Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

GLOBAL M2 IS EXPLODING.

WILL BITCOIN FOLLOW SOON 🚀 ??? Source: Vivek⚡️@Vivek4real_

The stagflation trade is proving to be a rare winner as the stock market rout continues.

The Goldman L/S Stagflation basket—which benefits from rising commodity & healthcare stocks while betting against consumer discretionary and chip stocks—has gained nearly 18% in 2025. Source: HolgerZ, Bloomberg

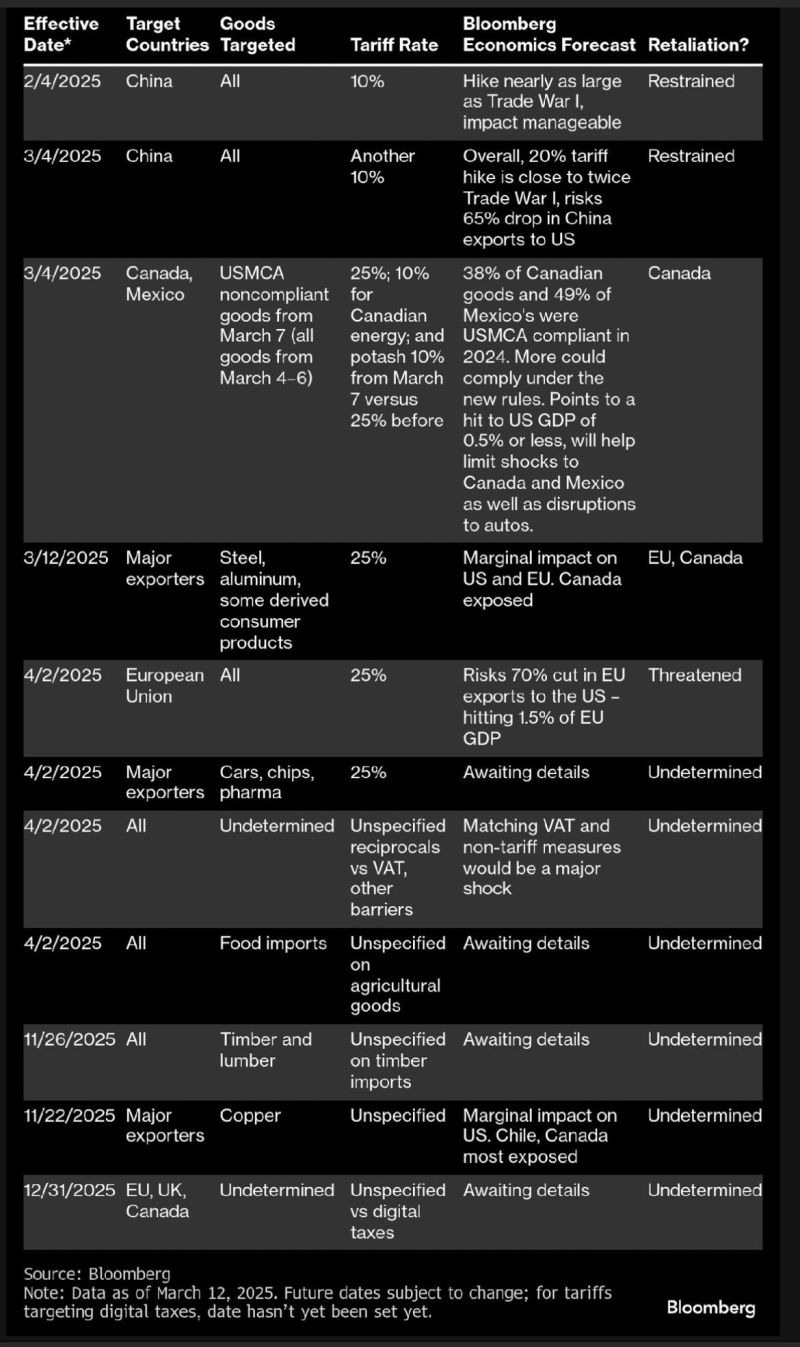

U.S. TARIFFS CHEAT SHEET

Source: Wall St Engine @wallstengine, Bloomberg

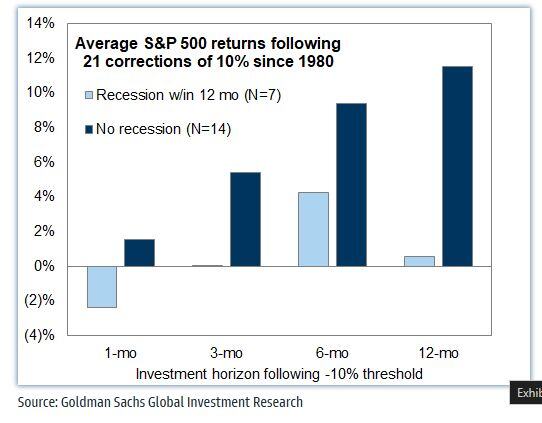

SP500 corrections are usually good buying opportunities

Source: Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi

Visualizing the Rise in Global Coal Consumption ⚡️

Source: Visual Capitalist

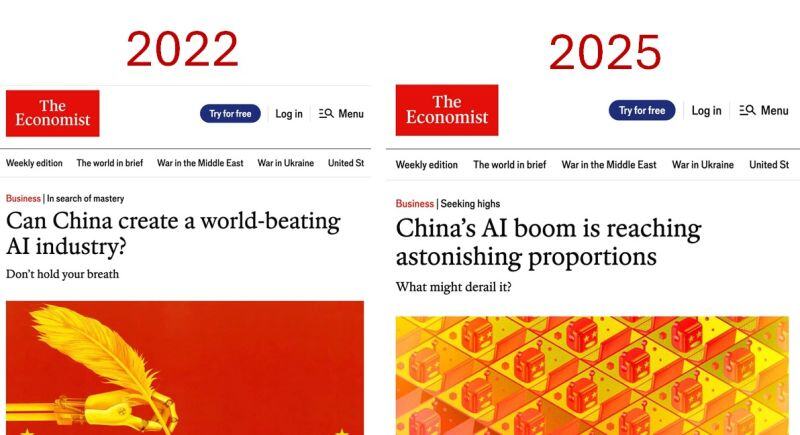

What a change of perception in 3 years...

It seems that the West too often underestimates China China has achieved what they deemed impossible to do. We've seen this first hand in the EVs, electric batteries, solar panels, wind turbines and renewable energy. We might see it with AI as well Source: Cyrus Janssen @thecyrusjanssen @richardturrin

Investing with intelligence

Our latest research, commentary and market outlooks