Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

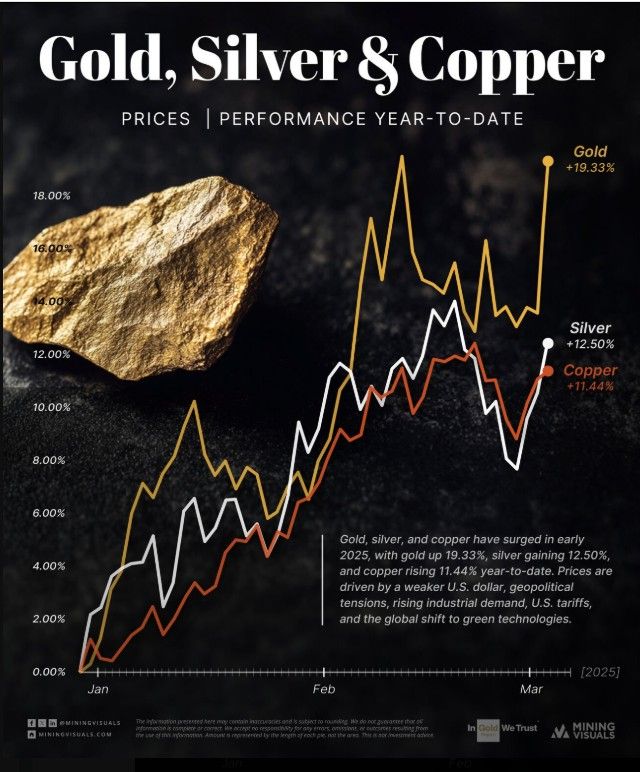

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

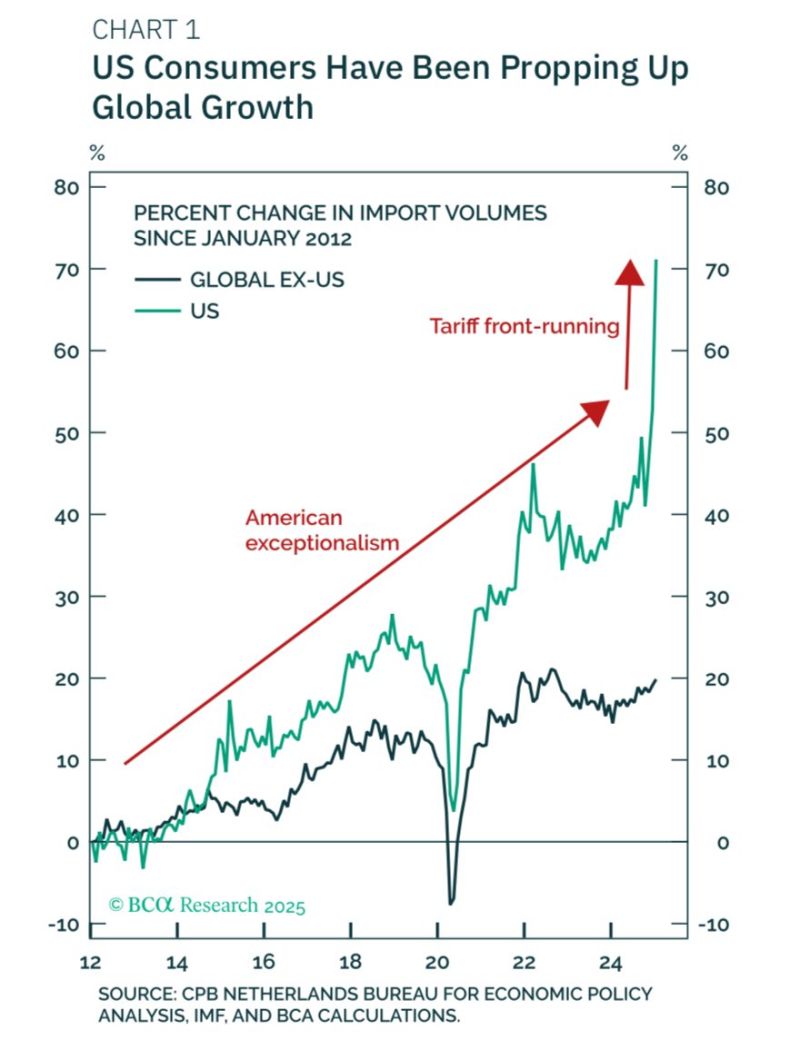

The global economy is currently benefiting from massive tariff front-running, as evidenced by the surge in imports to the US.

This has temporarily propped up production in places like Europe, Canada, and China. Will the floor fall out this week? Source: BCA, Peter Berezin on X

The World’s Top 10 Largest Trade Deficits by Country

Source: Voronoi

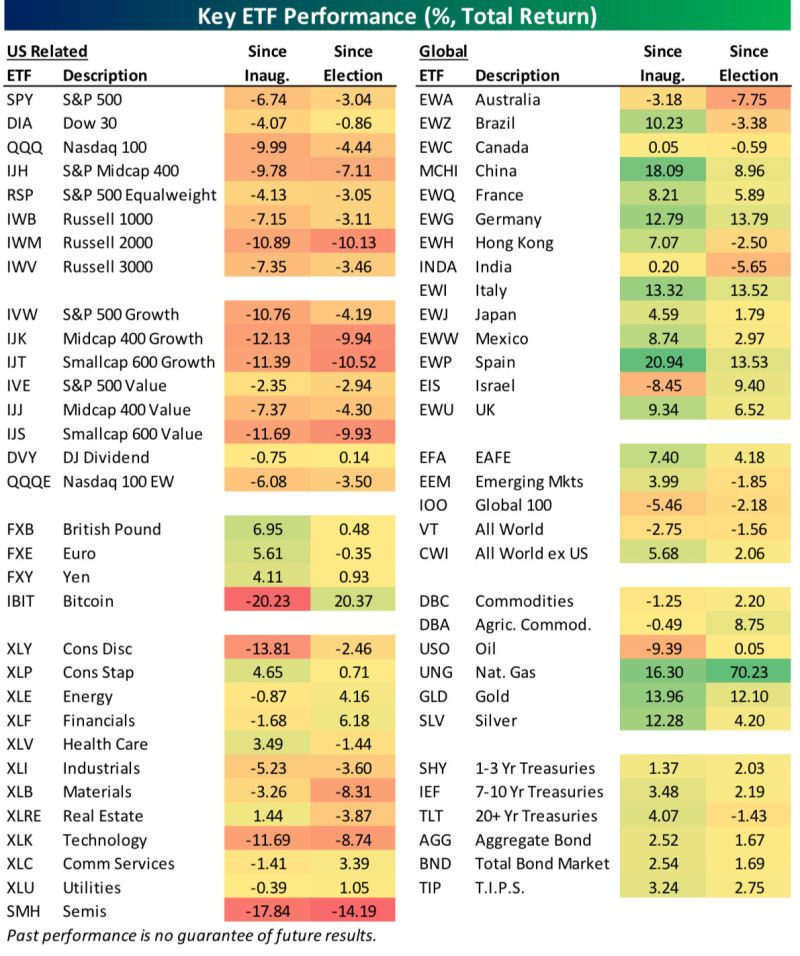

Since Trump’s second term began, the US $SPY is trailing Germany $EWG by more than 19 percentage points and China $MCHI by more than 24 percentage points.

A steep hill to climb already for those keeping score. Source: Bespoke @bespokeinvest

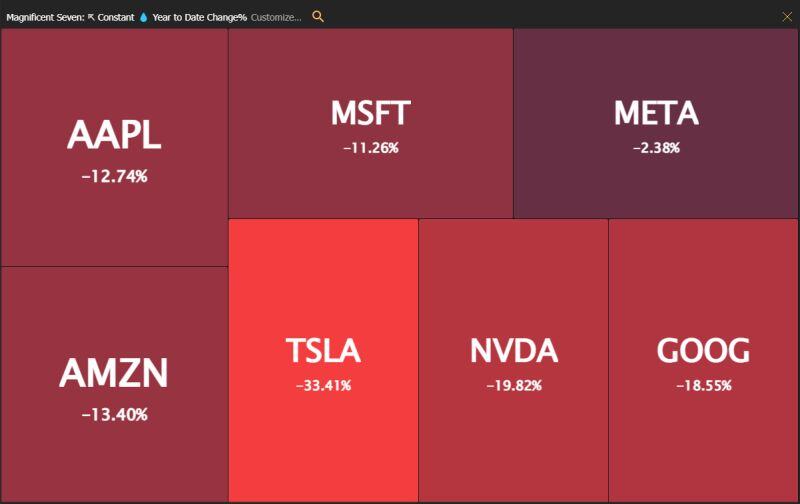

The Mag Seven is off to a historically rough start in 2025:

$META: -2.38% $MSFT: -11.26% $AAPL: -12.74% $AMZN: -13.40% $GOOG: -18.55% $NVDA: -19.82% $TSLA: -33.41% Source: Trend Spider

Goldman Sachs raises U.S. Recession odds to 35%

Source: Barchart

“‘The dollar has lost 96% of its purchasing power over the last century’ is the most misleading claim in all of finance,” says Riholtz in his new book.

As long as spend or you invest (instead of sitting on cash), you should be ok. Source: Eric Balchunas on X

Investing with intelligence

Our latest research, commentary and market outlooks