Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

From the behavior of a Developed Market to that of an Emerging Market in just one week?

Witnessing such a rare disconnect between the USD index (dark line) and US Treasury yields (blue line) is truly intriguing. Source: Andreas Steno Larsen

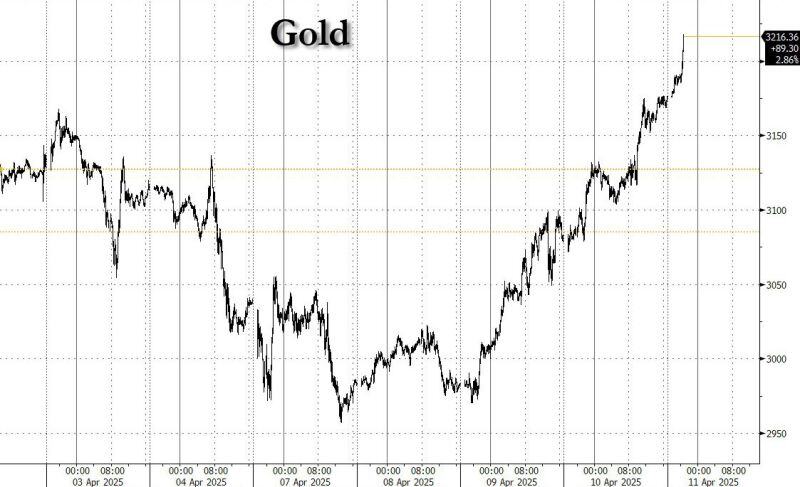

The US bond market just delivered a vote of no confidence in Trump.

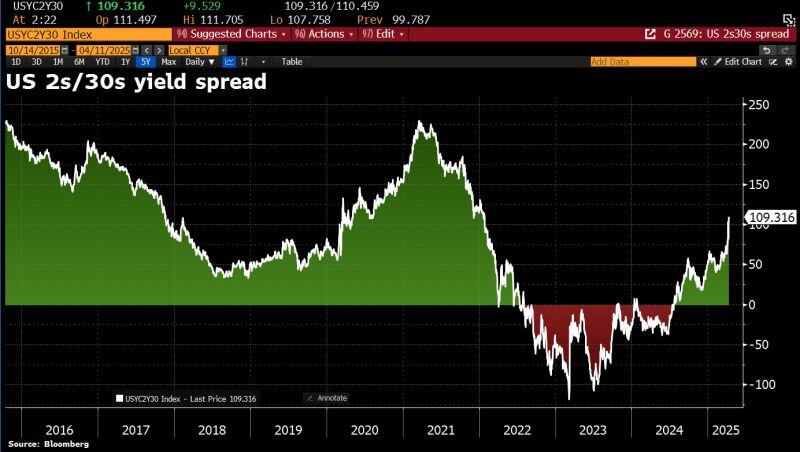

The yield curve is steepening sharply, w/2s/10s yield spread rising to 109bps — the widest gap since 2020. Source: Bloomberg, HolgerZ

Breaking news: China’s finance ministry said the increase from current additional levels of 84% would take effect from April 12.

Xi Jinping breaks silence, says Trump is bullying Europe and the entire world “There are no winners in tariff wars. Going against peace means isolating yourself,” Xi said during a meeting in Beijing with Spanish PM Pedro Sánchez — one of the hardest-hit in this trade war. The Chinese leader urged the EU to unite with Beijing against the U.S. president’s “unilateral intimidation.” Source: FT

Breaking news: China’s finance ministry said the increase from current additional levels of 84% would take effect from April 12.

Xi Jinping breaks silence, says Trump is bullying Europe and the entire world “There are no winners in tariff wars. Going against peace means isolating yourself,” Xi said during a meeting in Beijing with Spanish PM Pedro Sánchez — one of the hardest-hit in this trade war. The Chinese leader urged the EU to unite with Beijing against the U.S. president’s “unilateral intimidation.” Source: FT

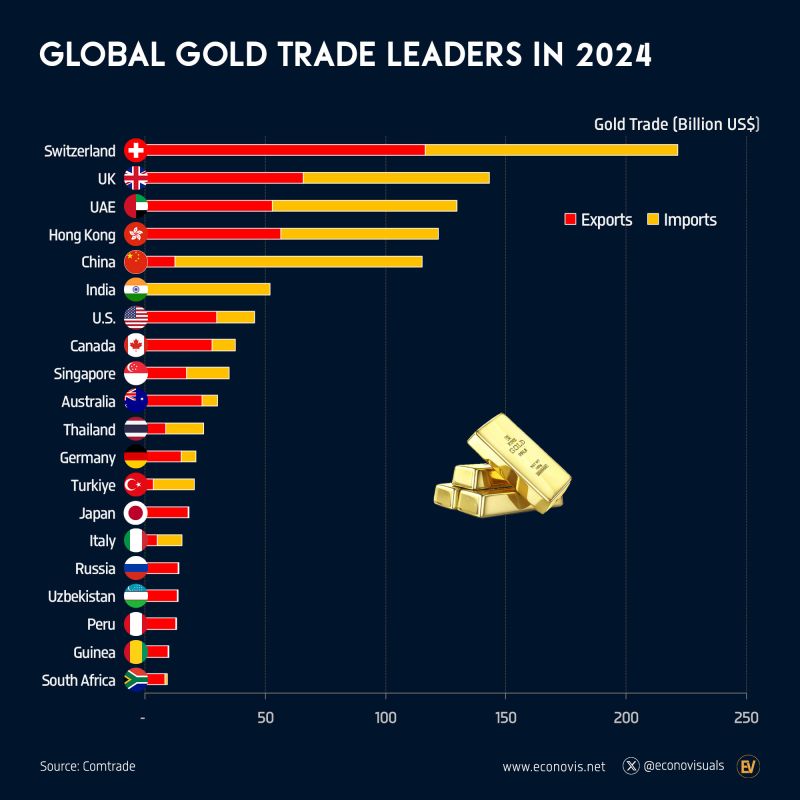

Global Gold Trade Leaders in 2024

In 2024, Switzerland ($116 billion), the United Kingdom ($66 billion), Hong Kong ($57 billion), and the United Arab Emirates ($53 billion) emerged as the world’s top gold exporters. These same economies also featured prominently among the top gold importers: Switzerland ($105 billion), the UK ($77 billion), Hong Kong ($65 billion), and the UAE ($77 billion). Meanwhile, China ($103 billion) and India ($52 billion) ranked as major gold importers but exported far less—$90 billion for China and $1 billion for India—making them the world’s largest net gold importers. Source: Econovis @econovisuals

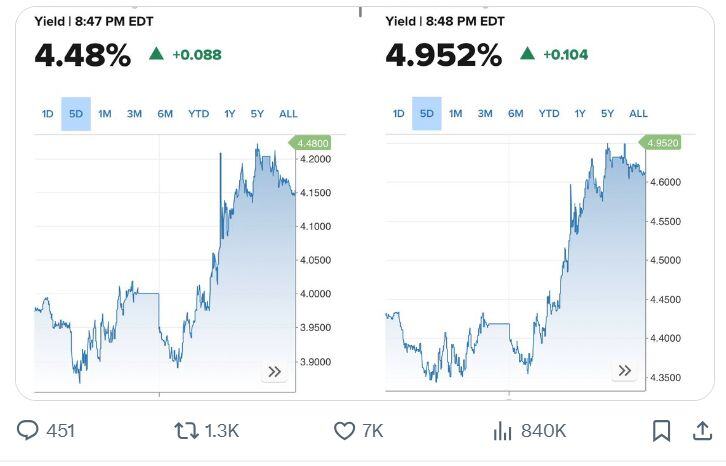

BREAKING: US 10Y Treasury yield rises to 4.48%, the largest single weekly increase since 2001.

U.S. 30-year treasury yields rise to 4.95%, weekly increase is biggest since 1982. Source: unusual_whales

Investing with intelligence

Our latest research, commentary and market outlooks