Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

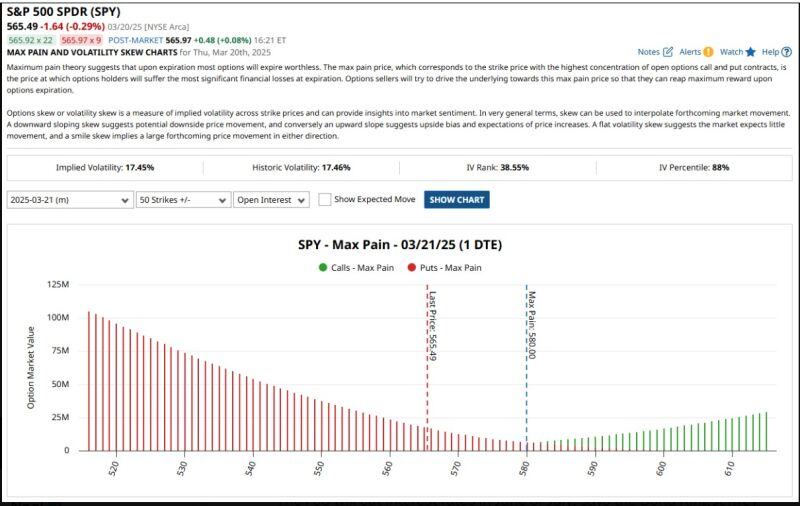

$4.5 Trillion set to expire for today's options expiration. The majority of that are puts!

source: barchart

Swiss Watch Exports Dip Again in February

After a brief rebound in January, the downward trend for Swiss watch exports resumed last month. According to the Federation of the Swiss Watch Industry, overall exports fell 8.2%, with 102,000 fewer watches shipped . The decline was broad-based across key markets and price segments: Mid-range watches (CHF 500–3,000): -15.4% High-end watches (> CHF 3,000): -7.3% Entry-level watches (< CHF 200): The only category to post a positive result. source : swissinfo

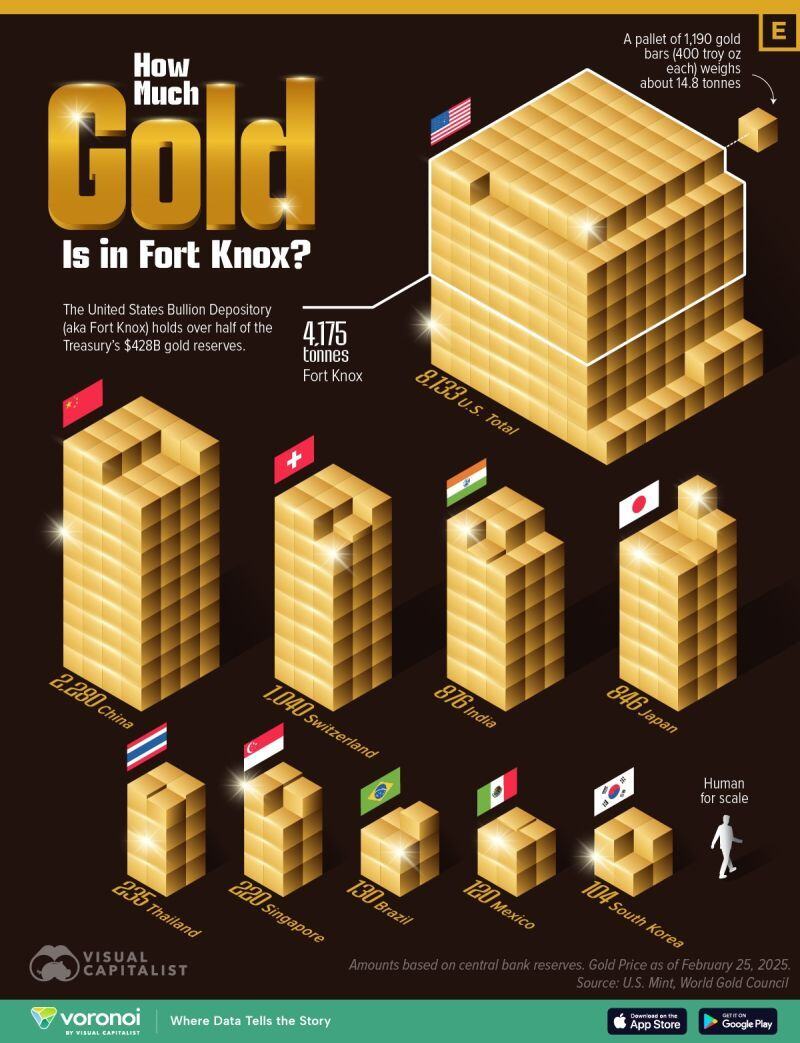

Visualized: How Much Gold Is in Fort Knox?

U.S. President Donald Trump has promised to visit Fort Knox “to make sure the gold is there.” Officially, the United States Bullion Depository (commonly known as Fort Knox) holds over half of the Treasury’s $428 billion of gold reserves. In this graphic, Visual Capitalist / Elements put that amount into perspective by comparing Fort Knox’s reserves with central bank gold reserves worldwide. The data comes from the U.S. Mint and the World Gold Council. For illustrative purposes, we considered a pallet of 1,190 gold bars (400 troy ounces each) weighing approximately 14.8 tonnes. What Is Fort Knox? Located in Kentucky, Fort Knox is a U.S. Army installation that serves as the primary storage site for America’s gold reserves. The facility was established in the 1930s to protect gold from potential foreign attacks. The first gold shipment arrived in 1937 via U.S. Mail from the Philadelphia Mint and the New York Assay Office. During World War II, Fort Knox safeguarded important U.S. documents, including the Declaration of Independence, the Constitution, and the Bill of Rights. It has also housed international treasures, such as the Magna Carta and the crown, sword, scepter, orb, and cape of St. Stephen, King of Hungary, before they were returned in 1978. Currently, it holds 4,175 tonnes of gold, equivalent to nearly half of China’s gold reserves and four times the Swiss central bank’s reserves. Only small samples have been removed for purity testing during audits; no major transfers have occurred for years. Source: Visual Capitalist, Elements

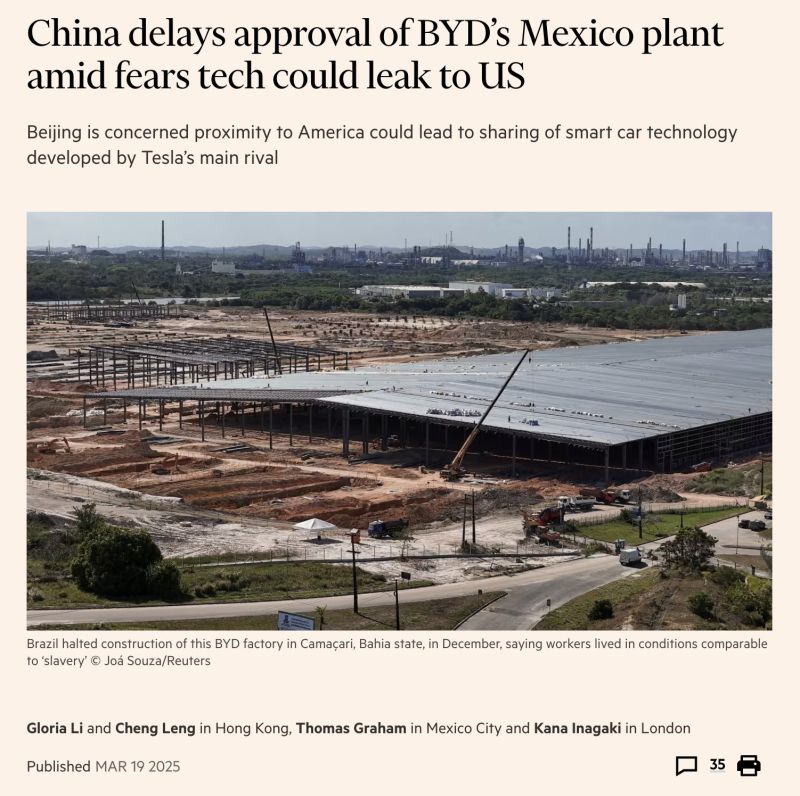

For years, the United States routinely accused China of technology theft.

Now, the opposite might happen: China is worried that the United States might steal technology from them. How the tables have turned. Source: Jostein Hauge @haugejostein

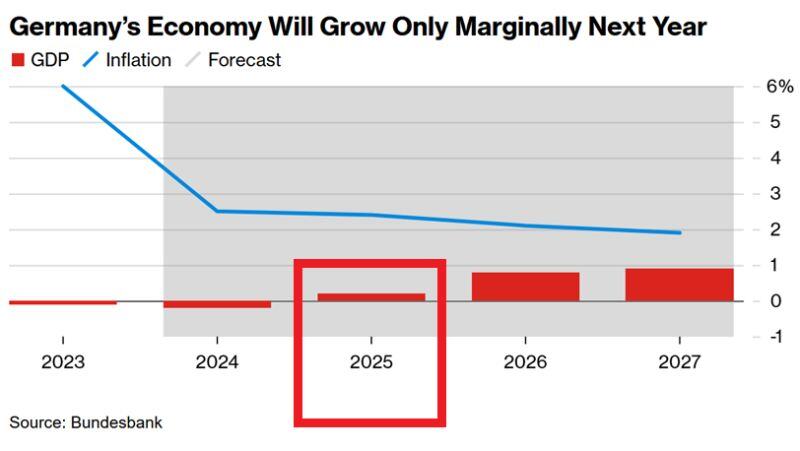

⚠️German economic outlooks remains DIRE:

In 2024 the world's 3rd largest economy FELL by 0.2% following a 0.3% decline in 2023. This is the 2nd time since 1950 that GDP contracted for 2 years in a row. German IFO Economic Research Institute expects just 0.2% growth in 2025. Source. Global Markets Investor

🔴 Germany’s 10-year bond yield rising to 4% is “entirely feasible” as a reset in the country’s borrowing costs plays out, according to Aviva Investors.

The rate surged to nearly 3% in recent weeks as Germany’s incoming chancellor spearheaded a huge spending package that is expected to lead to billions of euros in extra bond sales. Vasileios Gkionakis, senior economist and strategist at Aviva Investors, says yields are likely to keep rising as the fiscal measures boost economic growth. ➡️ 4% for German 10-Year Bund would mean German mortgages at 5% to 6% and the burst of the epic German real estate bubble. Would it also mean Italian, Spanish and French bonds yields at a level that could trigger the next Euro crisis. Good luck. Source: Bloomberg

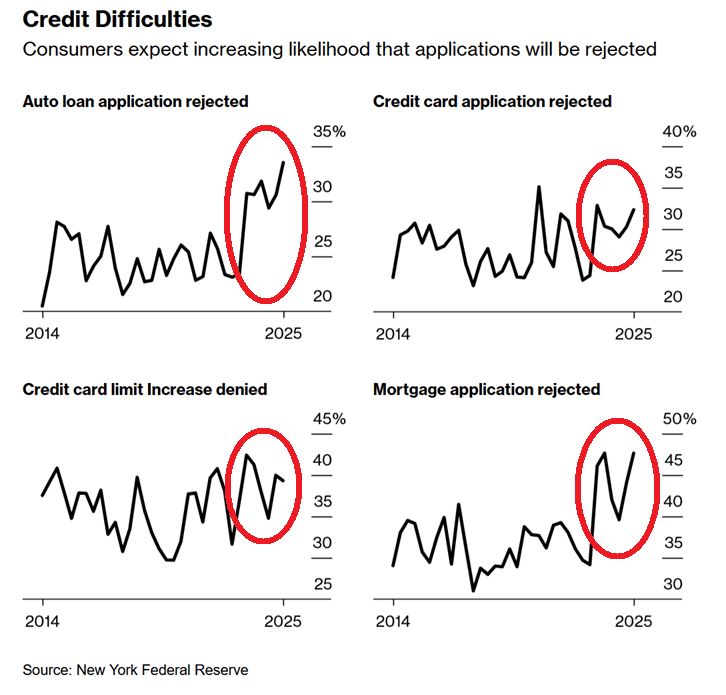

Americans expect credit application REJECTIONS at a higher rate than ever:

The perceived likelihood of credit application rejections: Auto loan: 34%, the highest on record Mortgage: 48%, the highest on record Credit card: 32%, the 3rd-highest ever Card limit increase: 39% Source: Global Market Investors, Bloomberg

🚨BREAKDOWN: LONDON-HEATHROW SHUTS DOWN AFTER MASSIVE POWER OUTAGE

London’s Heathrow Airport — one of the busiest in the world — will be completely closed Friday after a major fire at a nearby electrical substation triggered widespread blackouts across West London. Thousands of flights are impacted, with over 120 planes currently en route to Heathrow now forced to divert across the U.K. and Europe. Authorities have not given any timeline for reopening. Millions of passengers will be affected in what could become one of the largest airport shutdowns in years. Source: @sentdefender thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks