Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

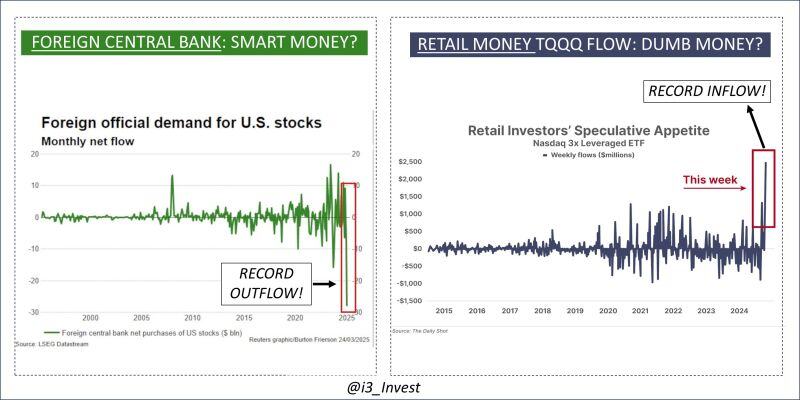

Who do you think is smarter here?

Source: Guilherme Tavares @i3_invest

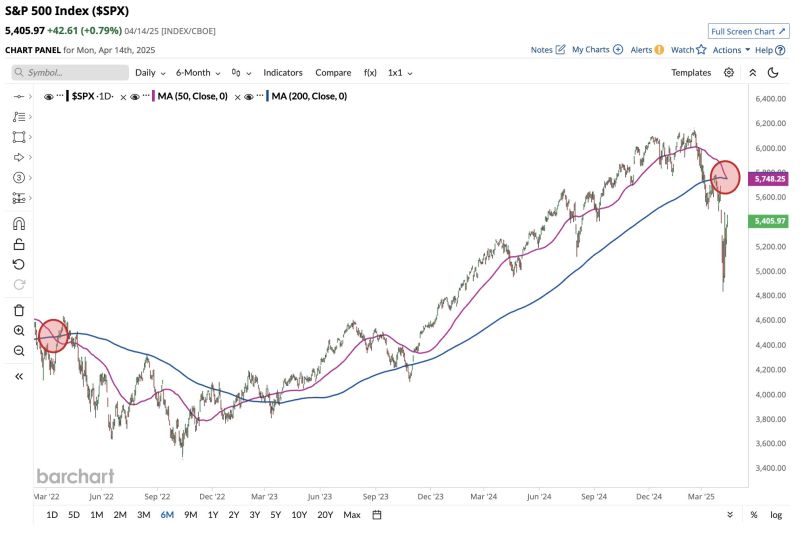

JUST IN 🚨: S&P 500 forms Death Cross ☠️ for the first time since March 2022

Source: Barchart

Extreme anti-US sentiment or just the start of a trend?

Source: Barchart

Donald Trump signalled he may offer carmakers some relief from tariffs, in the latest sign the US president will offer carve-outs to selected industries.

Trump said he was “looking at something to help car companies” that were making vehicles in North America. “They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump said from the Oval Office on Monday. His remarks came after the administration at the weekend exempted smartphones, laptops and other consumer electronic goods from steep “reciprocal” tariffs, although US officials later said those items could be caught in a later round of levies. Trump unveiled steep tariffs of 25 per cent on imports of cars and parts last month, in a move that threatens to push up costs for American consumers and upend global auto supply chains. Under the trading regime, cars and parts made in Canada and Mexico face lower levies and only attract the 25 per cent tariff on their non-US content if they otherwise comply with the rules of the 2020 USMCA trade agreement. Trump’s comments on Monday suggest he may offer carmakers more time to move supply chains to North America. Source: FT

Some Europeans start to realize what is coming...

▶️ British retailers have warned that Chinese companies risk flooding the U.K. with low cost goods, as U.S. President Donald Trump’s tariffs choke off access to the world’s largest consumer market. ▶️“Retailers are very concerned about the risk of some lower quality goods being rerouted from the US to Europe as a result of the tariffs,” said Helen Dickinson, chief executive at the British Retail Consortium. ▶️Analysts said that risk was especially pronounced among Chinese producers selling via online marketplaces such as Amazon, Shein and Temu. Source: CNBC

In trade negotiations. Bessent is highly qualified for the role, but is also tasked with finding quick solutions to complex issues while maintaining investor confidence in U.S. policies.

Bessent’s ascent is the direct outcome of the market turmoil that followed Liberation Day. When reporters asked him where the tariff negotiations were headed, his response was he did not know because he was not part of the negotiating team Source: Forbes

Investing with intelligence

Our latest research, commentary and market outlooks