Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

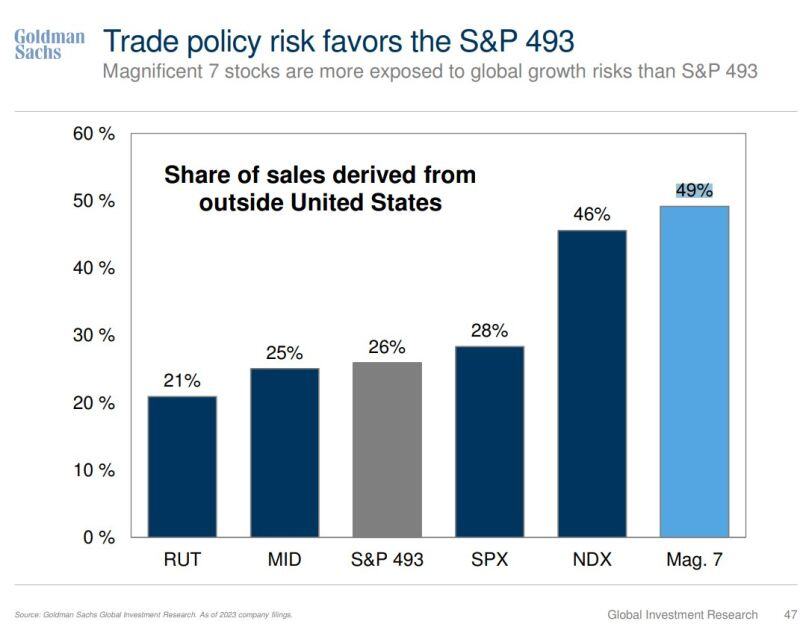

Magnificent 7 stocks are more exposed to global growth risks than S&P 493

(but would take advantage of a weaker dollar) Source: Mike Zaccardi, CFA, CMT, MBA, Goldman Sachs

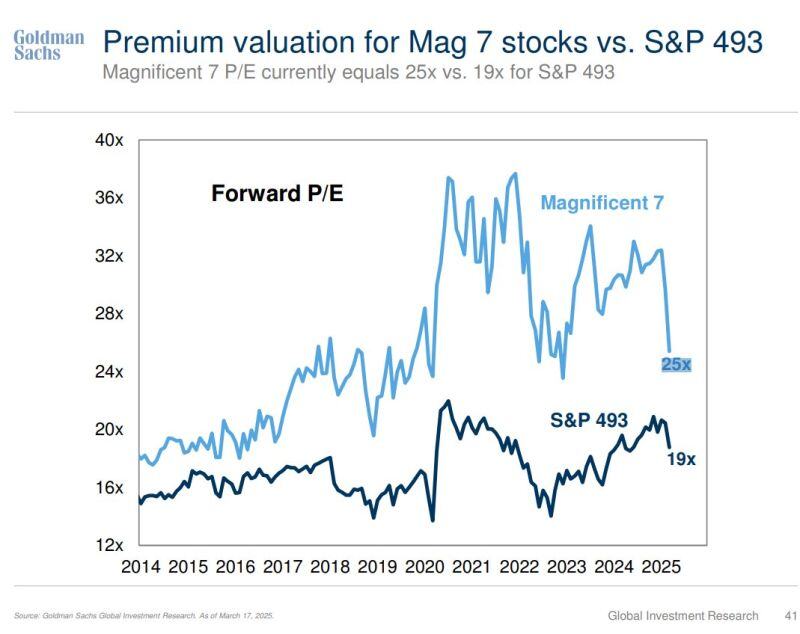

Mag 7 P/E just 25x... Narrowest spread to Other 493 in years

Source: Goldman Sachs, Mike Zaccardi, CFA, CMT, MBA

➡️ The Swiss National Bank snb lowered its key policy rate by 25bp to 0.25% today, as it was widely expected.

This rate cut follows the slowdown in inflation observed in the recent months, down to +0.3% in February. Low ongoing inflationary pressures, and the fact that inflation is now at the very bottom of the 0-to-2% target range of the SNB, warranted this additional decline in short-term interest rates. Indeed, with the SNB key rate at 0.25%, short-term real rates are brought down a marginally negative level that will help alleviate deflationary pressures and upward pressures on the Swiss franc. As such, monetary policy can be described as moderately accommodative, a stance appropriate to the combination of low inflationary pressures and moderate economic growth in Switzerland. ➡️ Looking ahead, expected developments on inflation and economic activity suggest that the rate cut cycle initiated a year ago is now completed. The 150bp decline in CHF short term-rates over 12 months, in parallel of the decline in inflation, has helped supporting economic activity and stabilizing the level of the Swiss franc. Inflation is now expected to stabilize in the coming months and even slightly pickup at the end of the year (toward +0.6%) and in 2026 (+0.8%). In the meantime, economic activity is projected to gradually improve, supported by higher real income for households due to the low level of inflation, and by more accommodative financing conditions. The stabilization and even slight pullback of the Swiss franc also removes a headwind for Swiss exporters. ➡️ However, the outlook is currently extremely uncertain for Switzerland and for the global economy: Potential tariffs on US imports from Switzerland and other European countries could significantly impact economic activity and confidence. They could also possibly revive upward pressures on the Swiss franc. Such scenario would eventually lead the SNB to further lower its key rate down to zero. The possibility of a return to negative interest rates cannot be ruled out in case of pronounced downward pressures on growth, along with upward pressures on the currency. However, such possibility would in our view require a significant deterioration in the economic environment. Moreover, the SNB is more likely to resort to interventions on the Forex market as a first option in case of unwarranted upward pressures on the CHF. Conversely, ongoing developments in the neighbouring Eurozone, and more specifically the prospect of a huge fiscal stimulus in Germany, could have a significant positive impact for Switzerland. and fuel firmer inflationary pressures, possibly paving the way for the SNB to adjust its key rate upward in consequence in 2026. ➡️ Our take >>> Today’s rate cut is likely to be the last of this monetary policy easing cycle for the SNB. However, we will continue to monitor both downside and upside risks to this scenario. Adrien Pichoud

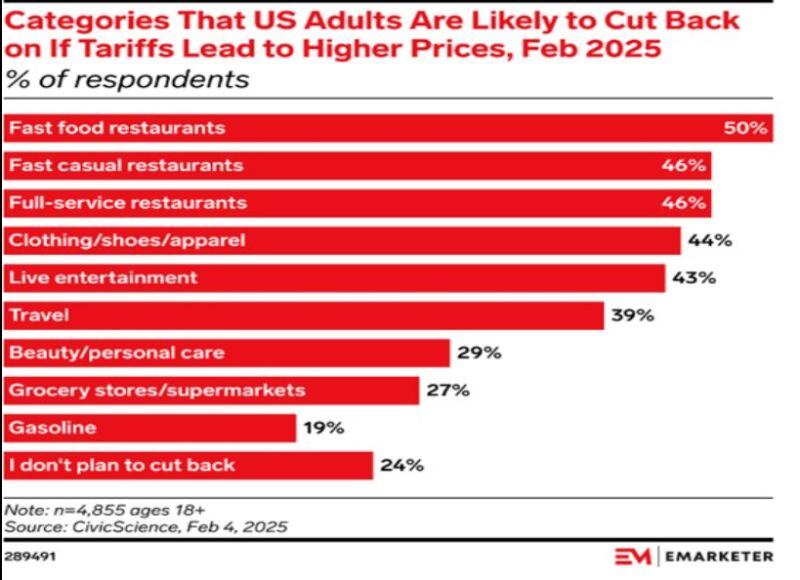

Categories that US adults are likely to cut back on if tariffs lead to higer prices

source : emarketer

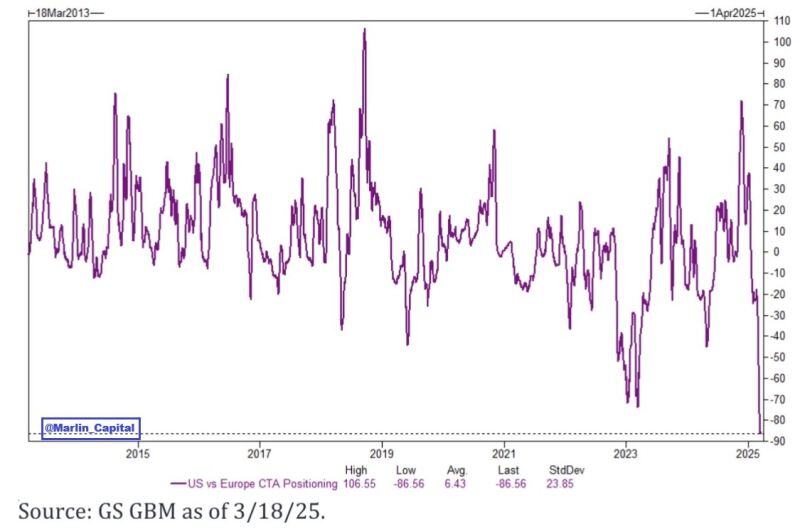

CTAs are short -$34B of US equities and long $52B of European equities.

This is the largest spread we have EVER seen. $SPY $QQQ $IWM $FEZ Source: David Marlin Marlin Capital Solutions

⚠ Swiss National Bank Says NO to Bitcoin!

SNB President Martin Schlegel confirms no plans to buy BTC or any crypto, citing volatility & regulatory concerns. Source: Roi Market @RoiMarkett

Investing with intelligence

Our latest research, commentary and market outlooks