Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

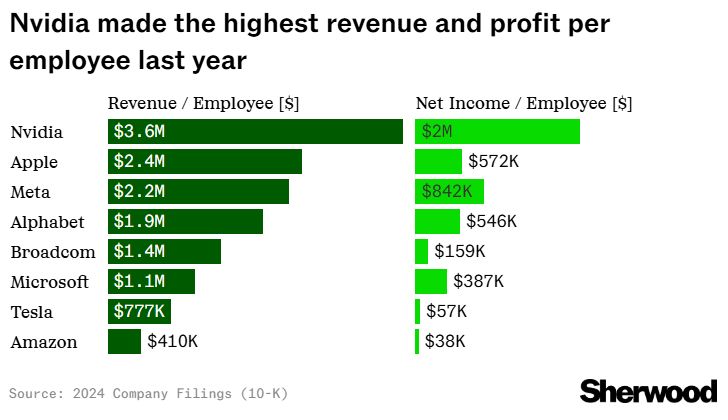

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING

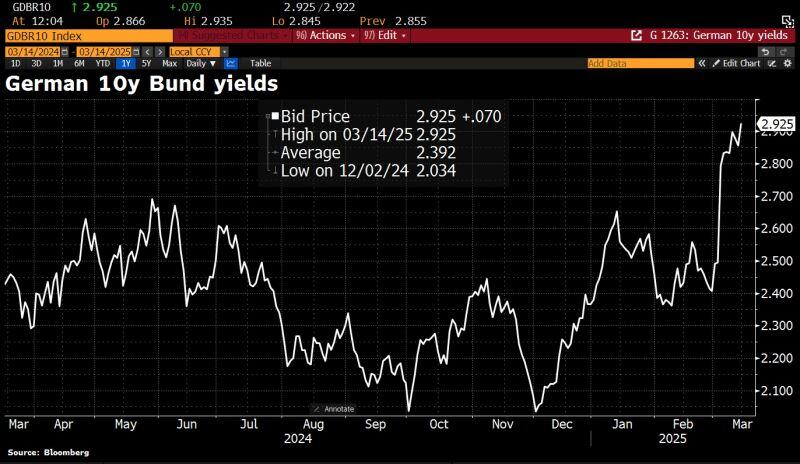

Germany's conservatives have agreed on a much-debated multibillion-euro financial package for defence and infrastructure (and on the country's €1,000bn debt plan) with the centre-left Social Democrats and the Green party, dpa learns. As a result, German 10y yields have jumped to 2.93%. Source: HolgerZ, Bloomberg, DPA

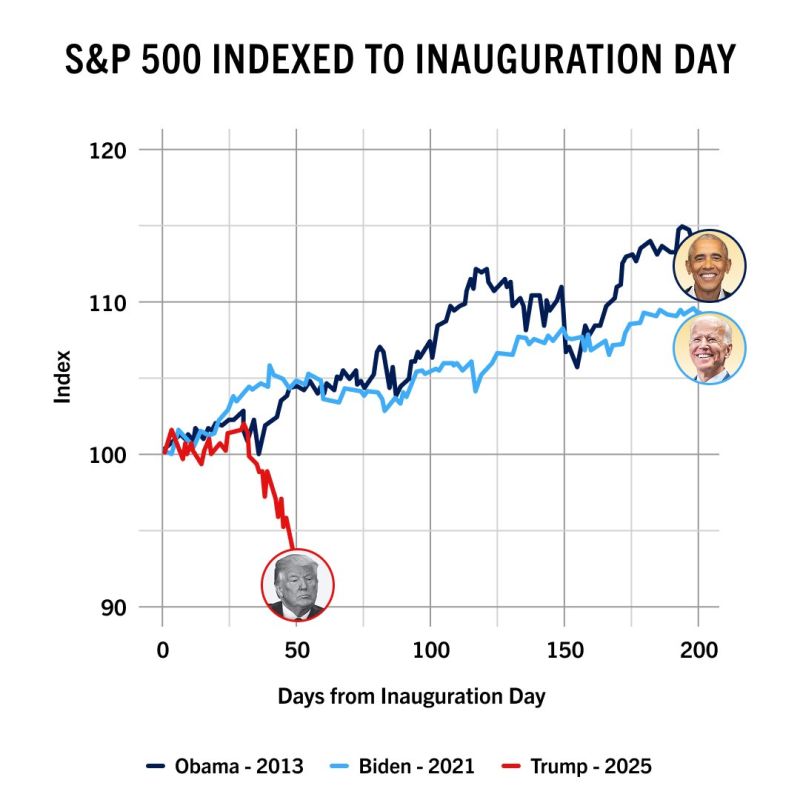

Here is a great theory on Trump’s plan originally proposed by @leadlagreport:

Source: Steve Burns @SJosephBurns

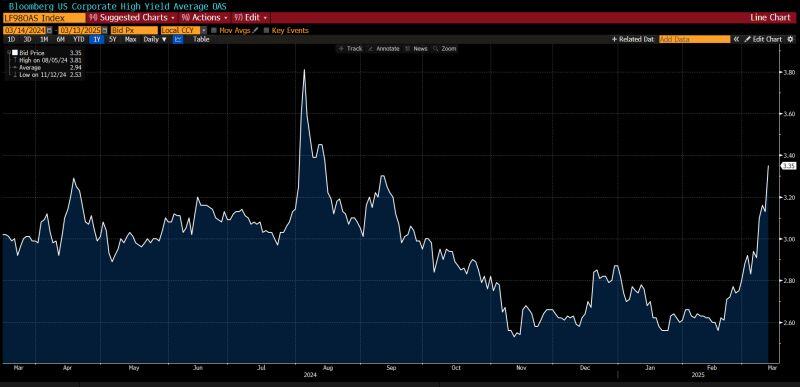

Riskier credit markets are starting to respond more significantly to the dislocation in US equity markets

Spreads on high-yield bonds rose the most since August yesterday. They're still relatively low on a historical basis, but the trajectory is catching many people's attention. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks