Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"The more you learn, the more you'll earn." — Warren Buffett

Source: Value Theory @ValueInvestorAc

JUST IN: Elon Musk says DOGE is investigating federal workers with low salaries but high net worth.

"There are quite a few people who have a salary of a few hundred thousand dollars, but somehow manage to accrue tens of millions of dollars." DOGE Source: @Mr_Check_Crypto

ELON IS IN THE OVAL OFFICE AND WARNS: "IT’S NOT OPTIONAL TO CUT FEDERAL SPENDING—IT’S ESSENTIAL".

Elon said he wants to add "common sense controls" to the government, adding they haven’t been present. He says taxpayer dollars must be spent wisely. It’s just common sense, he says, not "draconian." Source: CBS, Mario Nawfal on X

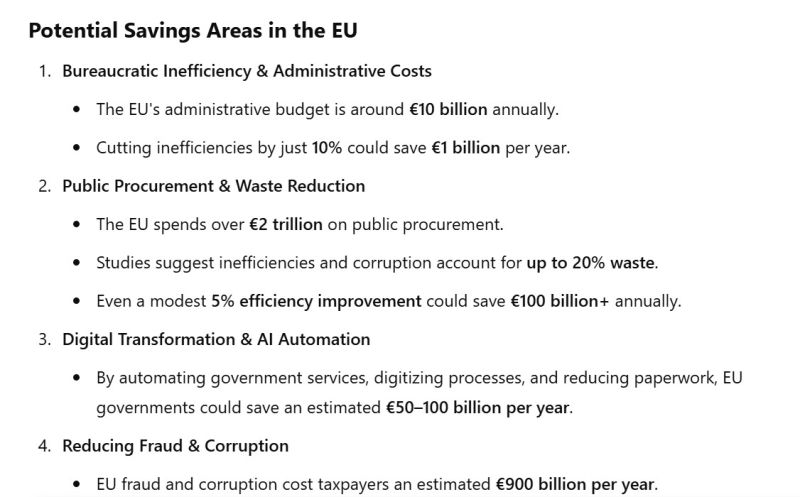

I asked ChatGPT the potential savings if the Department of Government Efficiency (D.O.G.E.) was implemented across the European Union.

Here's the answer: MORE THAN A TRILLION EURO PER YEAR (Fyi, the EU budget deficit is around 500 billion euros).

As highlighted in a post by Spencer Hakimian on X: The United States has a $66B 10 Year Bond from February 2015 coming due tomorrow.

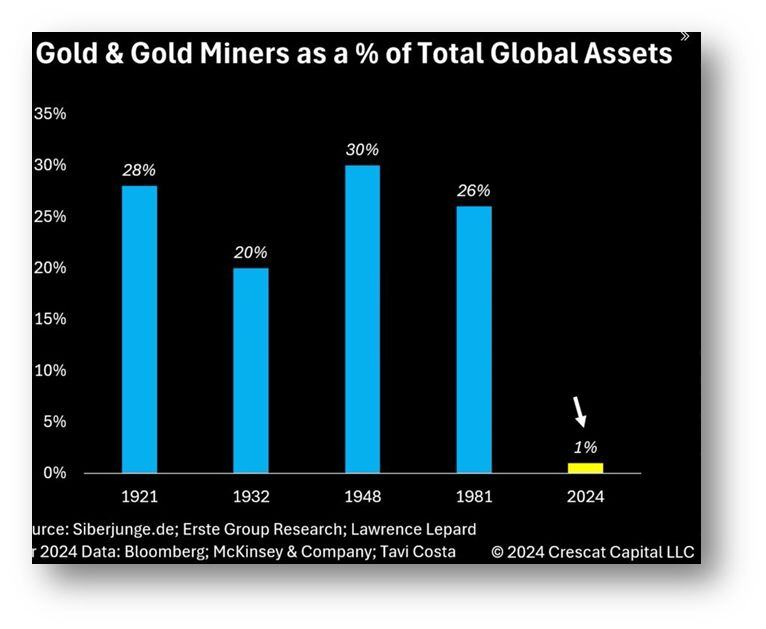

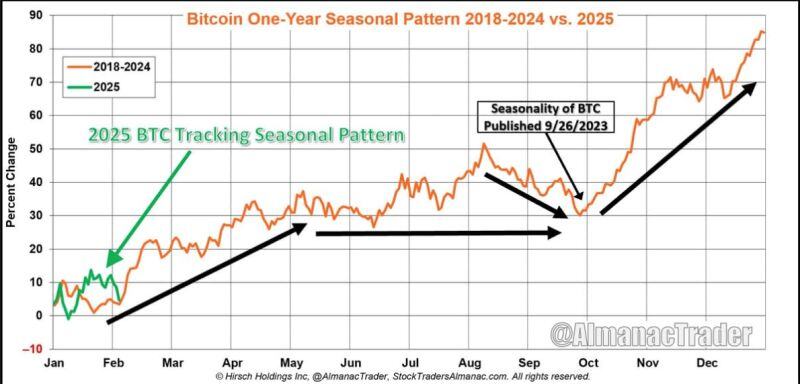

It had a 2.00% fixed coupon. It is going to be replaced with another $66B 10 Year Bond, but this time, with a 4.55% fixed coupon. This one single rollover will add an extra $1.67B per year to the national debt for the next 10 years. Bond auctions like these are happening every single day. After a decade of ZIRP, all of that debt now costs taxpayer money. No surprise that gold and bitcoin have been going to the roof Soruce: Bloomberg, Spencer Hakimian on X:

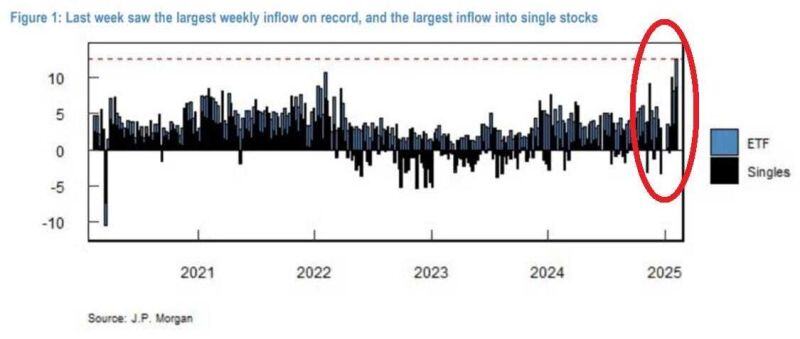

⚠️Retail investors have never been more EUPHORIC on US stocks:

Mom-and-pop investors bought a record $12 BILLION equities in the 1st week of February 👇 Roughly 70% went to Magnificent 7 ‼️ 🚨 Meanwhile, institutional investors have been selling over the last few weeks! Source: Global Markets Investors, JP Morgan

Investing with intelligence

Our latest research, commentary and market outlooks