Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

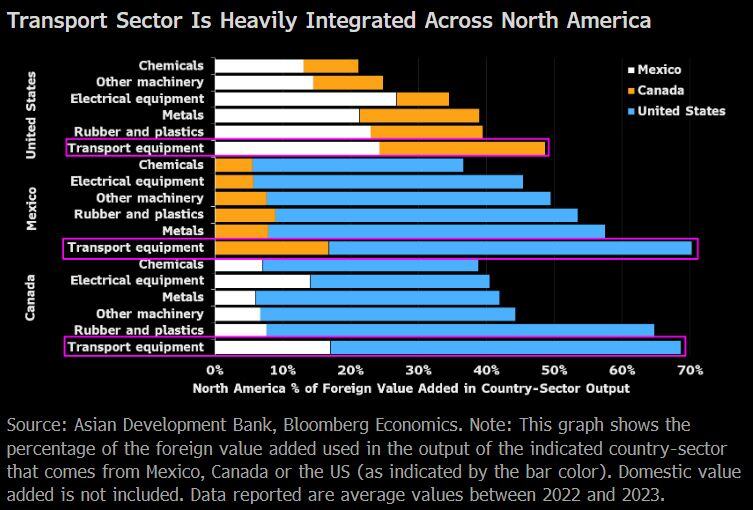

"Carmakers in the US rely on Canada and Mexico for more than 80% of imports of some key auto parts...

There’s even US value added embedded in cars imported from Mexico and Canada — so tariffs on these goods mean the US will effectively be tariffing itself." Source: Kevin Gordon @KevRGordon on X, Bloomberg

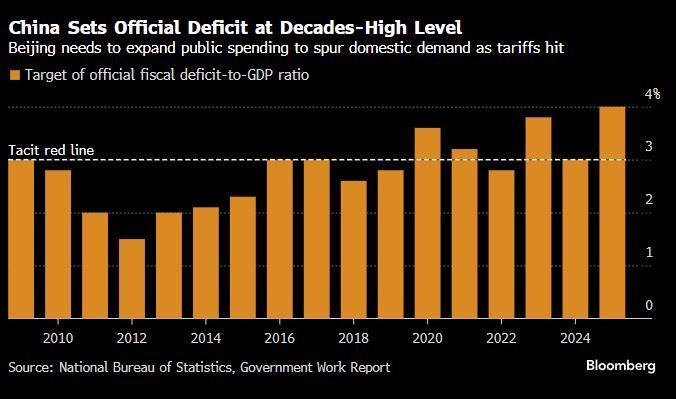

China's out with some proper fiscal firepower: Highest official deficit target in 30+ years

Plus... CNY1.3 trillion in ultra-long special sovereign bonds CNY4.4 trillion in new special local govt bonds CNY500 billion in special sovereign bonds China on Wednesday set its GDP growth target for 2025 at “around 5%” and laid out stimulus measures to boost its economy amid escalating trade tensions with the U.S. Beijing raised its budget deficit target to “around 4%” of GDP from 3% last year, according to the official report, as the country’s top legislative body held its annual meeting. The 4% deficit would mark the highest on record going back to 2010, according to data accessed via Wind Information. The prior high was 3.6% in 2020, the data showed. Source: Bloomberg, David Ingles on X, CNBC

Price has respected this trendline since the bear market lows of 2022...

Seems like an important spot to watch. $QQQ Source. Trend Spider

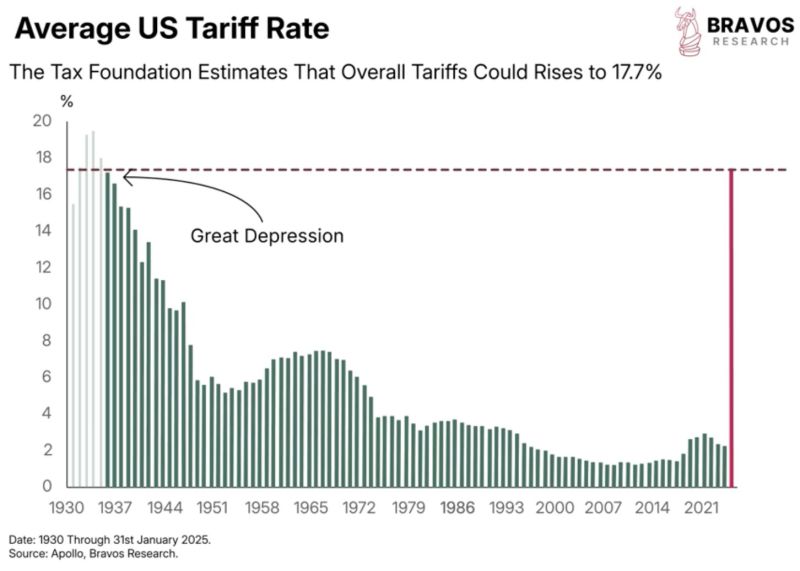

BREAKING: Tariffs have begun with 25% on Canada and Mexico, and 20% on China.

In fact, tariffs could hit an average of 17.7% under Trump. This would be THE highest levels seen since the Great Depression. Source: Bravos Research @bravosresearch

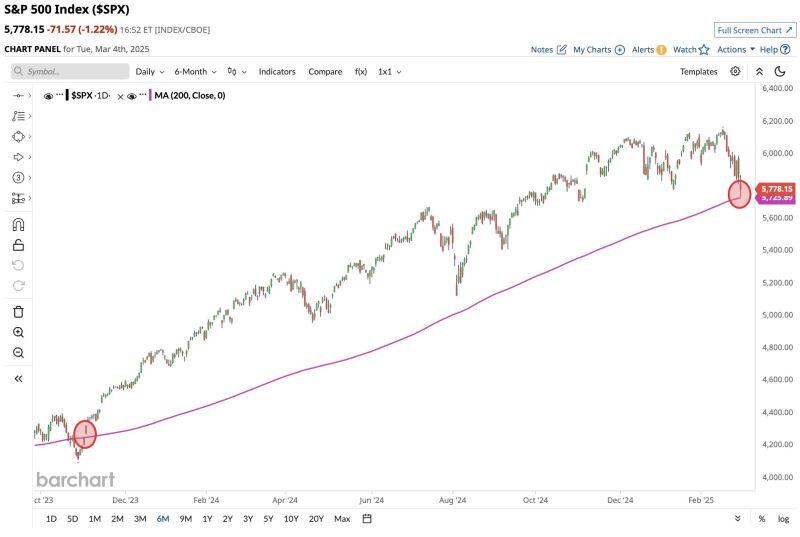

S&P 500 facing a date with destiny!

$SPX is testing its 200 Day moving average for the first time since November 2023 🚨 Source: Barchart

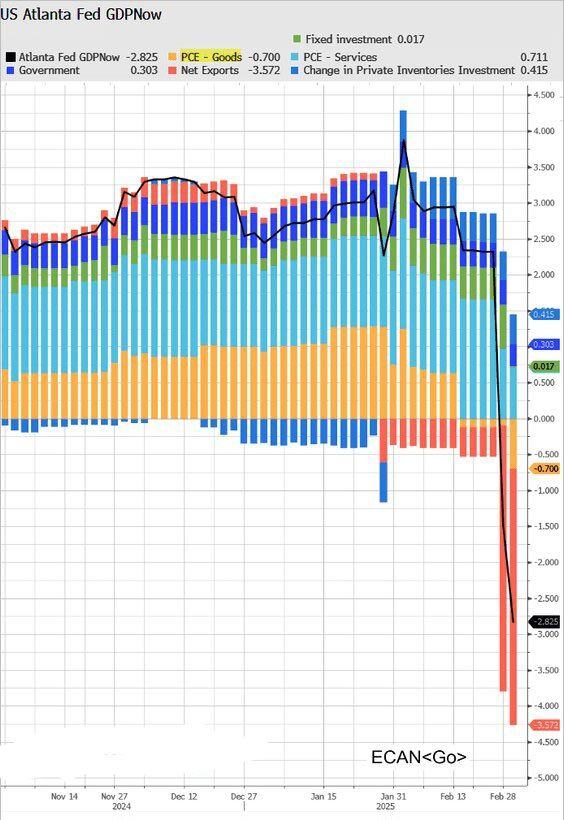

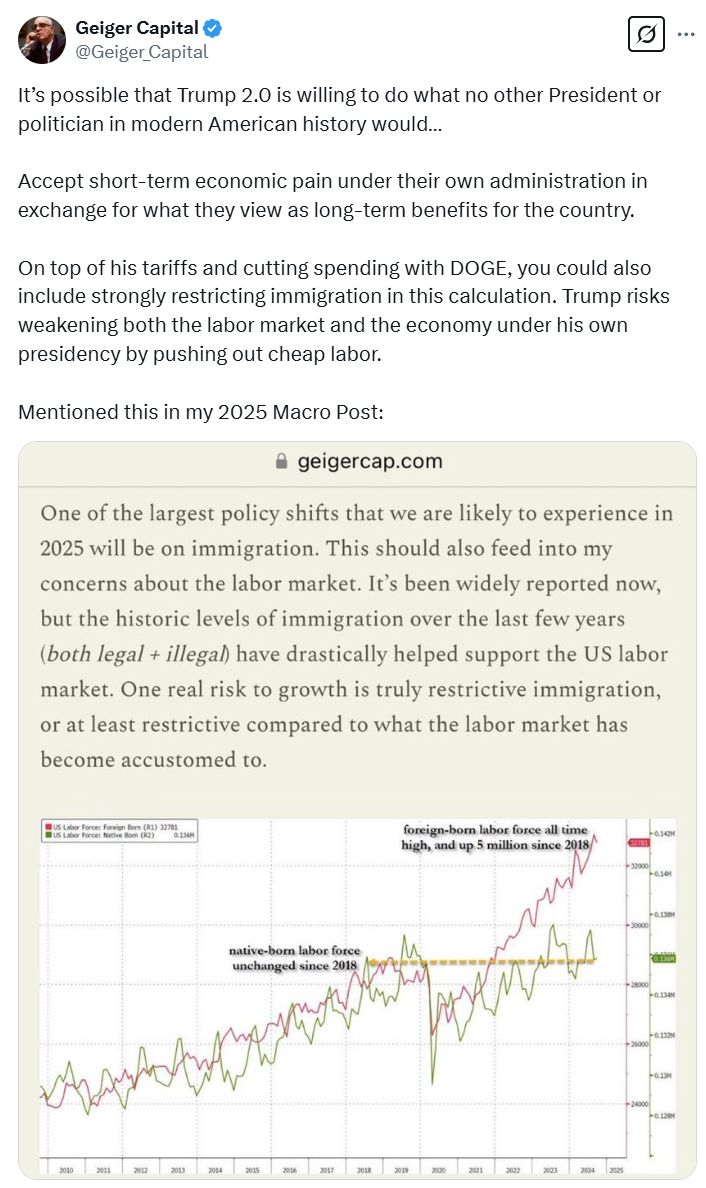

Short-term pain for long-term gain ???

Trump has mentioned both falling bond yields and a goal of balancing the budget… There will be an “adjustment period” and “some disturbance.” He is really going for it.

Investing with intelligence

Our latest research, commentary and market outlooks