Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️ Alert: Unconfirmed reports that President Trump will announce that the US is leaving NATO in his joint address to US Congress tomorrow!

Source: US Homeland Security News @defense_civil25 on X

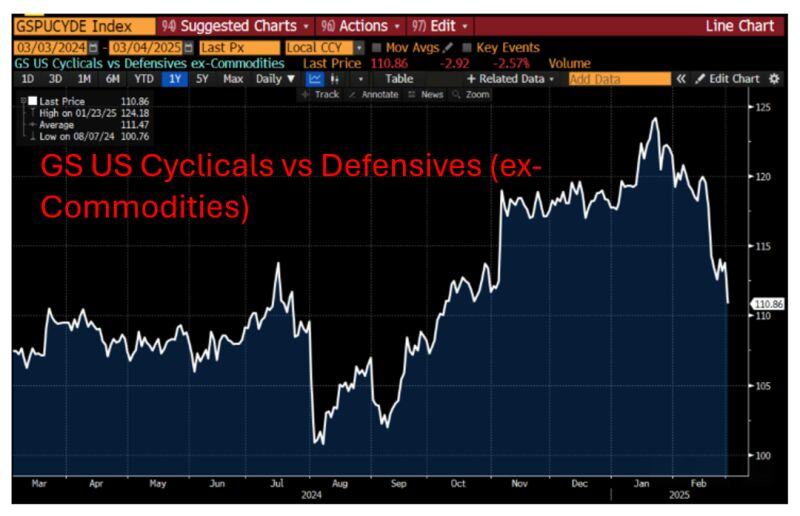

A clear message from the market:

Cyclicals vs defensives peaked in late January, with underperformance accelerating in mid-February. If you add to this the inverted 3m-10y yield curve, the odds of recession are on the rise. Source: Bloomberg, RBC

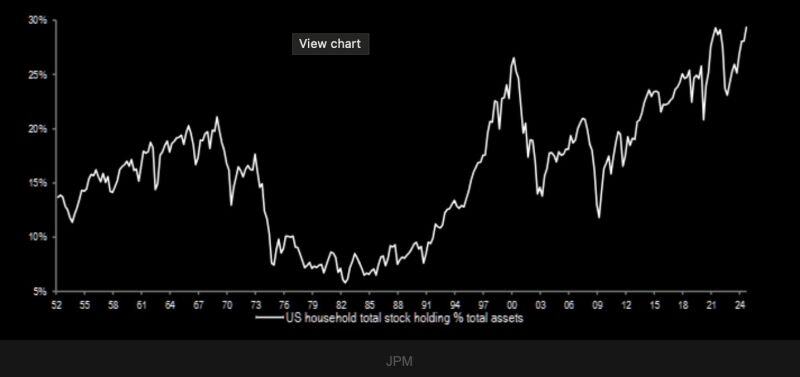

U.S. households now have the biggest allocation to stocks in history

Source: Win Smart, CFA @WinfieldSmart

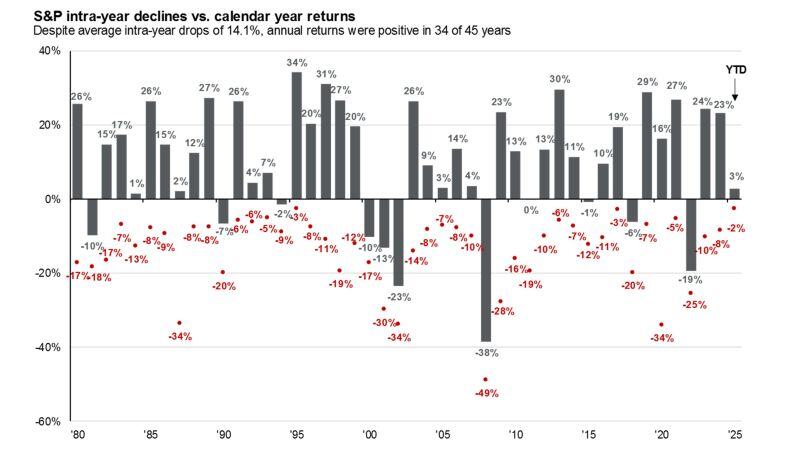

Remember: The average $SPX intra-year drawdown is 14.1%

Source: Bloomberg, Mike Zaccardi, CFA, CMT, MBA

"Be Greedy When Others Are Fearful"

One of Warren Buffett’s most famous quotes is to “be greedy when others are fearful.” Unfortunately, many anxious investors can’t stomach losses in the stock market, causing them to go to “all cash” at exactly the wrong times. Take large declines, for example. Since WW2, the S&P 500 has fallen more than 15% in nine different quarters. Following every single instance, the index was higher a year later with an average one-year gain of 25.1%. Similarly, the S&P 500 has had two-quarter drops of 20%+ just eight times, and over the next year, the index was up by at least 17% with gains every single time. source : bespoke

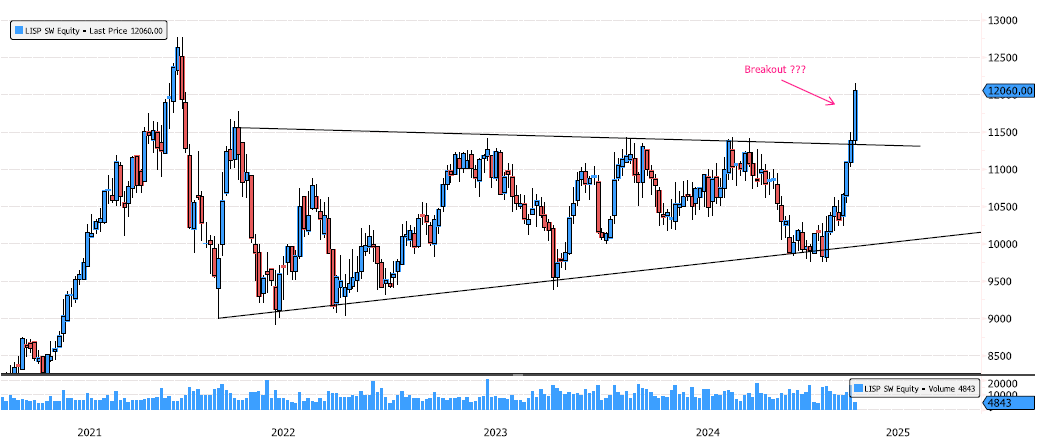

Lindt & Sprüngli Symmetrical Triangle Breakout ?

Lindt & Sprüngli (LISP SW) is breaking out of a large symmetrical triangle, a continuation pattern that has been forming since March 2022 ! The stock is seeing strong volume today due to earnings, and the long-term trend remains very bullish. This is a clear trend continuation pattern. Keep an eye on the price action as the breakout unfolds. Source: Bloomberg

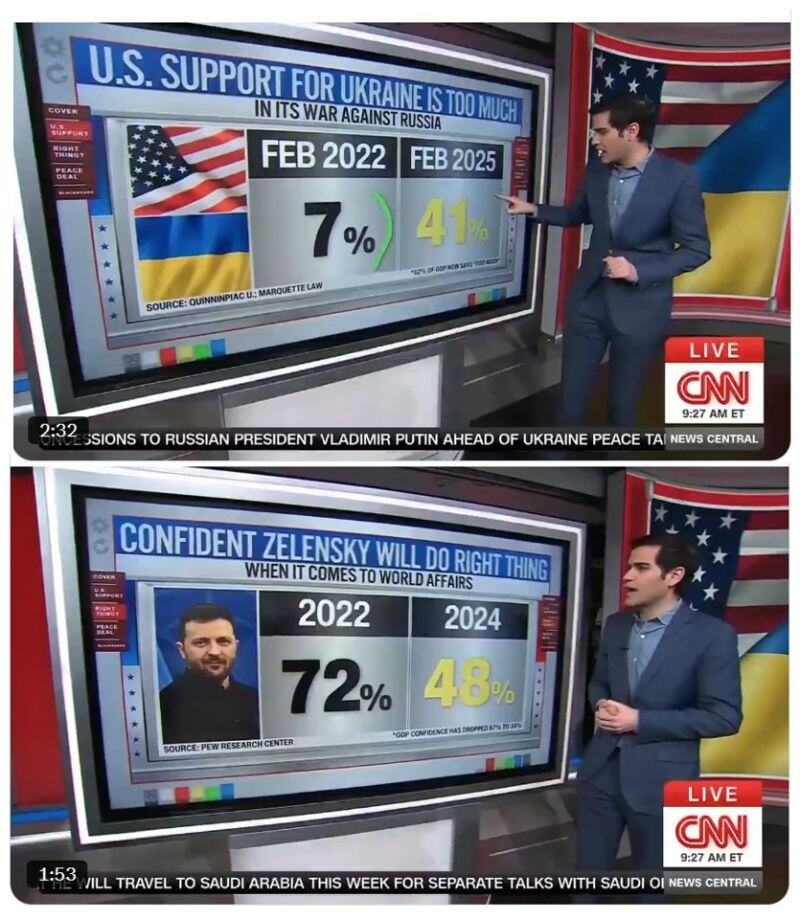

It seems that US opinion on Ukraine spending and Zelensky is starting to turn.

These numbers are from CNN which is definitely NOT pro-Trump. 👉 More people now think the U.S. is helping Ukraine too much—up from 7% to 41%. 👉On top of that, trust in Zelensky fell from 72% to under 48%

Investing with intelligence

Our latest research, commentary and market outlooks