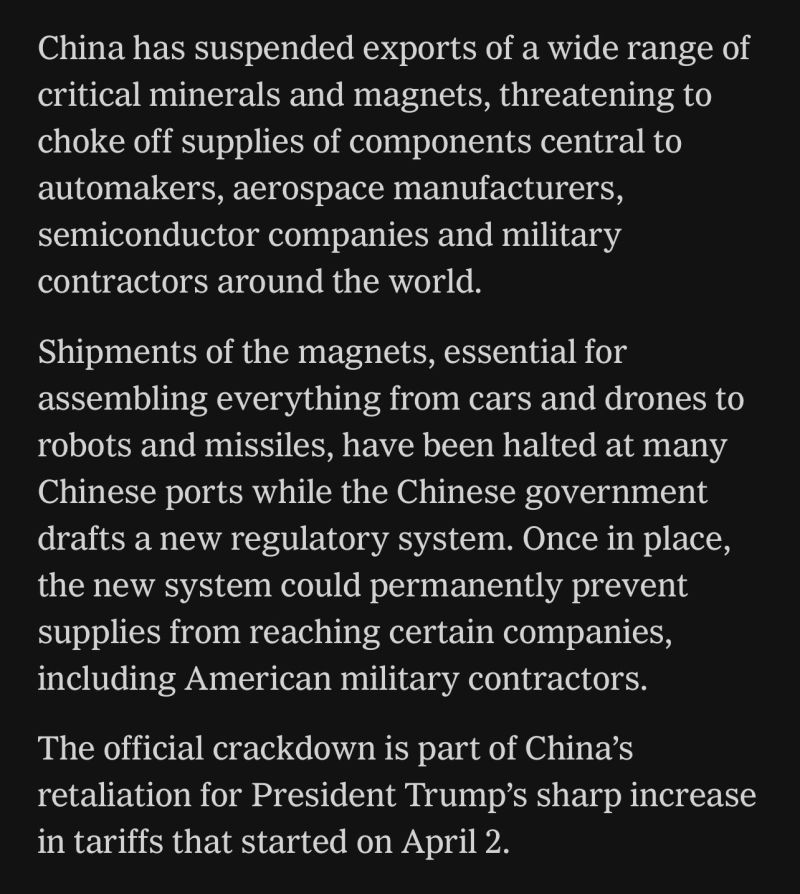

China has suspended exports of certain rare earth minerals and magnets to the U.S. and other countries

It’s also drafting new regulations to block these materials from reaching American companies Source: Stocktwits

BILLIONAIRE RAY DALIO: ‘I’M WORRIED ABOUT SOMETHING WORSE THAN A RECESSION’ - CNBC

“Right now we are at a decision-making point and very close to a recession,” Dalio said on NBC News “And I’m worried about something worse than a recession if this isn’t handled well”

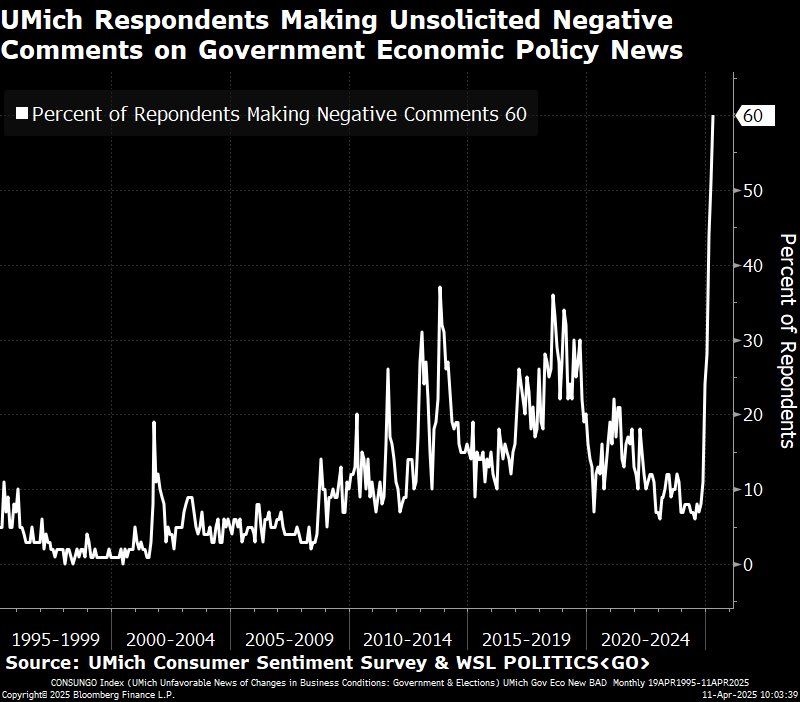

Chart for future history books...

Source: Michel A.Arouet, Bloomberg

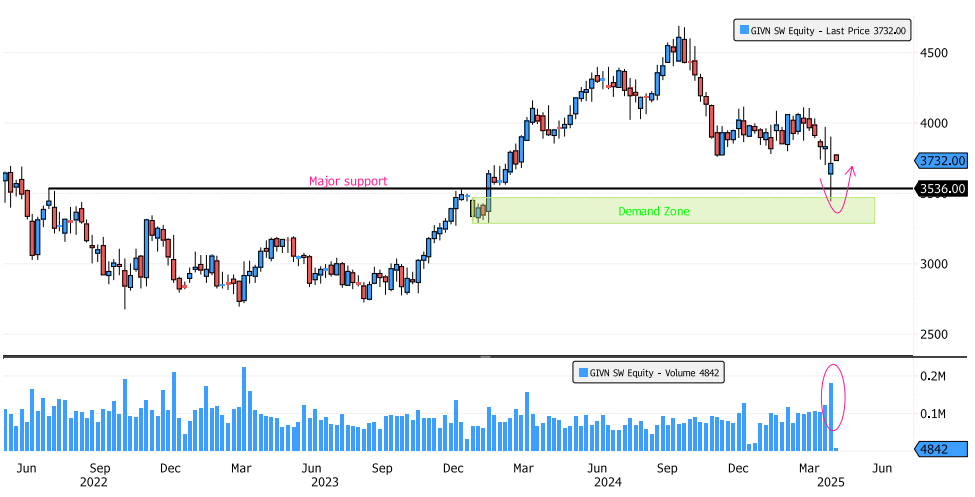

Givaudan Positive Reaction Last Week

Givaudan (GIVN SW) showed a positive reaction last week, rebounding strongly and closing the week above major support at 3536. The stock rebounded sharply from the demand zone between 3287-3468, and has consolidated 26% since the September 2024 high. It’s also at the 61.8% Fibonacci retracement. These technical levels aligning suggest a significant moment for the stock.Source: Bloomberg

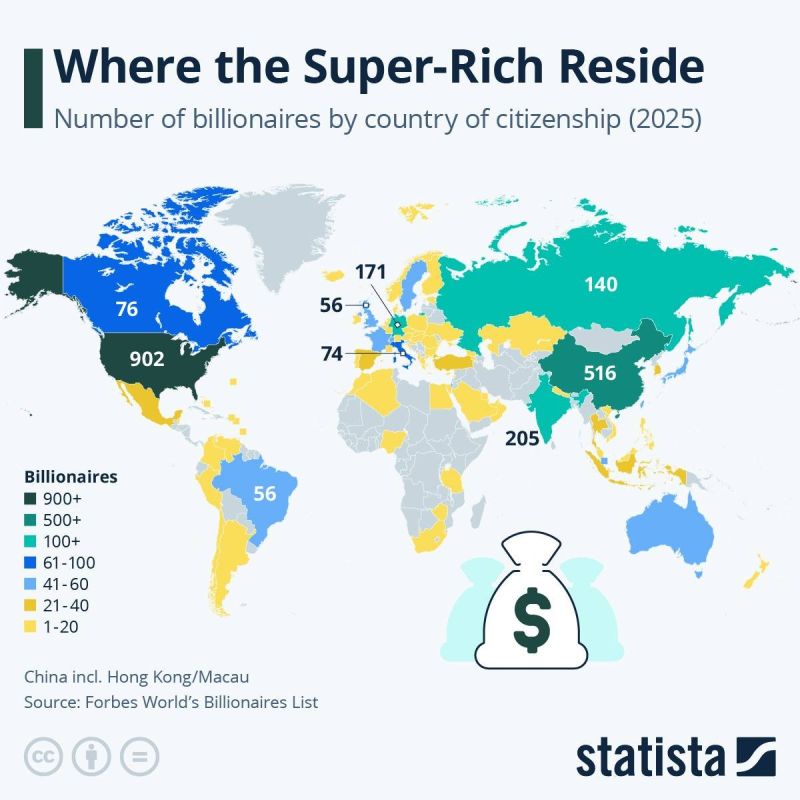

AMERICA STILL RULES BILLIONAIREVILLE—BUT LOOK WHO’S CLOSING IN...

The US has 902 billionaires in 2025, holding the crown as the planet’s top luxury zip code for the super-rich. But China (yes, including Hong Kong and Macau) isn’t exactly playing small—it’s up to 516 and catching up fast. India’s creeping in with 205, while the rest of the billionaire club is scattered across Europe, Russia, and a few surprise players like Brazil and Canada, each with 56. Moral of the story? The money’s global—but it mostly speaks English and Mandarin. Source: Statista thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks