Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

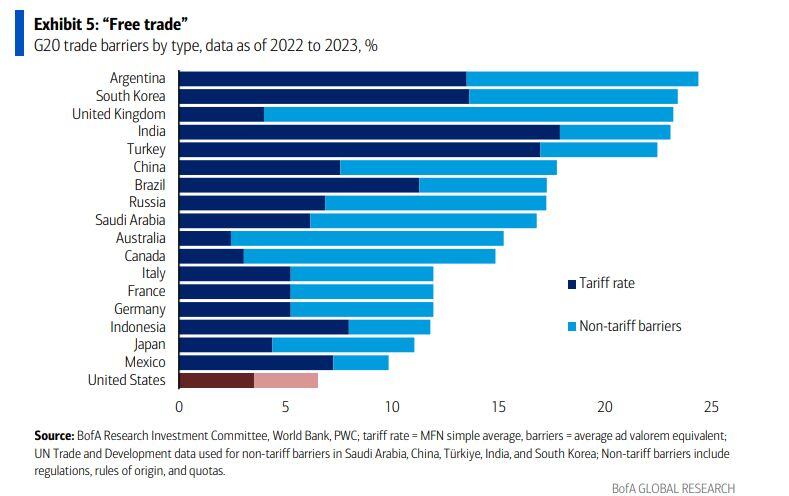

Every G20 country has higher average tariff rates than the United States save two

and most countries hide the true costs in expensive barriers like quotas, price controls, labeling requirements, and testing rules. Source: BofA, zerohedge

There’s another S&P 500 target cut — to a new Wall Street low

Another bank has cut its price target, and this time it’s to a new low on Wall Street. Barclays strategists say they’ve lowered their year-end S&P 500 price target to 5,900 from 6,600. That’s the lowest of any firm that’s a U.S. Treasury dealer, though Montreal-based BCA has a 4,450 year-end call. source : marketwatch

‼️'Retail investors' money is FURIOUSLY buying US equities:

Retail flows into technology stocks have more than TRIPLED in just a few weeks. Mom-and-pop investors have bought the largest US tech stocks despite the Nasdaq 100 index falling into a correction.👇 Source: Global Markets Investor

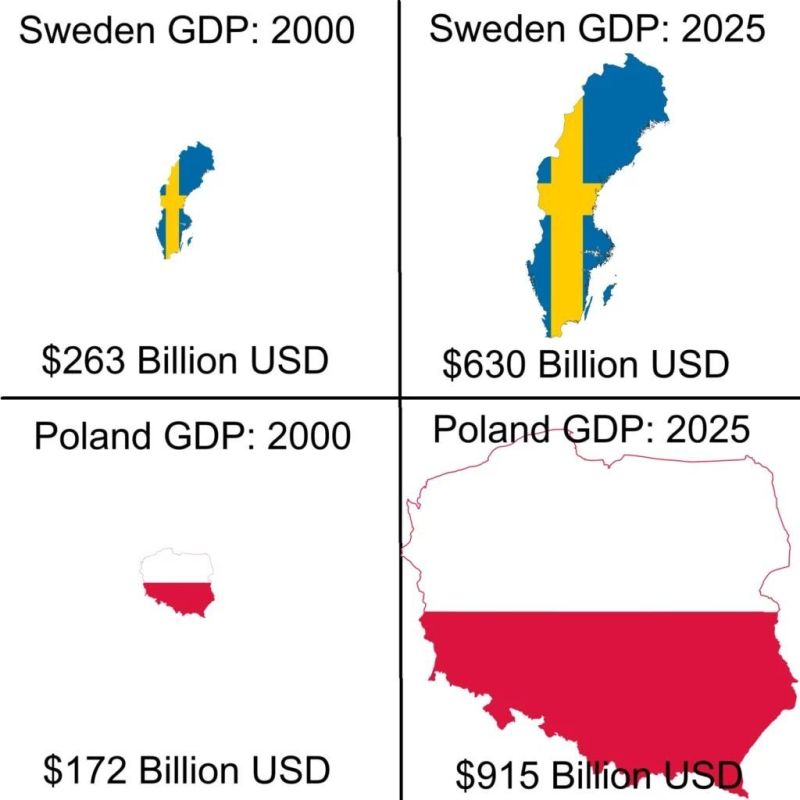

Economic miracle in poland...

This took place in just ONE generation... No secret sauce: Free market, hard work and entrepreneurial spirit. Source: Michel A.Arouet

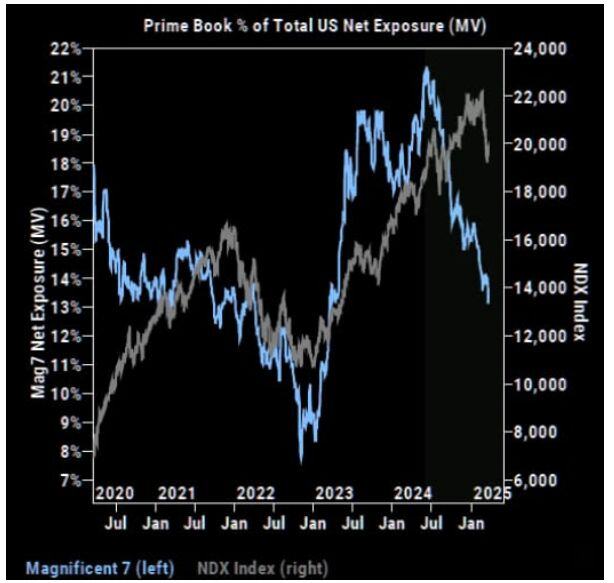

Hedge Funds have cut their exposure to Magnificent 7 stocks to the lowest level in 2 years 👀

Source: Barchart @Barchart, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks