Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

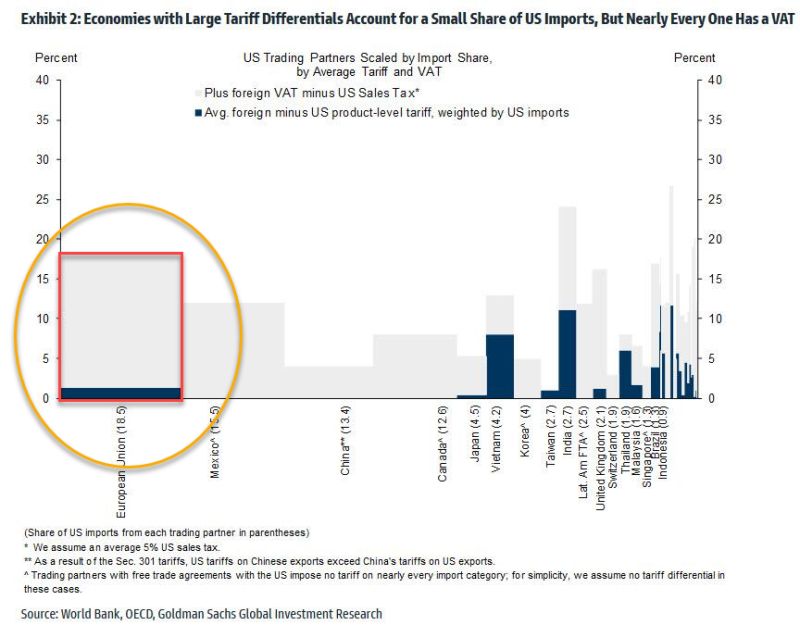

Trump will retaliate to VAT. This is potentially catastrophic for EU exporters

*TRUMP: VAT TAX WILL BE VIEWED AS A TARIFF *TRUMP: WILL CONSIDER COUNTRIES THAT USE VAT *TRUMP: PROVISIONS WILL BE MADE FOR NON-MONETARY TARIFFS The VAT response is notable because the tariff differential for the EU, for example, with and without VAT is massive and rises from just 2% (without VAT) to a whopping 18% with! And judging by Trump's comments, which said that the EU is "absolutely brutal" on trade, the inclusion of VAT is precisely meant to punish Europe. The chart below shows the amount that each country's VAT exceeds the US sales tax. And so, if indeed Trump imposes a reciprocal tariff policy also accounted for foreign VATs, it could add another 10% to the average US effective tariff rate. That could be catastrophic to exporters, and Deutsche Bank's George Saravelos agrees writing that if reciprocal tariffs are applied on a VAT basis, "European countries would be much higher on the list of impacted countries given high consumption taxes." Like Goldman, the DB strategist notes that the overall US tariff rate would increase by more than 10% Source: zerohedge

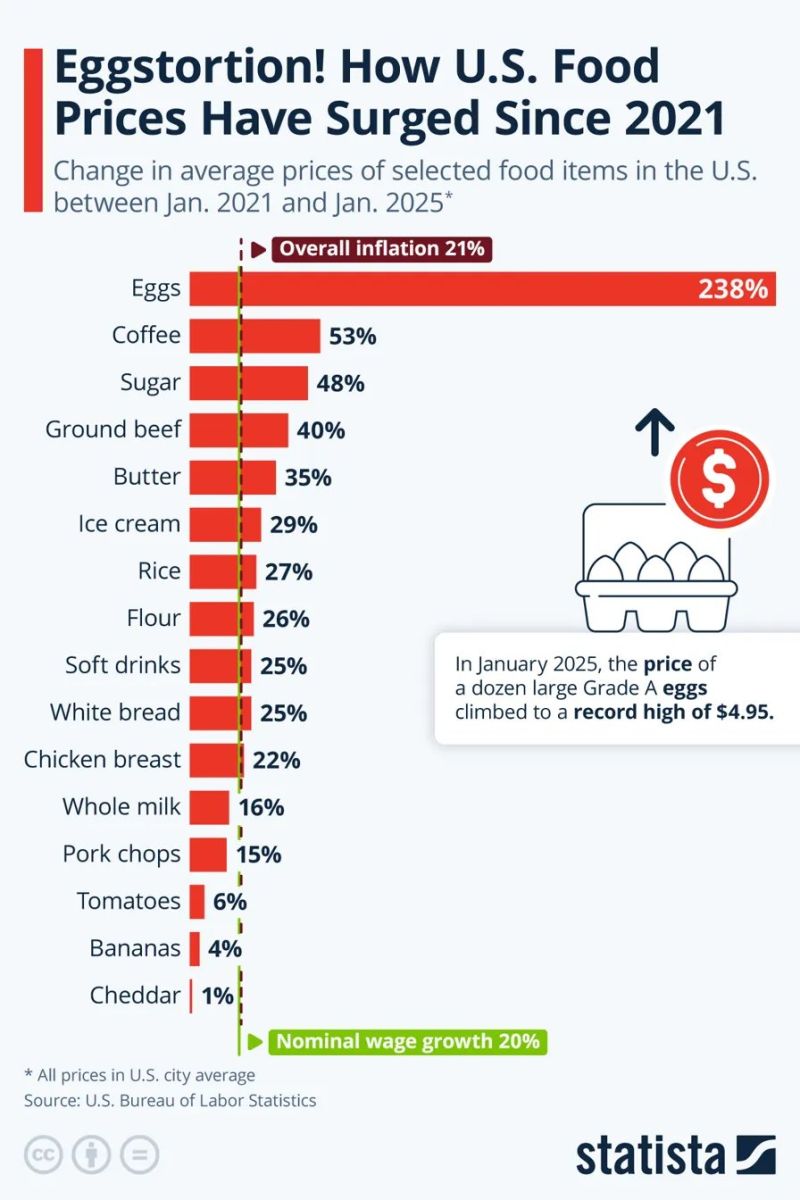

EGGS-ORBITANT! PRICES CRACK NEW RECORDS AS BIRD FLU STRIKES

A dozen eggs now costs $4.95 - up a shell-shocking 238% since 2021. U.S. farms forced to eliminate 34M hens in recent months as bird flu decimates supply chains. USDA Report: "The timing and scope of HPAI outbreaks has created an imbalance in the nation's supply of table shell eggs" While Americans aren't exactly walking on eggshells about cheese (1%) and bananas (4%), other staples like coffee (53%) and beef (40%) continue to burn holes in wallets. Source: Statista

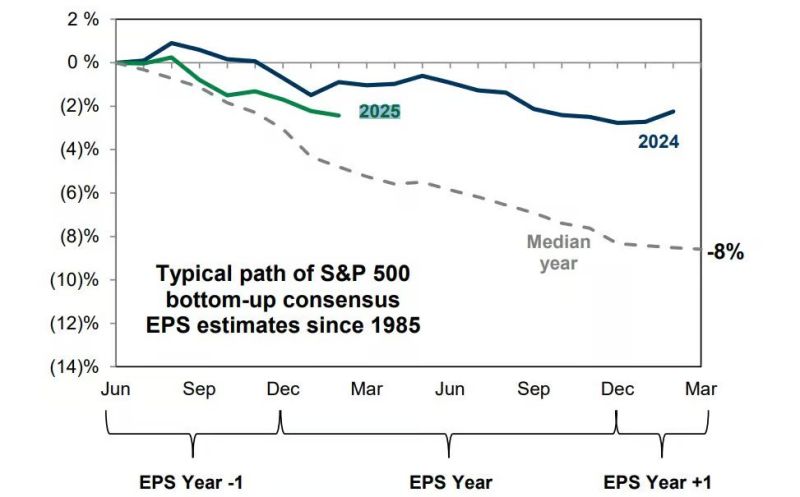

2025 US earnings estimates are tracking above the typical path.

Source: Goldman Sachs via @MikeZaccardi

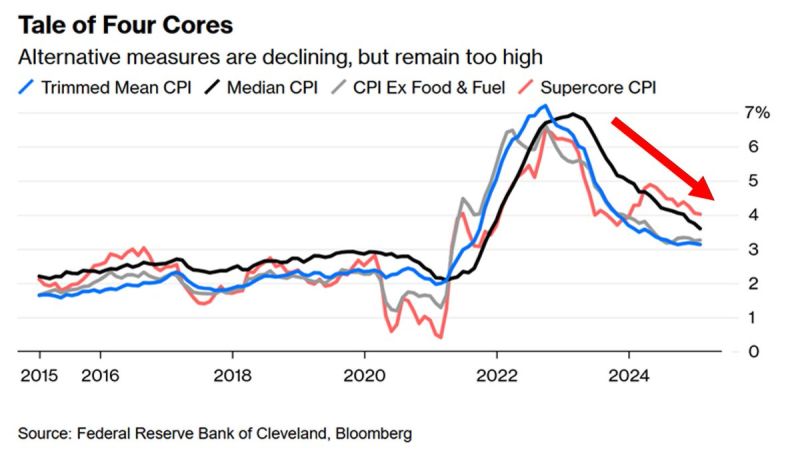

US inflation decline has slowed but is NOT re-surging:

US inflation metrics which exclude outliers and one-time bumps as still declining but at a slower rate. January is also the seasonally worst month as firms tend to announce price raises at the start of the calendar year. Source: Global Markets Investor

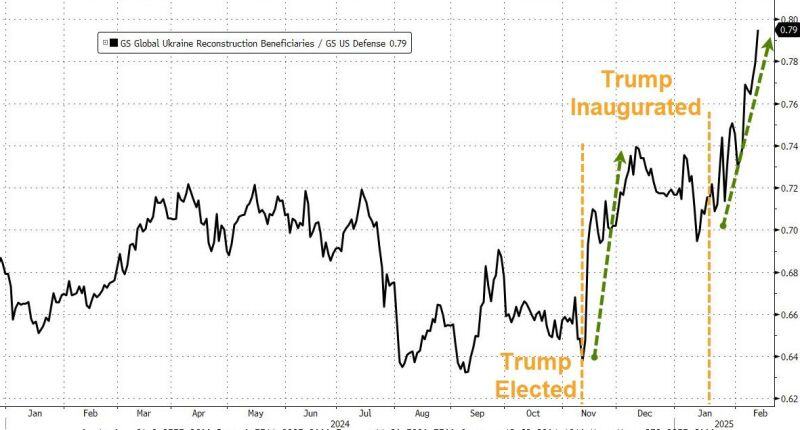

Goldman's basket of Ukraine reconstruction beneficiaries has dramatically outperformed defence stocks since Trump's election.

It's composed of industrials/infrastructure stocks. Source: www.zerohedge.com, Goldman

GameStop surged +20% on news it is considering buying Bitcoin with its $4.6 BILLION cash balance.

Source: Radar 𝘸 Archie

Investing with intelligence

Our latest research, commentary and market outlooks