Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31.

Per Reuters, the results were well below analysts’ expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown. The group’s key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH’s overall profit. Elsewhere, the company’s wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant. The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump’s tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year. Source: Quartr, Hypebeast

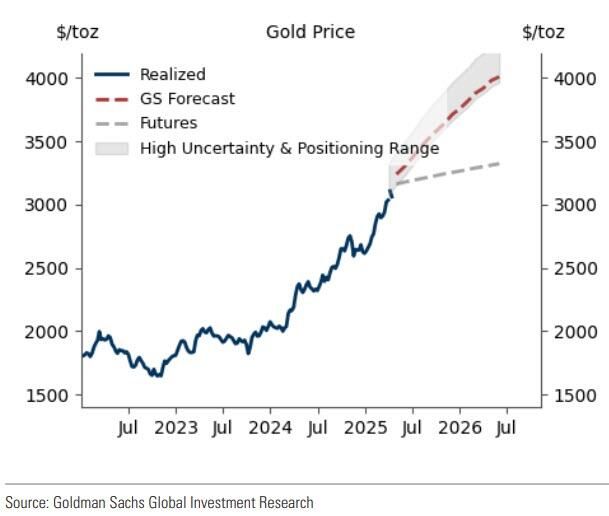

Gold could reach $4,000 over the next year+, according to a forecast by Goldman

Goldman Sachs now sees gold prices to hit $3,700 by the end of 2025. In the most extreme scenario, the bank sees gold prices to spike to $4,500 by the end of the year. Source: Markets & Mayhem

World's Biggest Pension Funds have halted their investments in the U.S. until the country stabilizes

Some of the world’s biggest pension funds are halting or reassessing their private market investments into the US, saying they will not resume until the country stabilises after Donald Trump’s erratic policy blitz. The moves underscore how big institutional investors are rethinking their exposure to the world’s largest economy as the US president’s trade policy upends markets, adding pressure to America’s private capital industry, which is under increasing liquidity strain. Some top Canadian funds are backing away from taking on more US private assets because of geopolitical concerns and fears they will lose tax breaks on their American investments. Canada Pension Plan Investment Board, which has C$699bn ($504bn) in assets, is among those considering its approach. Meanwhile, one of Denmark’s biggest retirement funds has paused new investments in US private equity because of concerns over stability and Trump’s threats to take over Greenland, an executive at the fund told the Financial Times. Source: FT, Barchart

$AAPL Apple gets upgrade at KeyBanc, Wedbush keeps bullish views amid Trump's tariffs scenario.

$APPL is up +4% Source: @DivesTech

NVIDIA TO MANUFACTURE AMERICAN-MADE AI SUPERCOMPUTERS IN US FOR FIRST TIME:

RTRS NVDA PLANS TO PRODUCE UP TO $500BN INFRASTRUCTURE IN THE US US VIA PARTNERSHIPS WITH TSMC, FOXCONN Source: zerohedge Image by created with DALL·E

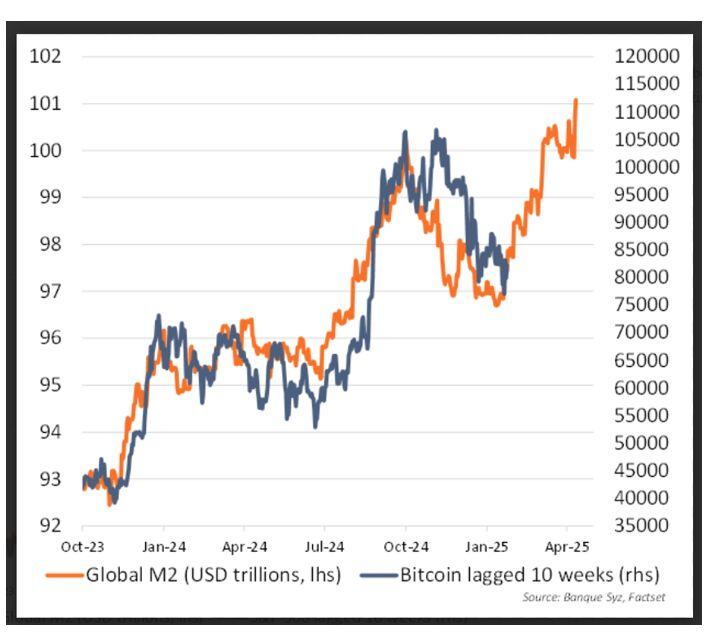

Global M2 (in orange) vs bitcoin lagged 10 weeks (in blue)

M2 proxy vs BTC continues to hold. Could the surge in Global M2 push $BTC to new highs?

Isn't it the most compelling chart for being a stock market investor?

Over the last 50 years: -US Inflation: up 6x -S&P 500 dividends: up 21x -S&P 500 total return: up 323x Over the long run, stocks trounce inflation and protect your purchasing power. Source: Peter Mallouk

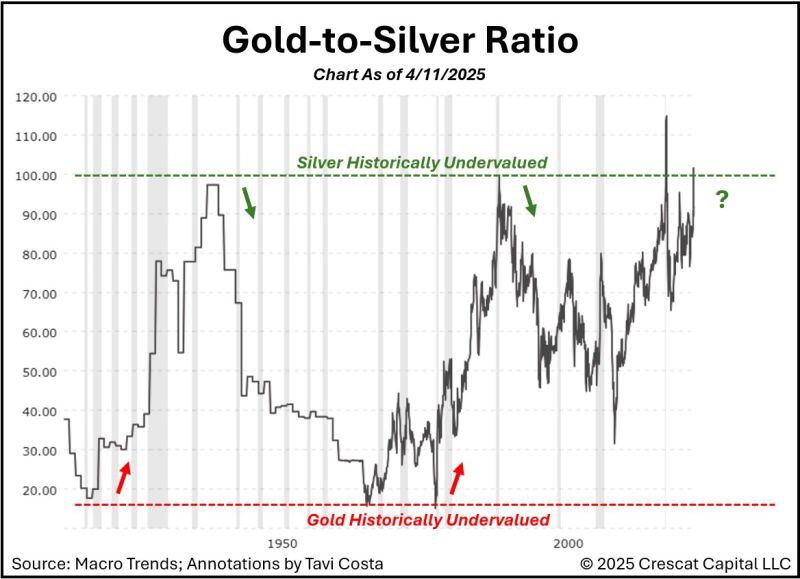

This is a fascinating chart for anyone looking at the gold-to-silver ratio in a historical context - courtesy of Otavio (Tavi) Costa.

Over the past 125 years, the ratio has only spent brief moments above the 100 level — extremes like this tend not to persist for long... Source: Tavi Costa, Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks