Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

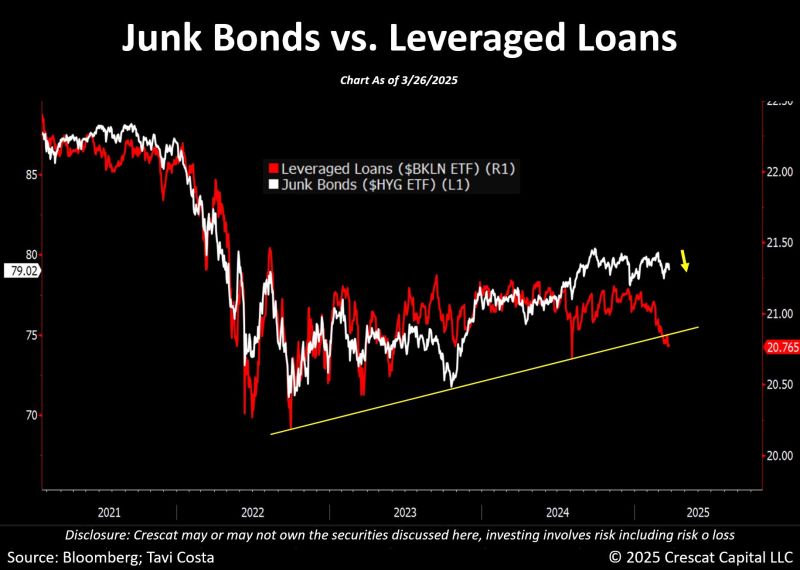

This is a very important chart.

Leveraged loans have already broken down. Will junk bonds start to roll over as well? Source: Bloomberg, Crescat Capital

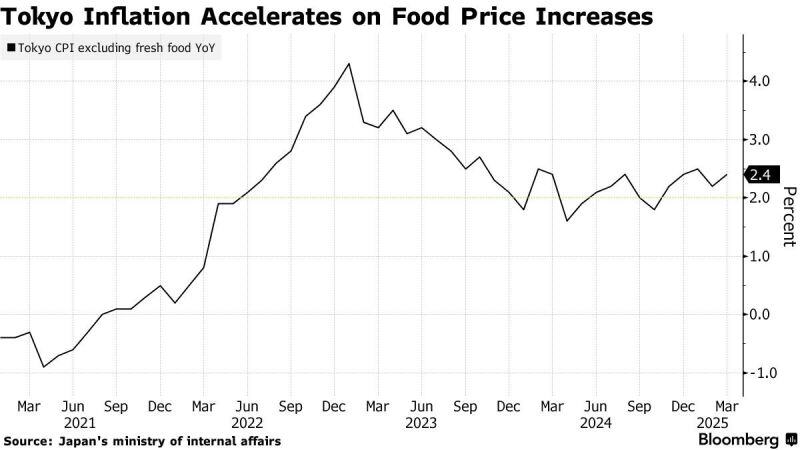

Japan | Tokyo inflation exceeds forecasts, keeping BOJ on rate hike path

- Bloomberg

🔴 EU TO TRUMP: TWO CAN PLAY THE TARIFF GAME — BIG TECH MAY GET BURNED

👉 With Trump slapping 25% tariffs on EU cars and threatening more, Brussels is plotting a counter strike — and this time, it’s not just bourbon and blue jeans on the line. 👉 EU officials are eyeing U.S. services exports, including Big Tech and intellectual property, as leverage — think blocked patents, frozen software updates, and Starlink losing out on juicy contracts. 👉EU diplomat: “The Americans think that they are the ones with escalation dominance, but we also have the ability to do that,” Source: FT thru Mario Nawfal on X

🔴 ROBINHOOD INTRODUCES “ROBINHOOD CORTEX”, OFFICIALLY BRINGING AI TO THEIR PLATFORM. THIS IS ABSOLUTELY WILD ‼️

Together with Cortex, Robinhood announced Robinhood Strategies and Robinhood Banking to give their customers access to privatewealth management and banking services historically reserved for the ultra-wealthy. They are also giving a first look at the next big thing from Robinhood: "Robinhood Cortex", an AI investment tool launching later this year that is designed to provide real-time analysis and insights that help customers better navigate the markets, identify opportunities, and stay up to date on the latest market moving news.

THE WHITE HOUSE GOT ITS FIRST COMPUTER IN 1978, YOUR IPHONE IS 50,000X STRONGER

In 1978, the White House installed its first-ever computer. Fast forward to today, and the phone in your pocket blows it out of the water—with 50,000 times more storage than that early machine. The original system was likely used for basic data entry and scheduling. Now, smartphones can run real-time simulations, stream HD video, and even handle AI processing—all from your hand. Source: @JonErlichman thru Mario Nawfal on X

President Trump Unleashes 25% Tariffs On Foreign-Made Auto Imports

"...we are going to charge countries for doing business in our country..." President Trump has announced a 25% tariff on all cars not made in the US. “This will continue to spur growth,” Trump told reporters. Trump confirmed that these new tariffs are in addition to existing tariffs and are expected to result in $100 billion in revenues. To underscore his seriousness, Trump said, “This is permanent.” In addition to the tariffs, Trump discussed his plan to allow Americans to deduct interest payments on cars that are made in America. source : zerohedge

Foreign investors withdrew ~$6 BILLION from US equity funds last week.

This is the the 3rd largest amount on record and in-line with levels seen during March 2020. source : BofA, kobeissiletter

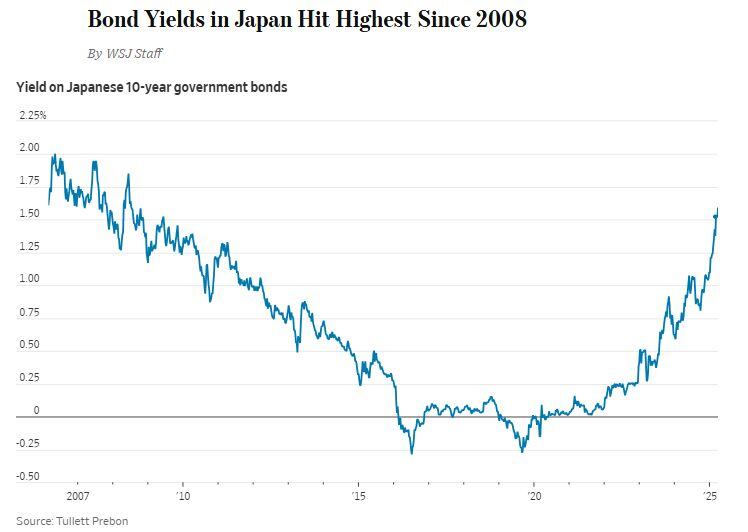

Japanese 10-Year Bond Yield jumps to highest level since the Global Financial Crisis 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks