Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The price of copper is likely to set new records this year at $12,000 or more a tonne

according to several of the world’s largest trading houses, lifted by growing global demand and the threat of US President Donald Trump’s trade tariffs. Source: FT

If Goldman is wrong and the market has priced in all the downside of April 2 (and then some)

it is possible that stocks will continue to rally, which means that the analogue chart between Trump 2 and Trump1 will remain valid. Source: www.zerohedge.com, Bloomberg

The S&P has closed above the 200-day moving average... WE DID IT! $SPY

The Great Market Crash of 2025 • Born: March 2025 • Died: March 2025 ??? Source: StockTwits

At over 500,000 bitcoin, MSTR has a larger bitcoin treasury than any company on earth today.

Source: @Saylor on X

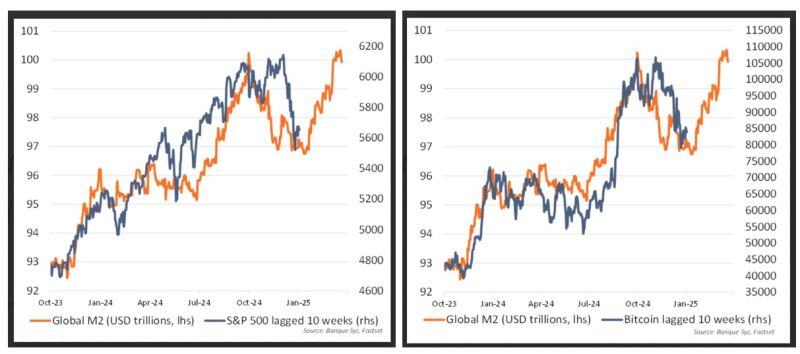

As our proprietary charts of M2 proxy (10 weeks advance) vs BTC and S&P500 suggested on Friday

The bottom could be near for risk assets as the lagged effects of a weaker dollar on global liquidity will provide a support to stocks and BTC Yesterday's advance seem to corroborate these findings. Source: Bank Syz

National Capitalism and the Trump Effect on Investment Pledges in the US 👇

Hyundai — $20 Billion UAE — $1.4 Trillion Saudi Arabia — $600 Billion Apple — $500 Billion Softbank, Open AI, Oracle — $100 Billion Nvidia — $100 Billion + Johnson & Johnson — $55 Billion Taiwan Semiconductor — $100 Billlion CMA CGM Group — $20 Billion Eli Lilly — $27 Billion Merck — $1 Billion GE Aerospace — $1 Billion Roughly $ 3 Trillion in new direct investment into America in the first few weeks of the Trump Administration. Source: Charlie Kirk @charliekirk11, FoxNews

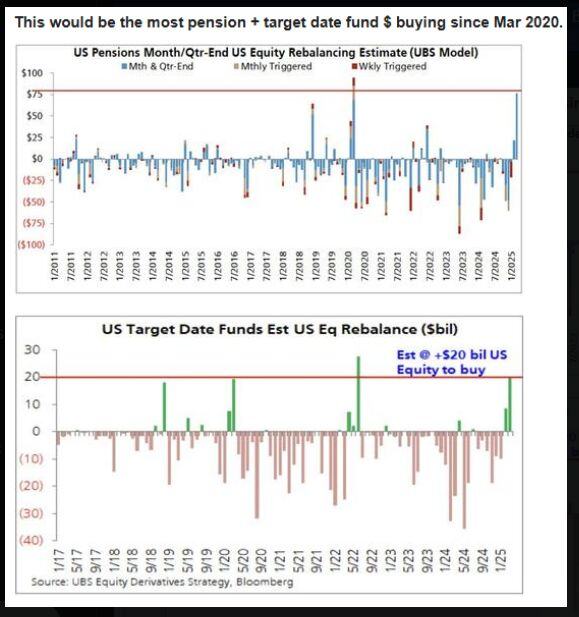

📢 Pension Funds and Target Funds could buy a combined $105 Billion of U.S. Stocks for monthly/quarterly rebalancing, according to UBS 🚀 🚀🚀

Source: Barchart

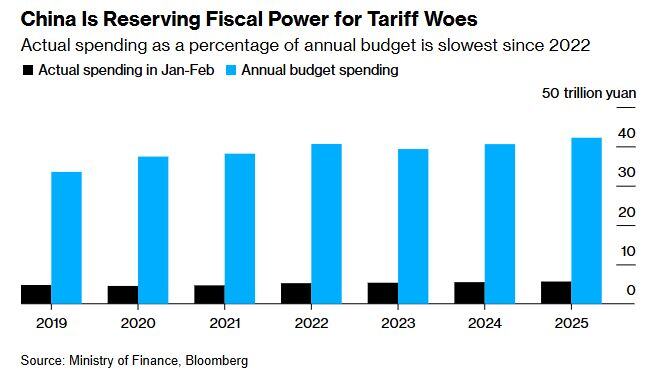

China Saves Fiscal Power for Trade War as Spending Progress Lags – Bloomberg

China’s government appears in no rush to implement its budget, as Beijing preserves spending power to counter any damage inflicted by higher US tariffs. The combined expenditure in the general public budget and the government fund account, China’s two main fiscal books, rose to 5.65 trillion yuan ($779 billion) in the first two months, an increase of 2.9% from the same period a year earlier, according to Bloomberg calculations based on data released by the Ministry of Finance on Monday.

Investing with intelligence

Our latest research, commentary and market outlooks